Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Niger merchant bank ltd with its registered office in Enugu commenced business on 1st April 2005 and decide to prepare its account to 30th November

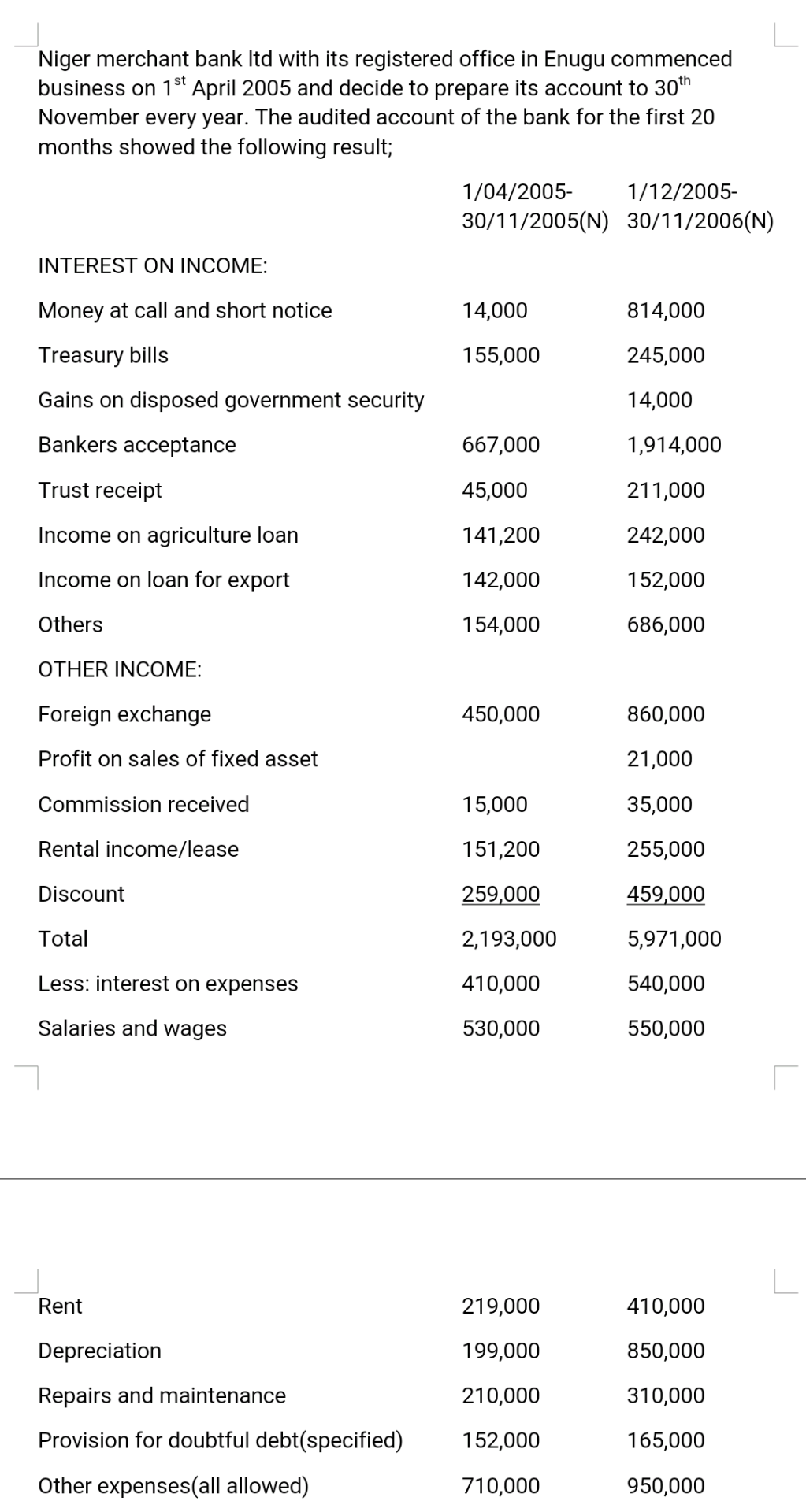

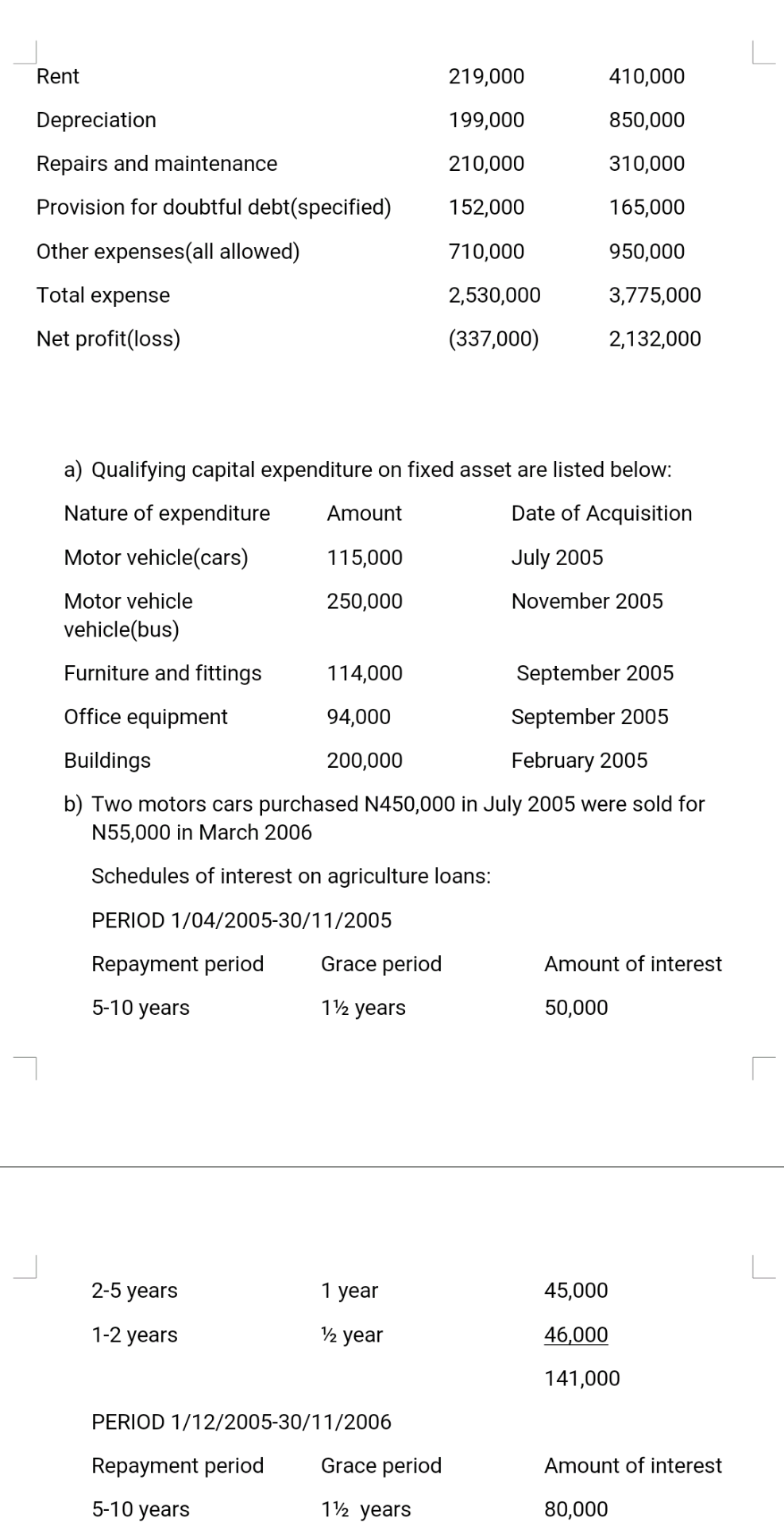

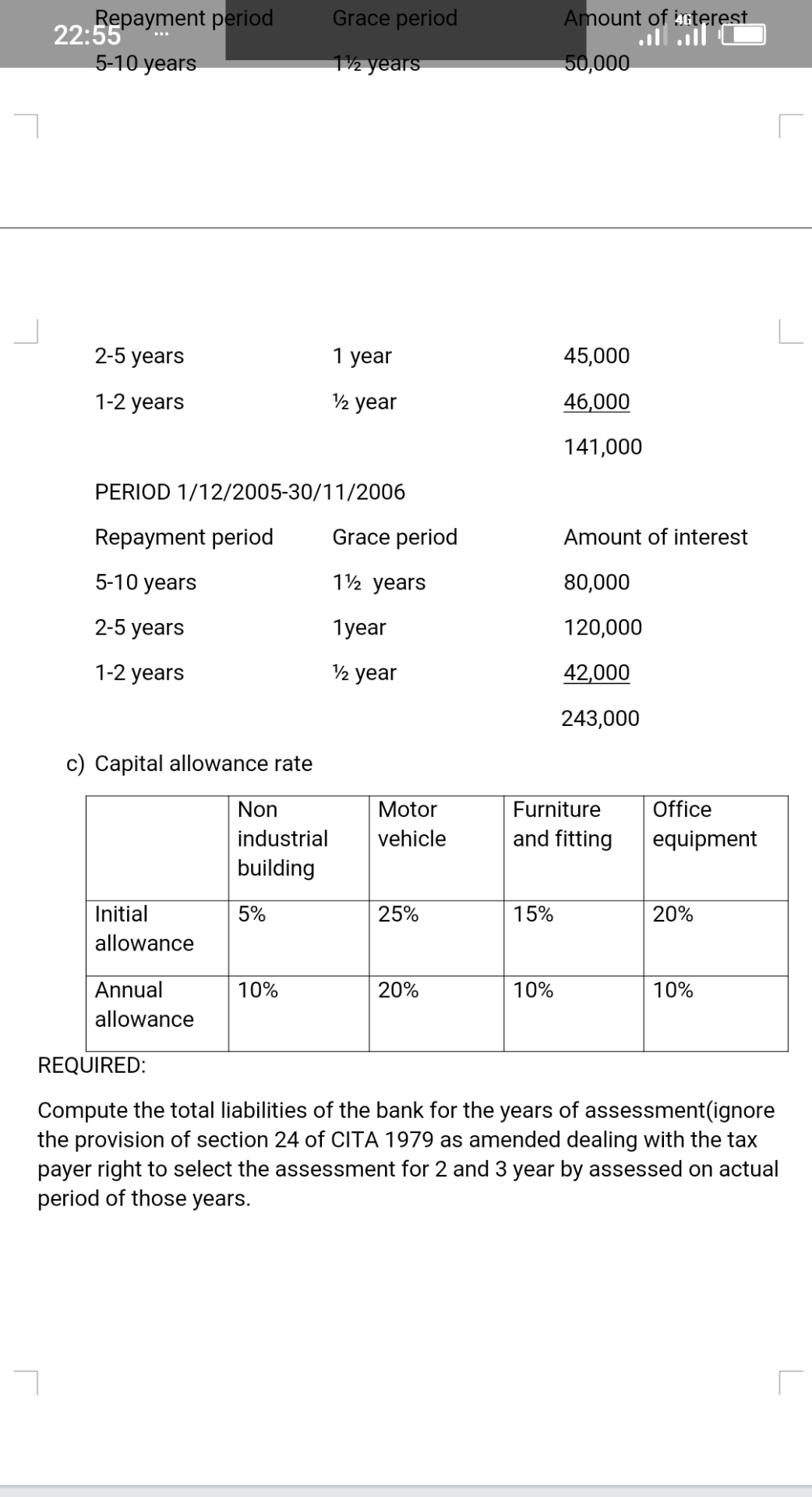

Niger merchant bank ltd with its registered office in Enugu commenced business on 1st April 2005 and decide to prepare its account to 30th November every year. The audited account of the bank for the first 20 months showed the following result; 1/04/2005- 1/12/2005- 30/11/2005(N) 30/11/2006(N) INTEREST ON INCOME: Money at call and short notice 14,000 814,000 Treasury bills 155,000 245,000 Gains on disposed government security 14,000 Bankers acceptance 667,000 1,914,000 Trust receipt 45,000 211,000 Income on agriculture loan 141,200 242,000 Income on loan for export 142,000 152,000 Others 154,000 686,000 OTHER INCOME: Foreign exchange 450,000 860,000 Profit on sales of fixed asset 21,000 Commission received 15,000 35,000 Rental income/lease 151,200 255,000 Discount 259,000 459,000 Total 2,193,000 5,971,000 540,000 Less: interest on expenses 410,000 Salaries and wages 530,000 550,000 Rent 219,000 410,000 Depreciation 199,000 850,000 Repairs and maintenance 210,000 310,000 Provision for doubtful debt(specified) 152,000 165,000 Other expenses(all allowed) 710,000 950,000 Rent 219,000 410,000 Depreciation 199,000 850,000 Repairs and maintenance 210,000 