Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nitando Inc, is a video game software company which is listed on the Shanghai Stock Exchange. It Question 1 Nitando Inc. is a video game

Nitando Inc, is a video game software company which is listed on the Shanghai Stock Exchange. It

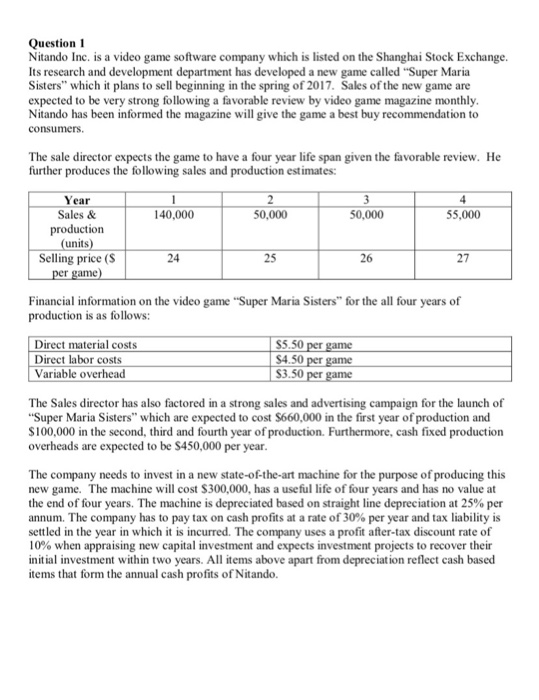

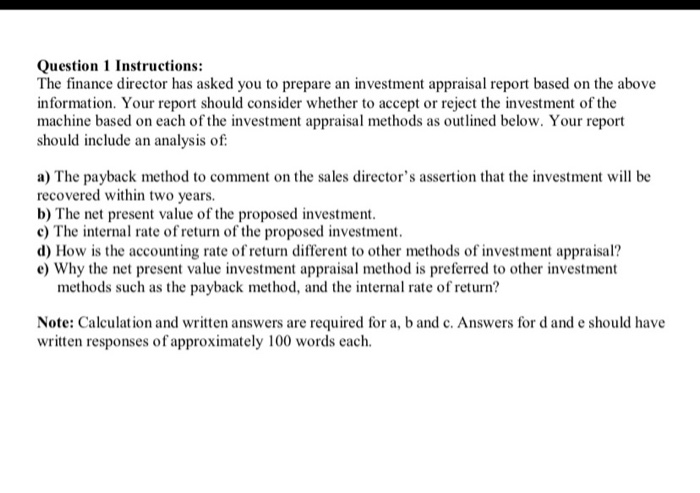

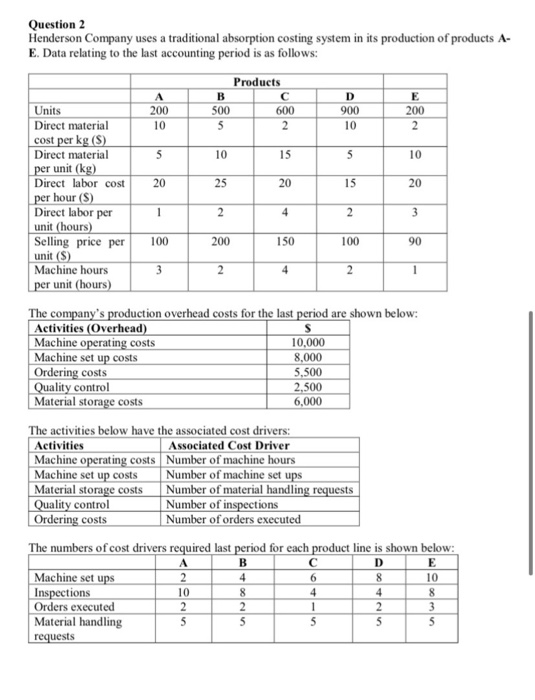

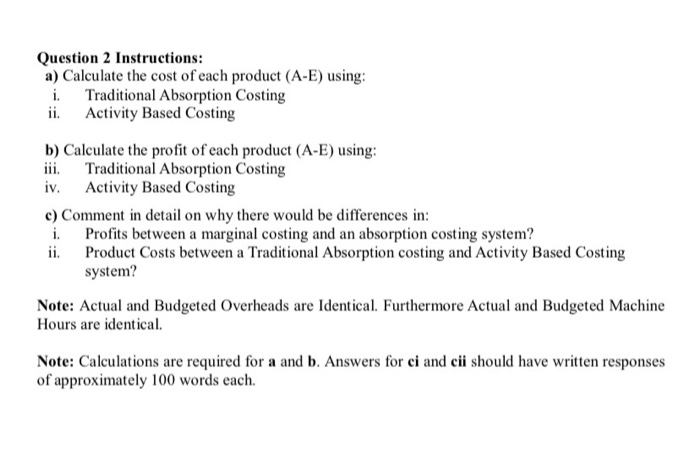

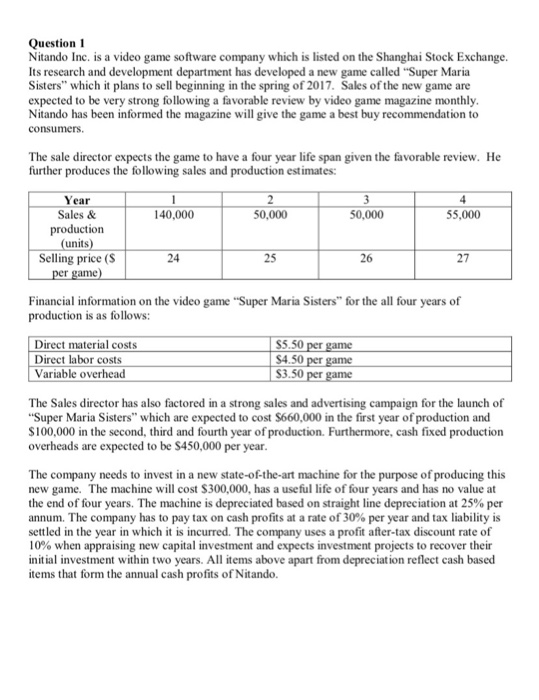

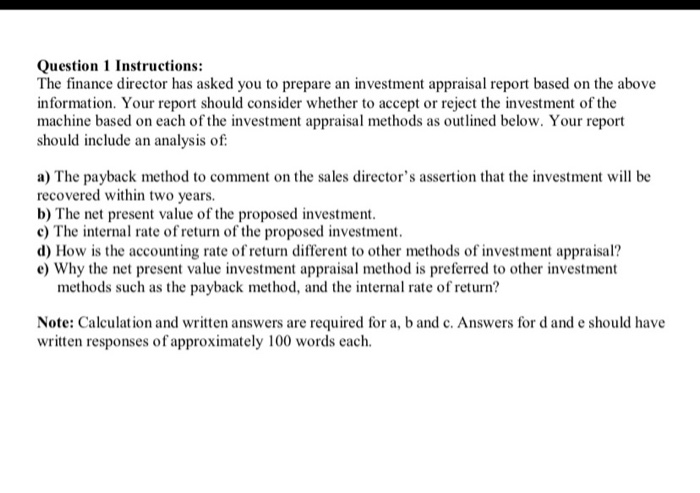

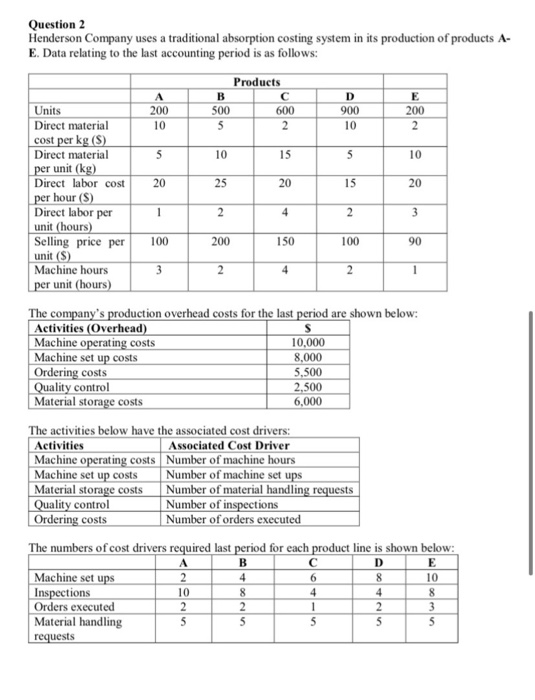

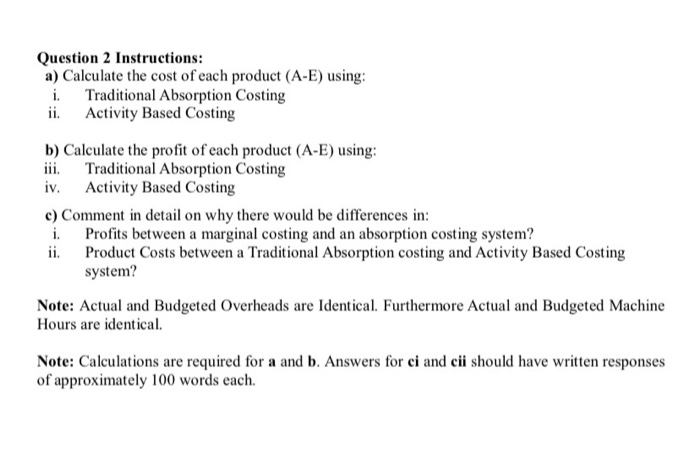

Question 1 Nitando Inc. is a video game software company which is listed on the Shanghai Stock Exchange. Its research and development department has developed a new game called "Super Maria Sisters" which it plans to sell beginning in the spring of 2017. Sales of the new game are expected to be very strong following a favorable review by video game magazine monthly Nitando has been informed the magazine will give the game a best buy recommendation to consumers. The sale director expects the game to have a four year life span given the favorable review. He further produces the following sales and production estimates 140,000 50,000 50,000 55,000 Year Sales & production (units) Selling price (S per game) 24 25 26 27 Financial information on the video game "Super Maria Sisters" for the all four years of