Question

- Nike Cost of Capitol Introduces the weighted average cost of capital (WACC). It provides a WACC calculation, although it has been intentionally designed to

- Nike Cost of Capitol Introduces the weighted average cost of capital (WACC). It provides a WACC calculation, although it has been intentionally designed to be misleading. Thus, your task is to identify and explain the "mistakes" in the analysis, which are intended to highlight conceptual issues regarding WACC and its components. Such issues are often misunderstood by students.

- You are required to review provided Nike Inc, Cost of Capital analysis provided. Upon reviewing, you are to explain the mistakes in the analysis. Address the mistakes in the analysis and write a proper analysis based on the information provided. Please come up with a solution to this case study with the correct calculations.

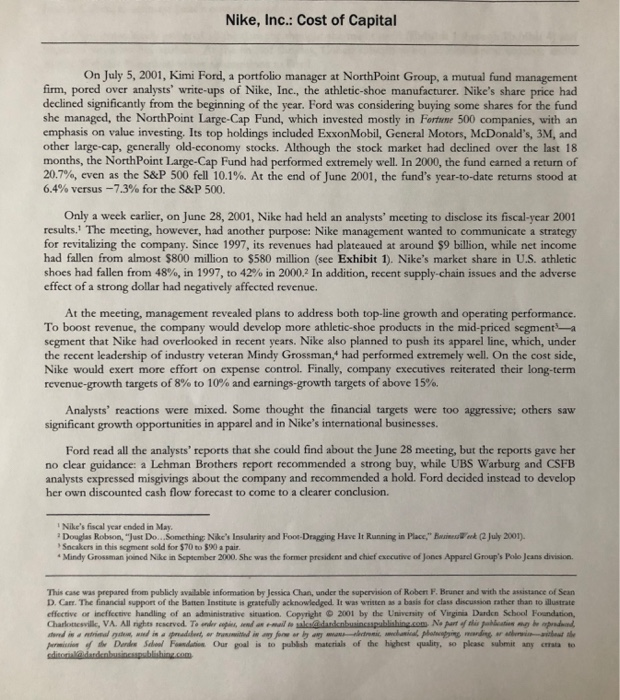

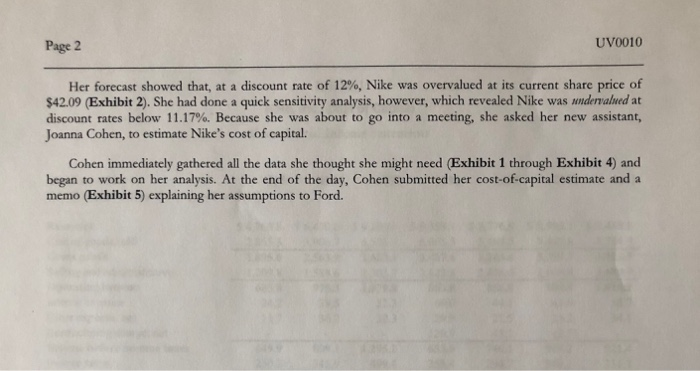

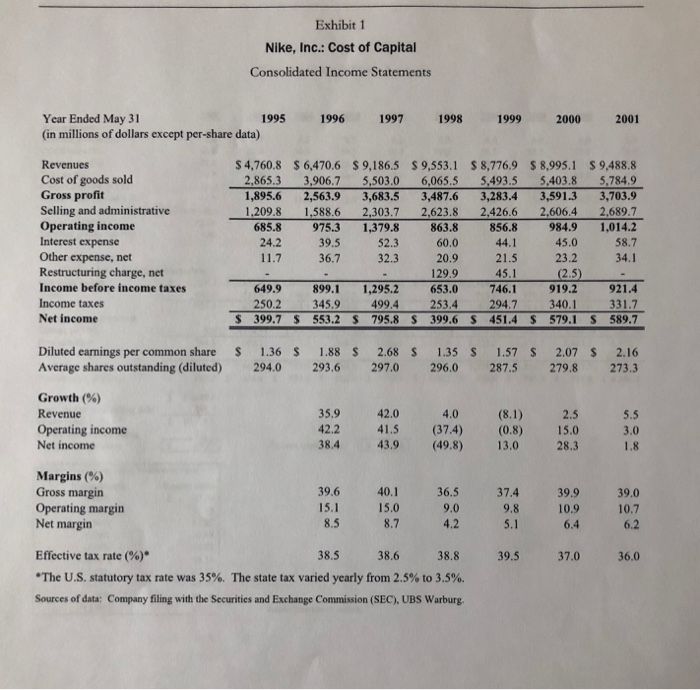

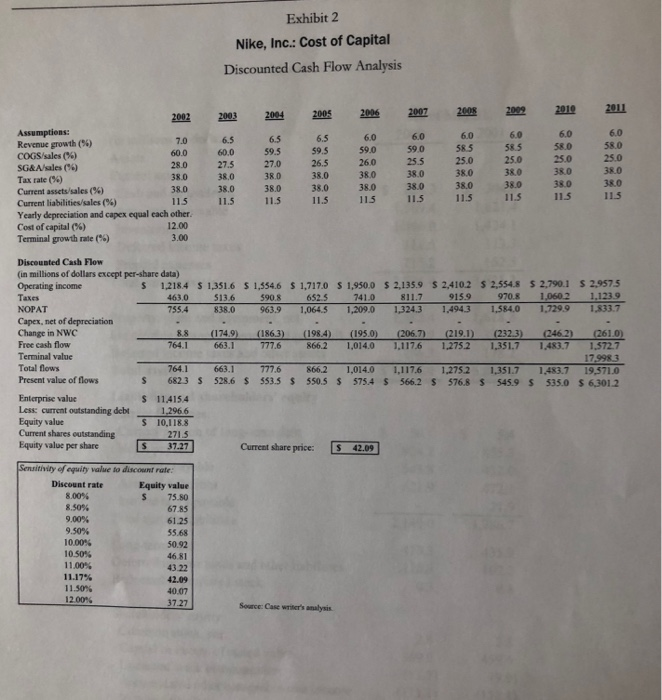

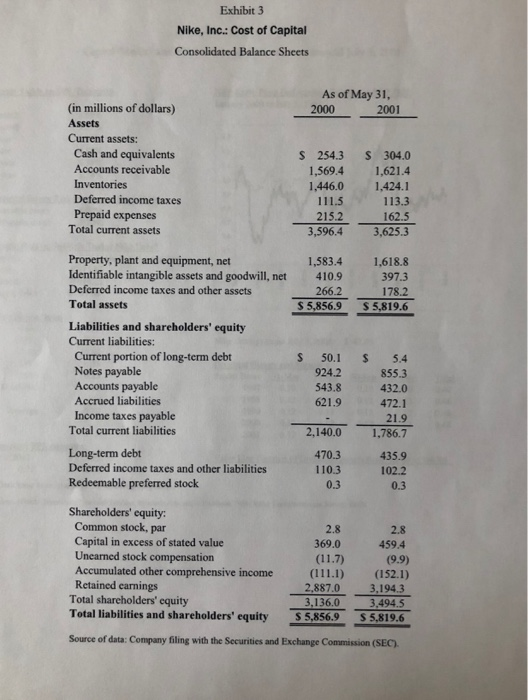

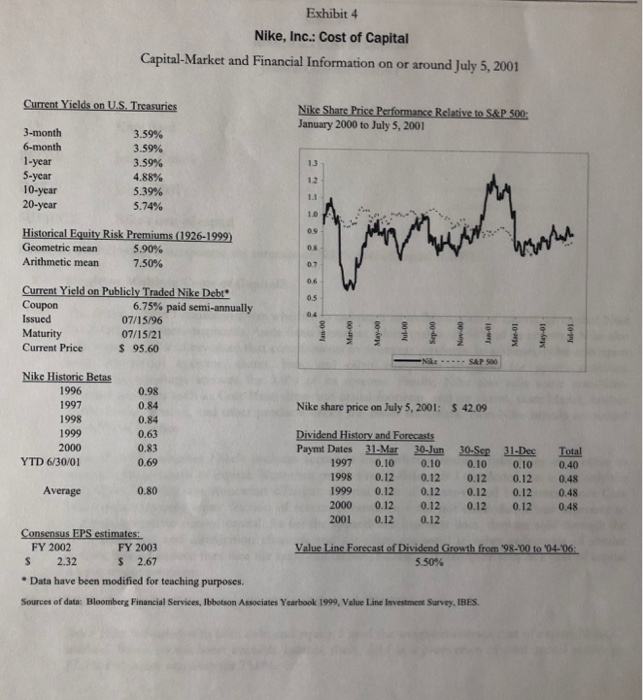

Nike, Inc.: Cost of Capital On July 5, 2001, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual fund management firm, pored over analysts' write-ups of Nike, Inc., the athletic shoe manufacturer. Nike's share price had declined significantly from the beginning of the year. Ford was considering buying some shares for the fund she managed, the NorthPoint Large-Cap Fund, which invested mostly in Fortune 500 companies, with an emphasis on value investing. Its top holdings included ExxonMobil, General Motors, McDonald's, 3M, and other large-cap, generally old-economy stocks. Although the stock market had declined over the last 18 months, the North Point Large-Cap Fund had performed extremely well. In 2000, the fund earned a return of 20.7%, even as the S&P 500 fell 10.1%. At the end of June 2001, the fund's year-to-date returns stood at 6.4% versus -7.3% for the S&P 500. Only a week earlier, on June 28, 2001, Nike had held an analysts' meeting to disclose its fiscal-year 2001 results. The meeting, however, had another purpose: Nike management wanted to communicate a strategy for revitalizing the company. Since 1997, its revenues had plateaued at around $9 billion, while net income had fallen from almost $800 million to $580 million (see Exhibit 1). Nike's market share in U.S. athletic shoes had fallen from 48%, in 1997, to 42% in 2000. In addition, recent supply-chain issues and the adverse effect of a strong dollar had negatively affected revenue. At the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic-shoe