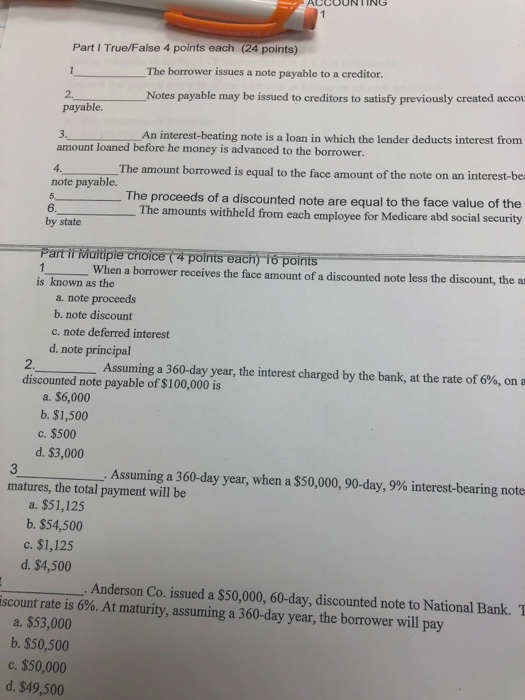

NG Part I True/False 4 points each (24 points) The borrower issues a note payable to a creditor. 2. payable Notes payable may be issued to creditors to satisfy previously created accou 3An interest-beating note is a loan in which the lender deducts interest from amount loaned before he money is advanced to the borrower. The amount borrowed is equal to the face amount of the note on an interest-be note payable. 5 6. by state The proceeds of a discounted note are equal to the face value of the The amounts withheld from each employee for Medicare abd social security Part i Multipie choice (4 points eachj 16 points When a borrower receives the face amount of a discounted note less the discount, the ar is known as the a. note proceeds b. note discount c. note deferred interest d. note principal 2. discounted note payable of $100,000 is Assuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a. $6,000 b. $1,500 c. $500 d. $3,000 . Assuming a 360-day year, when a $50,000, 90-day, 9% interest-bearing note matures, the total payment will be a. $51,125 b. $54,500 c. $1,125 d. $4,500 Anderson Co. issued a $50,000, 60-day, discounted note to National Bank. T iscount rate is 6%. At maturity, assuming a 360-day year, the borrower will pay a. $53,000 b. $50,500 c. $50,000 d. $49,500 NG Part I True/False 4 points each (24 points) The borrower issues a note payable to a creditor. 2. payable Notes payable may be issued to creditors to satisfy previously created accou 3An interest-beating note is a loan in which the lender deducts interest from amount loaned before he money is advanced to the borrower. The amount borrowed is equal to the face amount of the note on an interest-be note payable. 5 6. by state The proceeds of a discounted note are equal to the face value of the The amounts withheld from each employee for Medicare abd social security Part i Multipie choice (4 points eachj 16 points When a borrower receives the face amount of a discounted note less the discount, the ar is known as the a. note proceeds b. note discount c. note deferred interest d. note principal 2. discounted note payable of $100,000 is Assuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a. $6,000 b. $1,500 c. $500 d. $3,000 . Assuming a 360-day year, when a $50,000, 90-day, 9% interest-bearing note matures, the total payment will be a. $51,125 b. $54,500 c. $1,125 d. $4,500 Anderson Co. issued a $50,000, 60-day, discounted note to National Bank. T iscount rate is 6%. At maturity, assuming a 360-day year, the borrower will pay a. $53,000 b. $50,500 c. $50,000 d. $49,500