Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nick owns 100% of Times Up Corporation, a firm that designs and builds one-of-a-kind watches and timepieces, in addition to several sales and administrative

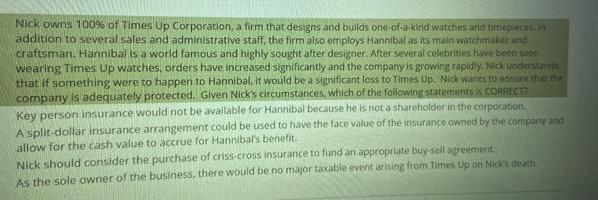

Nick owns 100% of Times Up Corporation, a firm that designs and builds one-of-a-kind watches and timepieces, in addition to several sales and administrative staff, the firm also employs Hannibal as its main watchmaker and craftsman. Hannibal is a world famous and highly sought after designer. After several celebrities have been seent wearing Times Up watches, orders have increased significantly and the company is growing rapidly. Nick understand that if something were to happen to Hannibal, it would be a significant loss to Times Up. Nick wants to ensure that the company is adequately protected. Given Nick's circumstances, which of the following statements is CORRECTI Key person insurance would not be available for Hannibal because he is not a shareholder in the corporation. A split-dollar insurance arrangement could be used to have the face value of the insurance owned by the company and allow for the cash value to accrue for Hannibal's benefit. Nick should consider the purchase of criss-cross insurance to fund an appropriate buy sell agreement. As the sole owner of the business, there would be no major taxable event arising from Times Up on Nick's deaths

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Correct answer is b A split dollar insurance arrangement could be used to have the face value in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started