products in the mid-priced segment segment that Nike had overlooked in recent years. Nike also planned to push its apparel line, which, under the recent leadership of industry veteran Mindy Grossman, had performed extremely well. On the cost side, Nike would exert more effort on expense control. Finally, company executives reiterated their long-term revenue-growth targets of 8% to 10% and earnings-growth targets of above 15%. Analysts' reactions were mixed. Some thought the financial targets were too aggressive; others saw significant growth opportunities in apparel and in Nike's international businesses. Ford read all the analysts' reports that she could find about the June 28 meeting, but the reports gave her no clear guidance: a Lehman Brothers report recommended a strong buy, while UBS Warburg and CSFB analysts expressed misgivings about the company and recommended a hold. Ford decided instead to develop her own discounted cash flow forecast to come to a clearer conclusion. Nike's fiscal year ended in May. Douglas Robson, "Just Do Something Nike's Insularity and Foot-Dragging Have It Running in Place, BusinessWek (2 July 2001). Secakers in this segment sold for $70 to $90 a pair * Mindy Grossman joined Nike in September 2000. She was the former president and chief executive of Jones Apparel Group's Polo Jeans division. This case was prepared from publicly available information by Jessica Chan, under the supervision of Robert F. Bruner and with the assistance of Sean D. Carr. The financial support of the Batten Institute is gratefully acknowledged. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2001 by the University of Virginia Durden School Foundation, Charlottesville, VA. All rights reserved. To ender ops, ond or email to sales@dankenbusinesspublishing.com. No part of this partis mg bor predand. artina , - praident, - rianar, amalaria', plaitangy tamin either is permission de Derdes School Foundation Our goal is to publish materials of the highest quality, so please submit any emrat to editorial dandenbusinessblishing.com Page 2 UV0010 Her forecast showed that, at a discount rate of 12%, Nike was overvalued at its current share price of $42.09 Exhibit 2). She had done a quick sensitivity analysis, however, which revealed Nike was undervalued at discount rates below 11.17%. Because she was about to go into a meeting, she asked her new assistant, Joanna Cohen, to estimate Nike's cost of capital. Cohen immediately gathered all the data she thought she might need Exhibit 1 through Exhibit 4) and began to work on her analysis. At the end of the day, Cohen submitted her cost-of-capital estimate and a memo (Exhibit 5) explaining