Answered step by step

Verified Expert Solution

Question

1 Approved Answer

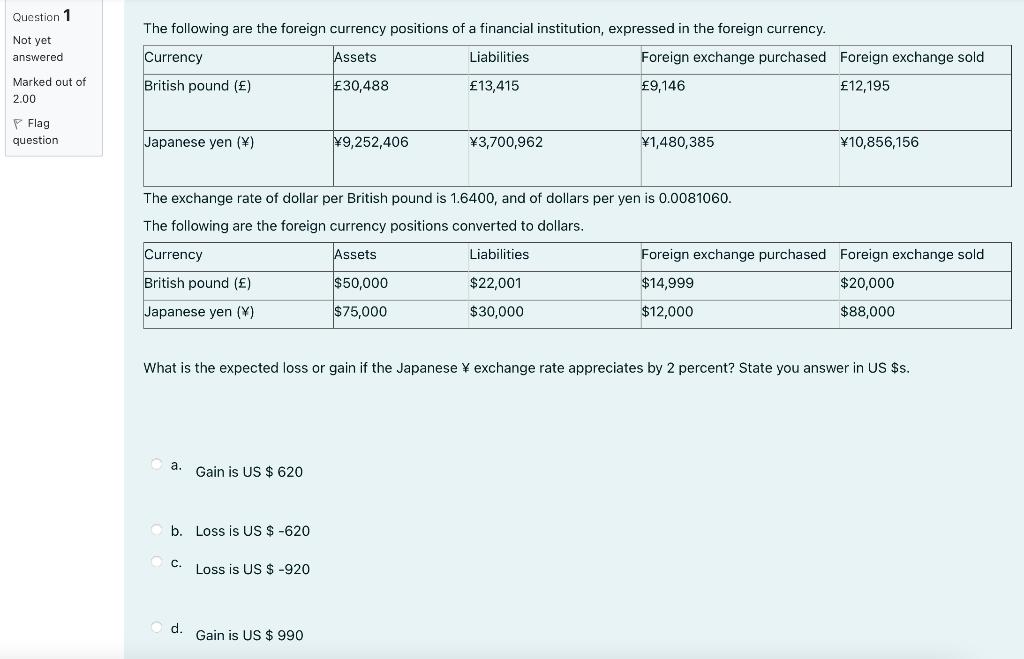

Question 1 Not yet answered Marked out of 2.00 Flag question The following are the foreign currency positions of a financial institution, expressed in

Question 1 Not yet answered Marked out of 2.00 Flag question The following are the foreign currency positions of a financial institution, expressed in the foreign currency. Assets Liabilities 13,415 30,488 Currency British pound () Japanese yen () Currency British pound () Japanese yen (Y) a. Gain is US $620 The exchange rate of dollar per British pound is 1.6400, and of dollars per yen is 0.0081060. The following are the foreign currency positions converted to dollars. Assets $50,000 $75,000 b. Loss is US $ -620 C. Od. 9,252,406 Loss is US $ -920 3,700,962 Gain is US $ 990 What is the expected loss or gain if the Japanese exchange rate appreciates by 2 percent? State you answer in US $s. Foreign exchange purchased Foreign exchange sold 9,146 12,195 Liabilities. $22,001 $30,000 1,480,385 10,856,156 Foreign exchange purchased Foreign exchange sold $14,999 $20,000 $88,000 $12,000

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Option b loss of US6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started