310,000 Provision for doubtful debt(specified) 152,000 165,000 Other expenses(all allowed) 710,000 950,000 Total expense 2,530,000 3,775,000 Net profit(loss) (337,000) 2,132,000 a) Qualifying capital expenditure on fixed asset are listed below: Nature of expenditure Amount Date of Acquisition Motor vehicle(cars) 115,000 July 2005 250,000 November 2005 Motor vehicle vehicle(bus) Furniture and fittings 114,000 September 2005 Office equipment 94,000 September 2005 Buildings 200,000 February 2005 b) Two motors cars purchased N450,000 in July 2005 were sold for N55,000 in March 2006 Schedules of interest on agriculture loans: PERIOD 1/04/2005-30/11/2005 Repayment period Grace period Amount of interest 5-10 years 1/2 years 50,000 2-5 years 1 year 45,000 1-2 years 12 year 46,000 141,000 PERIOD 1/12/2005-30/11/2006 Repayment period Grace period Amount of interest 5-10 years 112 years 80,000 Grace period Amount of acterest Repayment period 22:55' 5-10 years 11/2 years 50,000 2-5 years 1 year 45,000 1-2 years 12 year 46,000 141,000 PERIOD 1/12/2005-30/11/2006 Repayment period Grace period Amount of interest 5-10 years 112 years 80,000 2-5 years 1 year 120,000 1-2 years 12 year 42,000 243,000 c) Capital allowance rate Non industrial building Motor vehicle Furniture and fitting Office equipment 5% 25% 15% 20% Initial allowance 10% 20% 10% 10% Annual allowance REQUIRED: Compute the total liabilities of the bank for the years of assessment(ignore the provision of section 24 of CITA 