her assumptions to Ford. Exhibit 1 Nike, Inc.: Cost of Capital Consolidated Income Statements 1996 1997 1998 1999 2000 2001 Year Ended May 31 1995 (in millions of dollars except per-share data) Revenues Cost of goods sold Gross profit Selling and administrative Operating income Interest expense Other expense, net Restructuring charge, net Income before income taxes Income taxes Net income $ 4,760.8 $ 6,470.6 S 9,186.5 S 9,553.1 $ 8,776.9 $ 8,995.1 $ 9,488.8 2,865.3 3,906.7 5,503.0 6,065.5 5,493.5 5.403.8 5,784.9 1,895.6 2,563.9 3,683.5 3,487.6 3,283.4 3,591.3 3,703.9 1.209.8 1,588.6 2,303.7 2,623.8 2,426.6 2,606.4 2.689.7 685.8 975.3 1,379.8 863.8 856.8 984.9 1,014.2 24.2 39.5 52.3 60.0 44.1 45.0 58.7 11.7 36.7 32.3 20.9 21.5 23.2 34.1 129.9 45.1 (2.5) 649.9 899.1 1,295.2 653.0 746.1 919.2 921.4 250.2 345,9 499.4 253.4 294.7 340.1 331.7 $ 399.7 $ 553.2 $ 795.8 $ 399.6 S 451.4 $ 579.1 S 589.7 S Diluted earnings per common share Average shares outstanding (diluted) 1.36 $ 294.0 1.88 S 293.6 2.68 $ 297.0 1.35 S 296.0 1.57 $ 287.5 2.07 $ 279.8 2.16 273.3 Growth (%) Revenue Operating income Net income 4.0 35.9 42.2 38.4 42.0 41.5 43.9 (37.4) (49.8) (8.1) (0.8) 13.0 2.5 15.0 28.3 5.5 3.0 1.8 Margins (%) Gross margin Operating margin Net margin 39.6 15.1 8.5 40.1 15.0 8.7 36.5 9.0 4.2 37.4 9.8 39.9 10.9 6.4 39.0 10.7 6.2 5.1 38.8 39.5 37.0 36.0 Effective tax rate (%) 38.5 38.6 *The U.S. statutory tax rate was 35%. The state tax varied yearly from 2.5% to 3.5%. Sources of data: Company filing with the Securities and Exchange Commission (SEC), UBS Warburg. Exhibit 2 Nike, Inc.: Cost of Capital Discounted Cash Flow Analysis 2004 2003 2005 2006 2008 2011 2007 2010 60 2002 Assumptions: Revenue growth (56) 7.0 COGS/sales (%) 60.0 SG&Asles () 28.0 Tax rate (9 38.0 Current assets/sales (96) 38.0 Current liabilities/sales (%) 115 Yearly depreciation and capex equal each other Cost of capital (%) 12.00 Terminal growth rate (*) 3.00 6.5 60.0 27.5 38,0 380 11.5 6.5 59.5 27.0 38,0 38.0 11.5 6.5 59.5 26.5 38.0 38.0 11.5 59.0 26.0 38,0 38.0 115 6.0 59 0 25.5 38.0 38.0 11.5 6.0 585 25.0 38.0 38.0 11.5 6.0 58.5 25.0 38.0 38.0 11.5 6.0 580 25.0 380 38.0 11.5 6.0 58.0 25.0 380 38.0 113 Discounted Cash Flow (in millions of dollars except per-share data) Operating income S 1,218.4 S 1,351.6 S 1,554.6 $ 1,717,0 $1,950,0 $ 2,135.9 S 2,410.2 S 2,554.8 $ 2,790.1 S 2,957.5 Taxes 463.0 $13.6 590.8 6525 741.0 811.7 915.9 970.8 1,060.2 1,1239 NOPAT 755.4 838.0 963.9 1,064.5 1,209.0 1,324.3 1.4943 1,584,0 1,729.9 1.833.7 Capex, net of depreciation Change in NWC 8.8 (1749) (1863) (1984) (195.0) (2067 (219.1) (2323) (246.2) (2610) Free cash flow 764.1 663.1 777.6 8662 