Answered step by step

Verified Expert Solution

Question

1 Approved Answer

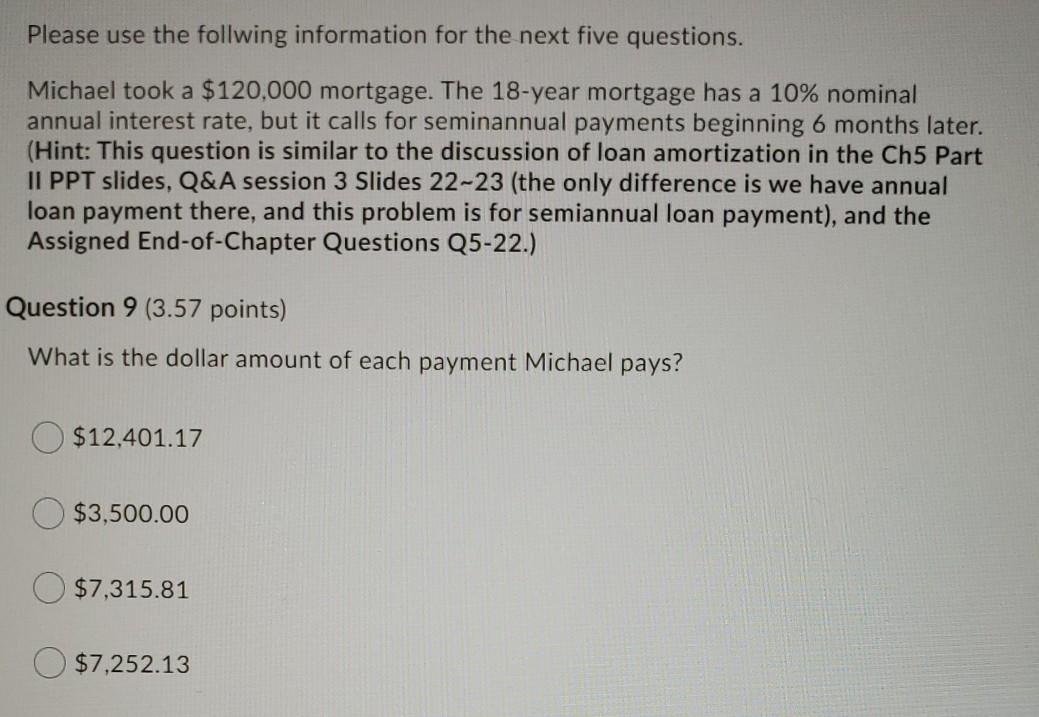

Please use the follwing information for the next five questions. Michael took a $120,000 mortgage. The 18-year mortgage has a 10% nominal annual interest rate,