1979 as amended dealing with the tax payer right to select the assessment for 2 and 3 year by assessed on actual period of those years. Niger merchant bank ltd with its registered office in Enugu commenced business on 1st April 2005 and decide to prepare its account to 30th November every year. The audited account of the bank for the first 20 months showed the following result; 1/04/2005- 1/12/2005- 30/11/2005(N) 30/11/2006(N) INTEREST ON INCOME: Money at call and short notice 14,000 814,000 Treasury bills 155,000 245,000 Gains on disposed government security 14,000 Bankers acceptance 667,000 1,914,000 Trust receipt 45,000 211,000 Income on agriculture loan 141,200 242,000 Income on loan for export 142,000 152,000 Others 154,000 686,000 OTHER INCOME: Foreign exchange 450,000 860,000 Profit on sales of fixed asset 21,000 Commission received 15,000 35,000 Rental income/lease 151,200 255,000 Discount 259,000 459,000 Total 2,193,000 5,971,000 540,000 Less: interest on expenses 410,000 Salaries and wages 530,000 550,000 Rent 219,000 410,000 Depreciation 199,000 850,000 Repairs and maintenance 210,000 310,000 Provision for doubtful debt(specified) 152,000 165,000 Other expenses(all allowed) 710,000 950,000 Rent 219,000 410,000 Depreciation 199,000 850,000 Repairs and maintenance 210,000 310,000 Provision for doubtful debt(specified) 152,000 165,000 Other expenses(all allowed) 710,000 950,000 Total expense 2,530,000 3,775,000 Net profit(loss) (337,000) 2,132,000 a) Qualifying