1,014.0 1.117.6 1.275.2 1,351.7 1.483.7 1.572.7 Terminal value 17,9983 Total flows 764.1 663.1 777.6 866.2 1,014.0 1.117.6 1.2752 1,351.7 1,483.7 19,571.0 Present value of flows S 6823 5 528.6 $ 553.5 $ 550.5 S 575.4 $ 566.2 $ 576.8 $ 545.9 $ 535.0 $ 6,3012 Enterprise value $ 11,415.4 Less: current outstanding debt 1.2966 Equity value $ 10.118.8 Current shares outstanding 271.5 Equity value per share s 37.27 Current share price: s 42.09 Sensitivity of equity value to discount rate: Discount rate Equity value 8.00% s 75.80 8.50% 67.85 9.00% 61.25 9.50% 55.68 10.00% 50.92 10.50% 46.81 11.00% 43.22 11.17% 42.09 11.50% 40.07 12.00% 37.27 Source: Case writer's analysis Exhibit 3 Nike, Inc.: Cost of Capital Consolidated Balance Sheets As of May 31, 2000 2001 (in millions of dollars) Assets Current assets: Cash and equivalents Accounts receivable Inventories Deferred income taxes Prepaid expenses Total current assets S 254.3 1,569.4 1,446.0 111.5 215.2 3,596.4 S 304.0 1,621.4 1,424.1 113.3 162.5 3,625.3 Property, plant and equipment, net 1,583.4 1.618.8 Identifiable intangible assets and goodwill, net 410.9 397.3 Deferred income taxes and other assets 266.2 178.2 Total assets S 5,856.9 $ 5,819.6 Liabilities and shareholders' equity Current liabilities: Current portion of long-term debt S 50.1 $ 5.4 Notes payable 924.2. 855.3 Accounts payable 543.8 432.0 Accrued liabilities 621.9 472.1 Income taxes payable 21.9 Total current liabilities 2.140.0 1,786.7 Long-term debt 470.3 435.9 Deferred income taxes and other liabilities 110.3 102.2 Redeemable preferred stock 0.3 0.3 Shareholders' equity: Common stock, par 2.8 2.8 Capital in excess of stated value 369.0 459.4 Unearned stock compensation (11.7) (9.9) Accumulated other comprehensive income (111.1) (152.1) Retained earnings 2.887.0 3.194.3 Total shareholders' equity 3,136.0 3,494.5 Total liabilities and shareholders' equity $ 5,856.9 S 5.819.6 Source of data: Company filing with the Securities and Exchange Commission (SEC) Exhibit 4 Nike, Inc.: Cost of Capital Capital-Market and Financial Information on or around July 5, 2001 Current Yields on U.S. Treasures Nike Share Price Performance Relative to S&P 500: January 2000 to July 5, 2001 13 3-month 6-month 1-year 5-year 10-year 20-year 3.59% 3.59% 3.59% 4.88% 5.39% 5.74% 12 1.1 10 0.9 Historical Equity Risk Premiums (1926-1999) Geometric mean 5.90% Arithmetic mean 7.50% 08 0.7 06 Jan 00 Mar 00 May-00 Current Yield on Publicly Traded Nike Debt 0.5 Coupon 6.75% paid semi-annually 04 Issued 07/15/96 Maturity 07/15/21 Current Price $ 95.60 SAP SOO Nike Historic Betas 1996 0.98 1997 0.84 Nike share price on July 5, 2001: $42.09 1998 0.84 1999 0.63 