Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nick has plans to open some pizza restaurants , but he is not sure how many to open He has prepared a payoff table (values

Nick has plans to open some pizza restaurants , but he is not sure how many to open He has prepared a payoff table (values are in thousands of dollars ) to help analyze the situation

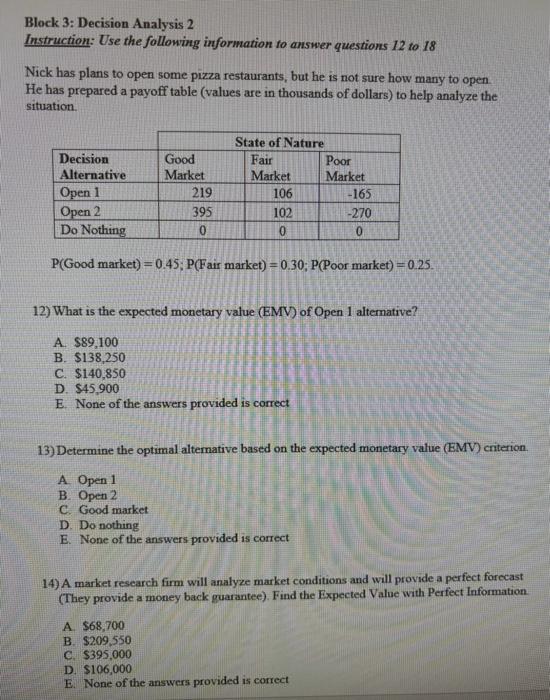

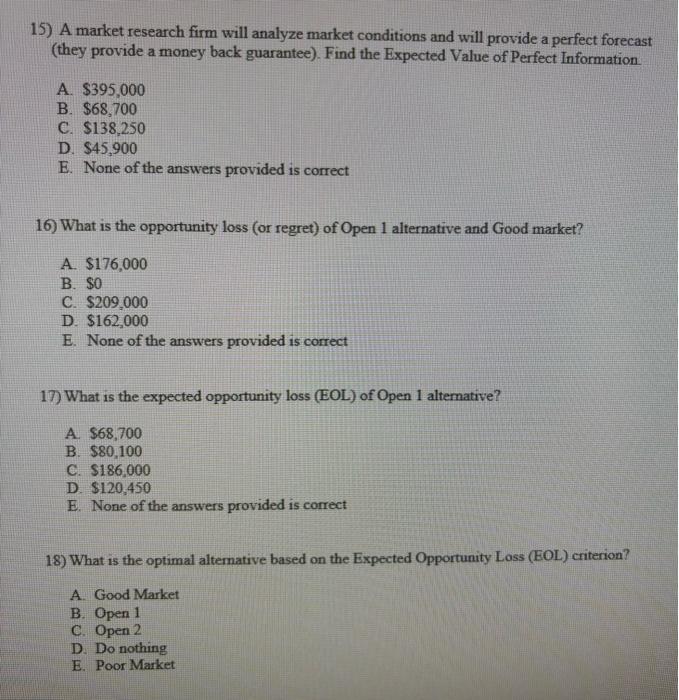

Block 3: Decision Analysis 2 Instruction: Use the following information fo answer questions 12 to 18 Nick has plans to open some pizza restaurants, but he is not sure how many to open He has prepared a payoff table (values are in thousands of dollars) to help analyze the situation. P(Goodmarket)=0.45;P(Fairmarket)=0.30;P(Poormarket)=0.25 12) What is the expected monetary value (EMV) of Open 1 alternative? A. $89,100 B. $138,250 C. $140,850 D. $45,900 E. None of the answers provided is correct 13) Determine the optimal alternative based on the expected monetary value (EMV) criterion. A. Open 1 B. Open 2 C. Good market D. Do nothing E. None of the answers provided is correct 14) A market research firm will analyze market conditions and will provide a perfect forecast (They provide a money back guarantee). Find the Expected Value with Perfect Information. A. $68,700 B. $209,550 C. $395,000 D. $106,000 E. None of the answers provided is correct 15) A market research firm will analyze market conditions and will provide a perfect forecast (they provide a money back guarantee). Find the Expected Value of Perfect Information A. $395,000 B. $68,700 C. $138,250 D. $45,900 E. None of the answers provided is correct 16) What is the opportunity loss (or regret) of Open 1 alternative and Good market? A. $176,000 B. $0 C. $209,000 D. $162,000 E. None of the answers provided is correct 17) What is the expected opportunity loss (EOL) of Open 1 alternative? A. $68,700 B. $80,100 C. $186,000 D. $120,450 E. None of the answers provided is correct 18) What is the optimal alternative based on the Expected Opportunity Loss (EOL) criterion? A. Good Market B. Open 1 C. Open 2 D. Do nothing E. Poor Market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started