capital expenditure on fixed asset are listed below: Nature of expenditure Amount Date of Acquisition Motor vehicle(cars) 115,000 July 2005 250,000 November 2005 Motor vehicle vehicle(bus) Furniture and fittings 114,000 September 2005 Office equipment 94,000 September 2005 Buildings 200,000 February 2005 b) Two motors cars purchased N450,000 in July 2005 were sold for N55,000 in March 2006 Schedules of interest on agriculture loans: PERIOD 1/04/2005-30/11/2005 Repayment period Grace period Amount of interest 5-10 years 1/2 years 50,000 2-5 years 1 year 45,000 1-2 years 12 year 46,000 141,000 PERIOD 1/12/2005-30/11/2006 Repayment period Grace period Amount of interest 5-10 years 112 years 80,000 Grace period Amount of acterest Repayment period 22:55' 5-10 years 11/2 years 50,000 2-5 years 1 year 45,000 1-2 years 12 year 46,000 141,000 PERIOD 1/12/2005-30/11/2006 Repayment period Grace period Amount of interest 5-10 years 112 years 80,000 2-5 years 1 year 120,000 1-2 years 12 year 42,000 243,000 c) Capital allowance rate Non industrial building Motor vehicle Furniture and fitting Office equipment 5% 25% 15% 20% Initial allowance 10% 20% 10% 10% Annual allowance REQUIRED: Compute the total liabilities of the bank for the years of assessment(ignore the provision of section 24 of CITA 1979 as amended dealing with the tax payer right to select the assessment for 2 and 3 year by assessed on actual period of those years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started