Dividend History and Forecasts 2000 0.83 Paymt Dates 31-Mar 30-Jun 30-Sep 31-Dec Total YTD 6/30/01 0.69 1997 0.10 0.10 0.10 0.10 0.40 1998 0.12 0.12 0.12 0.12 0.48 Average 0.80 1999 0.12 0.12 0.12 0.12 0.48 2000 0.12 0.12 0.12 0.12 0.48 2001 0.12 0.12 Consensus EPS estimates: FY 2002 FY 2003 Value Line Forecast of Dividend Growth from 98-20 to 04.06 $ 2.32 $ 2.67 5.50% Data have been modified for teaching purposes. Sources of data: Bloomberg Financial Services, Ibbotson Associates Yearbook 1999, Value Line Investment Survey, IBES Nike, Inc.: Cost of Capital On July 5, 2001, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual fund management firm, pored over analysts' write-ups of Nike, Inc., the athletic shoe manufacturer. Nike's share price had declined significantly from the beginning of the year. Ford was considering buying some shares for the fund she managed, the NorthPoint Large-Cap Fund, which invested mostly in Fortune 500 companies, with an emphasis on value investing. Its top holdings included ExxonMobil, General Motors, McDonald's, 3M, and other large-cap, generally old-economy stocks. Although the stock market had declined over the last 18 months, the North Point Large-Cap Fund had performed extremely well. In 2000, the fund earned a return of 20.7%, even as the S&P 500 fell 10.1%. At the end of June 2001, the fund's year-to-date returns stood at 6.4% versus -7.3% for the S&P 500. Only a week earlier, on June 28, 2001, Nike had held an analysts' meeting to disclose its fiscal-year 2001 results. The meeting, however, had another purpose: Nike management wanted to communicate a strategy for revitalizing the company. Since 1997, its revenues had plateaued at around $9 billion, while net income had fallen from almost $800 million to $580 million (see Exhibit 1). Nike's market share in U.S. athletic shoes had fallen from 48%, in 1997, to 42% in 2000. In addition, recent supply-chain issues and the adverse effect of a strong dollar had negatively affected revenue. At the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic-shoe products in the mid-priced segment segment that Nike had overlooked in recent years. Nike also planned to push its apparel line, which, under the recent leadership of industry veteran Mindy Grossman, had performed extremely well. On the cost side, Nike would exert more effort on expense control. Finally, company executives reiterated their long-term revenue-growth targets of 8% to 10% and earnings-growth targets of above 15%. Analysts' reactions were mixed. Some thought the financial targets were too aggressive; others saw significant growth opportunities in apparel and in Nike's international