Answered step by step

Verified Expert Solution

Question

1 Approved Answer

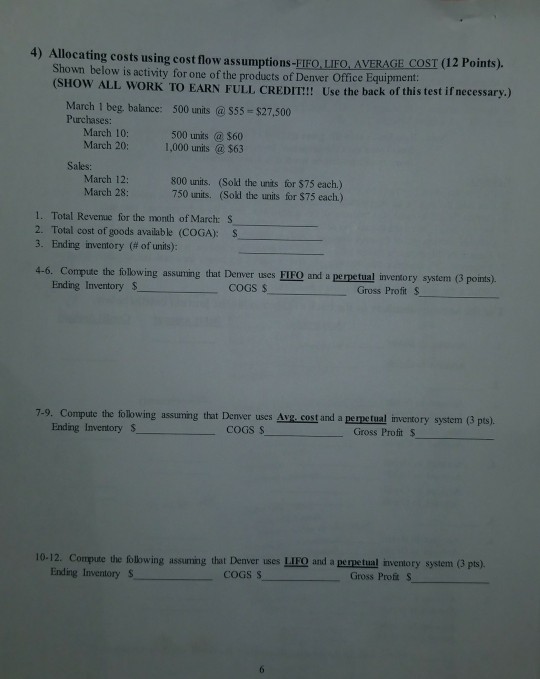

ng costs using cost flow assumptions-FIFO LIFO, AVERAGE COST (12 Points). Shown below is activity for one of the products of Denver Office Equipment (SHOW

ng costs using cost flow assumptions-FIFO LIFO, AVERAGE COST (12 Points). Shown below is activity for one of the products of Denver Office Equipment (SHOW ALL WORK TO EARN FULL CREDIT!! Use the back of this test if necessary.) March I beg balance: 500 units @ $55- $27,500 Purchases: March 10: March 20: 1,000 units $63 500 units @ $60 Sales March 12: March 28: 800 units. (Sold the units for $75 each.) 750 units. (Sold the units for $75 each.) 1 Total Revenue for the month of March: S 2. Total cost of goods available (COGA): 3. Ending inventory (# of units): Compute the following assuming that Denver uses FIFO and a perzetual invenory system (3 ponts). Ending Inventory SCOGS S 4-6. Compute the following assuming that Denver uses FIFO and a perpetual inventory system (3 points) Gross Profit S 7.9. Compute the folowing assuming that Demver uses Avg. cost and a pere tual imventory systcm (3 pts). Ending Inventory S coos s Gross Profit $ 10-12. Compute the folowing assuming that Denver uses LIFO and a perpetual inventory system (3 pts). Ending Inventory $- COGS S Gross Profi S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started