Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Next, you intend to account for the following December 2023 transactions: Cash sales of baking classes hosted in December totaled $9,600. Cost of goods

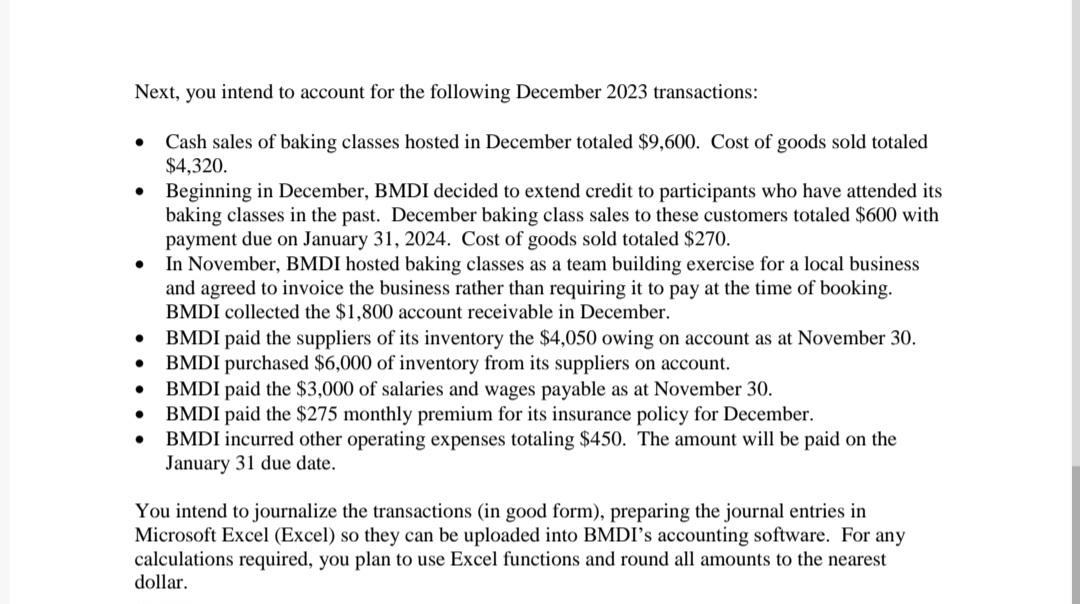

Next, you intend to account for the following December 2023 transactions: Cash sales of baking classes hosted in December totaled $9,600. Cost of goods sold totaled $4,320. Beginning in December, BMDI decided to extend credit to participants who have attended its baking classes in the past. December baking class sales to these customers totaled $600 with payment due on January 31, 2024. Cost of goods sold totaled $270. In November, BMDI hosted baking classes as a team building exercise for a local business and agreed to invoice the business rather than requiring it to pay at the time of booking. BMDI collected the $1,800 account receivable in December. BMDI paid the suppliers of its inventory the $4,050 owing on account as at November 30. BMDI purchased $6,000 of inventory from its suppliers on account. BMDI paid the $3,000 of salaries and wages payable as at November 30. BMDI paid the $275 monthly premium for its insurance policy for December. BMDI incurred other operating expenses totaling $450. The amount will be paid on the January 31 due date. You intend to journalize the transactions (in good form), preparing the journal entries in Microsoft Excel (Excel) so they can be uploaded into BMDI's accounting software. For any calculations required, you plan to use Excel functions and round all amounts to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BMDI December 2023 Transactions Excel Friendly Here are the journal entries for BMDIs December 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started