businesses. Ford read all the analysts' reports that she could find about the June 28 meeting, but the reports gave her no clear guidance: a Lehman Brothers report recommended a strong buy, while UBS Warburg and CSFB analysts expressed misgivings about the company and recommended a hold. Ford decided instead to develop her own discounted cash flow forecast to come to a clearer conclusion. Nike's fiscal year ended in May. Douglas Robson, "Just Do Something Nike's Insularity and Foot-Dragging Have It Running in Place, BusinessWek (2 July 2001). Secakers in this segment sold for $70 to $90 a pair * Mindy Grossman joined Nike in September 2000. She was the former president and chief executive of Jones Apparel Group's Polo Jeans division. This case was prepared from publicly available information by Jessica Chan, under the supervision of Robert F. Bruner and with the assistance of Sean D. Carr. The financial support of the Batten Institute is gratefully acknowledged. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2001 by the University of Virginia Durden School Foundation, Charlottesville, VA. All rights reserved. To ender ops, ond or email to sales@dankenbusinesspublishing.com. No part of this partis mg bor predand. artina , - praident, - rianar, amalaria', plaitangy tamin either is permission de Derdes School Foundation Our goal is to publish materials of the highest quality, so please submit any emrat to editorial dandenbusinessblishing.com Page 2 UV0010 Her forecast showed that, at a discount rate of 12%, Nike was overvalued at its current share price of $42.09 Exhibit 2). She had done a quick sensitivity analysis, however, which revealed Nike was undervalued at discount rates below 11.17%. Because she was about to go into a meeting, she asked her new assistant, Joanna Cohen, to estimate Nike's cost of capital. Cohen immediately gathered all the data she thought she might need Exhibit 1 through Exhibit 4) and began to work on her analysis. At the end of the day, Cohen submitted her cost-of-capital estimate and a memo (Exhibit 5) explaining her assumptions to Ford. Exhibit 1 Nike, Inc.: Cost of Capital Consolidated Income Statements 1996 1997 1998 1999 2000 2001 Year Ended May 31 1995 (in millions of dollars except per-share data) Revenues Cost of goods sold Gross profit Selling and administrative Operating income Interest expense Other expense, net Restructuring charge, net Income before income taxes Income taxes Net income $ 4,760.8 $ 6,470.6 S 9,186.5 S 9,553.1 $ 8,776.9 $ 8,995.1 $ 9,488.8 2,865.3 3,906.7 5,503.0 6,065.5 5,493.5 5.403.8 5,784.9 1,895.6 2,563.9 3,683.5 3,487.6 3,283.4 3,591.3 3,703.9 1.209.8 1,588.6 2,303.7 