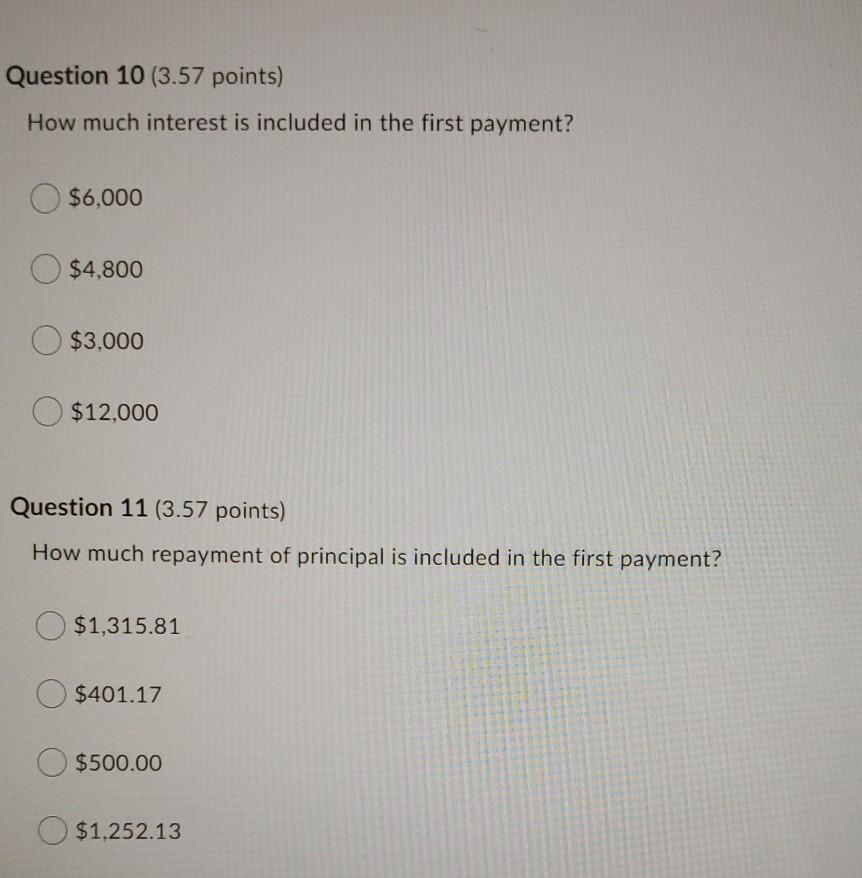

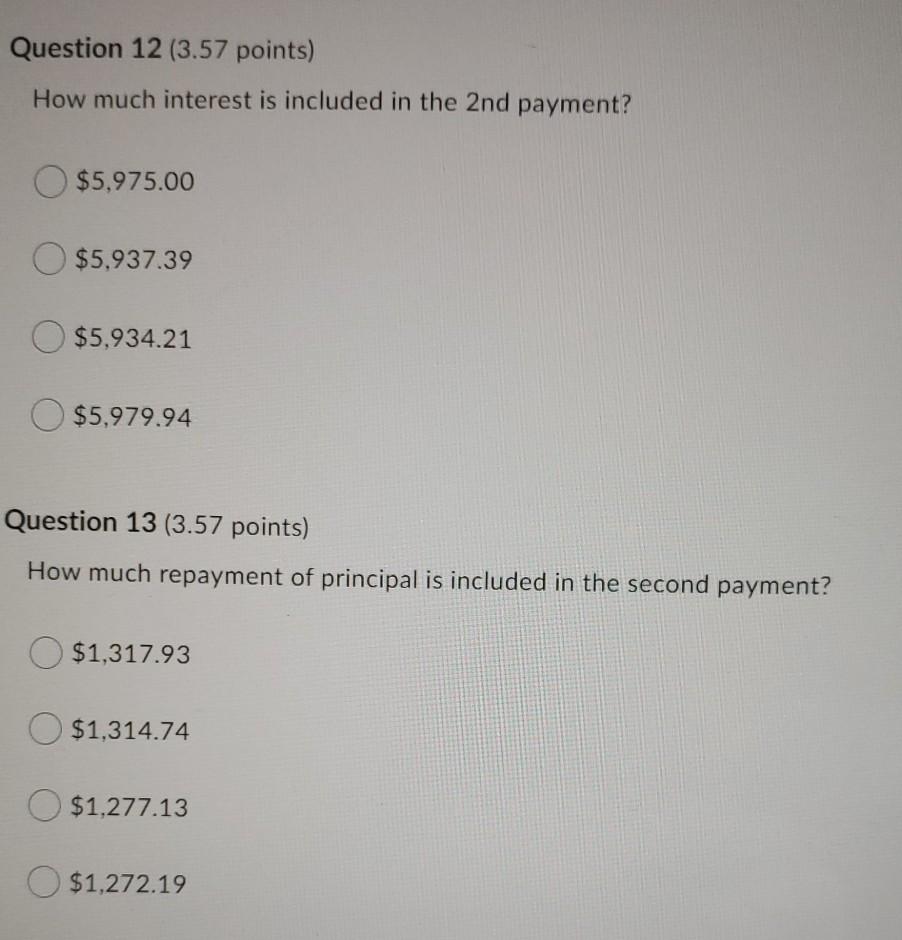

Please use the follwing information for the next five questions. Michael took a $120,000 mortgage. The 18-year mortgage has a 10% nominal annual interest rate, but it calls for seminannual payments beginning 6 months later. (Hint: This question is similar to the discussion of loan amortization in the Ch5 Part II PPT slides, Q&A session 3 Slides 22-23 (the only difference is we have annual loan payment there, and this problem is for semiannual loan payment), and the Assigned End-of-Chapter Questions Q5-22.) Question 9 (3.57 points) What is the dollar amount of each payment Michael pays? $12,401.17 $3,500.00 $7,315.81 $7,252.13 Question 10 (3.57 points) How much interest is included in the first payment? O $6,000 $4,800 $3,000 $12,000 Question 11 (3.57 points) How much repayment of principal is included in the first payment? $1,315.81 $401.17 $500.00 $1,252.13 Question 12 (3.57 points) How much interest is included in the 2nd payment? $5,975.00 $5,937.39 $5,934.21 $5,979.94 Question 13 (3.57 points) How much repayment of principal is included in the second payment? $1,317.93 $1,314.74 $1,277.13 $1,272.19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started