2,623.8 2,426.6 2,606.4 2.689.7 685.8 975.3 1,379.8 863.8 856.8 984.9 1,014.2 24.2 39.5 52.3 60.0 44.1 45.0 58.7 11.7 36.7 32.3 20.9 21.5 23.2 34.1 129.9 45.1 (2.5) 649.9 899.1 1,295.2 653.0 746.1 919.2 921.4 250.2 345,9 499.4 253.4 294.7 340.1 331.7 $ 399.7 $ 553.2 $ 795.8 $ 399.6 S 451.4 $ 579.1 S 589.7 S Diluted earnings per common share Average shares outstanding (diluted) 1.36 $ 294.0 1.88 S 293.6 2.68 $ 297.0 1.35 S 296.0 1.57 $ 287.5 2.07 $ 279.8 2.16 273.3 Growth (%) Revenue Operating income Net income 4.0 35.9 42.2 38.4 42.0 41.5 43.9 (37.4) (49.8) (8.1) (0.8) 13.0 2.5 15.0 28.3 5.5 3.0 1.8 Margins (%) Gross margin Operating margin Net margin 39.6 15.1 8.5 40.1 15.0 8.7 36.5 9.0 4.2 37.4 9.8 39.9 10.9 6.4 39.0 10.7 6.2 5.1 38.8 39.5 37.0 36.0 Effective tax rate (%) 38.5 38.6 *The U.S. statutory tax rate was 35%. The state tax varied yearly from 2.5% to 3.5%. Sources of data: Company filing with the Securities and Exchange Commission (SEC), UBS Warburg. Exhibit 2 Nike, Inc.: Cost of Capital Discounted Cash Flow Analysis 2004 2003 2005 2006 2008 2011 2007 2010 60 2002 Assumptions: Revenue growth (56) 7.0 COGS/sales (%) 60.0 SG&Asles () 28.0 Tax rate (9 38.0 Current assets/sales (96) 38.0 Current liabilities/sales (%) 115 Yearly depreciation and capex equal each other Cost of capital (%) 12.00 Terminal growth rate (*) 3.00 6.5 60.0 27.5 38,0 380 11.5 6.5 59.5 27.0 38,0 38.0 11.5 6.5 59.5 26.5 38.0 38.0 11.5 59.0 26.0 38,0 38.0 115 6.0 59 0 25.5 38.0 38.0 11.5 6.0 585 25.0 38.0 38.0 11.5 6.0 58.5 25.0 38.0 38.0 11.5 6.0 580 25.0 380 38.0 11.5 6.0 58.0 25.0 380 38.0 113 Discounted Cash Flow (in millions of dollars except per-share data) Operating income S 1,218.4 S 1,351.6 S 1,554.6 $ 1,717,0 $1,950,0 $ 2,135.9 S 2,410.2 S 2,554.8 $ 2,790.1 S 2,957.5 Taxes 463.0 $13.6 590.8 6525 741.0 811.7 915.9 970.8 1,060.2 1,1239 NOPAT 755.4 838.0 963.9 1,064.5 1,209.0 1,324.3 1.4943 1,584,0 1,729.9 1.833.7 Capex, net of depreciation Change in NWC 8.8 (1749) (1863) (1984) (195.0) (2067 (219.1) (2323) (246.2) (2610) Free cash flow 764.1 663.1 777.6 8662 1,014.0 1.117.6 1.275.2 1,351.7 1.483.7 1.572.7 Terminal value 17,9983 Total flows 764.1 663.1 777.6 866.2 1,014.0 1.117.6 1.2752 1,351.7 1,483.7 19,571.0 Present value of flows S 6823 5 528.6 $ 553.5 $ 550.5 S 575.4 $ 566.2 $ 576.8 $ 545.9 $ 535.0 $ 6,3012 Enterprise value $ 11,415.4 Less: current outstanding debt 1.2966 Equity value $ 10.118.8 Current shares outstanding 271.5 Equity value per share s 37.27 Current share price: s 42.09 Sensitivity of equity value to discount rate: Discount rate Equity value 8.00% s 75.80 8.50% 67.85 9.00% 61.25 9.50% 55.68 10.00% 50.92 10.50% 46.81 11.00% 43.22 11.17% 42.09 11.50% 40.07 12.00% 37.27 Source: Case writer's analysis Exhibit 3 Nike, Inc.: Cost of Capital Consolidated Balance Sheets As of May 31, 2000 2001 (in millions of dollars) Assets Current assets: Cash and equivalents Accounts receivable Inventories Deferred income taxes Prepaid expenses Total current assets S 254.3 1,569.4 1,446.0 111.5 215.2 3,596.4 S 304.0 1,621.4 1,424.1 113.3 162.5 3,625.3 Property, plant and equipment, net 1,583.4 1.618.8 Identifiable intangible assets and goodwill, net 410.9 397.3 Deferred income taxes and other assets 266.2 178.2 Total assets S 5,856.9 $ 5,819.6 Liabilities and shareholders' equity Current liabilities: Current portion of long-term debt S 50.1 $ 5.4 Notes payable 924.2. 855.3 Accounts payable 543.8 432.0 Accrued liabilities 621.9 472.1 Income taxes payable 21.9 Total current liabilities 2.140.0 1,786.7 Long-term debt 470.3 435.9 Deferred income taxes and other liabilities 110.3 102.2 Redeemable preferred stock 0.3 0.3 Shareholders' equity: Common stock, par 2.8 2.8 Capital in excess of stated value 369.0 459.4 Unearned stock compensation (11.7) (9.9) Accumulated other comprehensive income (111.1) (152.1) Retained earnings 2.887.0 3.194.3 Total shareholders' equity 3,136.0 3,494.5 Total liabilities and shareholders' equity $ 5,856.9 S 5.819.6 Source of data: Company filing with the Securities and Exchange Commission (SEC) Exhibit 4 Nike, Inc.: Cost of Capital Capital-Market and Financial Information on or around July 5, 2001 Current Yields on U.S. Treasures Nike Share Price Performance Relative to S&P 500: January 2000 to July 5, 2001 13 3-month 6-month 1-year 5-year 10-year 20-year 3.59% 3.59% 3.59% 4.88% 5.39% 5.74% 12 1.1 10 0.9 Historical Equity Risk Premiums (1926-1999) Geometric mean 5.90% Arithmetic mean 7.50% 08 0.7 06 Jan 00 Mar 00 May-00 Current Yield on Publicly Traded Nike Debt 0.5 Coupon 6.75% paid semi-annually 04 Issued 07/15/96 Maturity 07/15/21 Current Price $ 95.60 SAP SOO Nike Historic Betas 1996 0.98 1997 0.84 Nike share price on July 5, 2001: $42.09 1998 0.84 1999 0.63 Dividend History and Forecasts 2000 0.83 Paymt Dates 31-Mar 30-Jun 30-Sep 31-Dec Total YTD 6/30/01 0.69 1997 0.10 0.10 0.10 0.10 0.40 1998 0.12 0.12 0.12 0.12 0.48 Average 0.80 1999 0.12 0.12 0.12 0.12 0.48 2000 0.12 0.12 0.12 0.12 0.48 2001 0.12 0.12 Consensus EPS estimates: FY 2002 FY 2003 Value Line Forecast of Dividend Growth from 98-20 to 04.06 $ 2.32 $ 2.67 5.50% Data have been modified for teaching purposes. Sources of data: Bloomberg Financial Services, Ibbotson Associates Yearbook 1999, Value Line Investment Survey, IBESStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started