production is as follows: Direct material costs Direct labor costs Variable overhead $5.50 per game S4.50 per game $3.50 per game The Sales director has also factored in a strong sales and advertising campaign for the launch of "Super Maria Sisters" which are expected to cost $660,000 in the first year of production and $100,000 in the second, third and fourth year of production. Furthermore, cash fixed production overheads are expected to be $450,000 per year. The company needs to invest in a new state-of-the-art machine for the purpose of producing this new game. The machine will cost $300,000, has a useful life of four years and has no value at the end of four years. The machine is depreciated based on straight line depreciation at 25% per annum. The company has to pay tax on cash profits at a rate of 30% per year and tax liability is settled in the year in which it is incurred. The company uses a profit after-tax discount rate of when appraising new capital investment and expects investment projects to recover their initial investment within two years. All items above apart from depreciation reflect cash based items that form the annual cash profits of Nitando Question 1 Instructions: The finance director has asked you to prepare an investment appraisal report based on the above information. Your report should consider whether to accept or reject the investment of the machine based on each of the investment appraisal methods as outlined below. Your report should include an analysis of: a) The payback method to comment on the sales director's assertion that the investment will be recovered within two years. b) The net present value of the proposed investment. c) The internal rate of return of the proposed investment d) How is the accounting rate of return different to other methods of investment appraisal? e) Why the net present value investment appraisal method is preferred to other investment methods such as the payback method, and the internal rate of return? Note: Calculation and written answers are required for a, b and c. Answers for d and e should have written responses of approximately 100 words each. Question 2 Henderson Company uses a traditional absorption costing system in its production of products A- E. Data relating to the last accounting period is as follows: Products A 200 500 D 900 600 200 20 Units Direct material cost per kg (S) Direct material per unit (kg) Direct labor cost per hour (S) Direct labor per unit (hours) Selling price per unit (S) Machine hours per unit (hours) 100 The company's production overhead costs for the last period are shown below: Activities (Overhead) Machine operating costs 10,000 Machine set up costs 8,000 Ordering costs 5.500 Quality control 2.500 Material storage costs 6,000 The activities below have the associated cost drivers: Activities Associated Cost Driver Machine operating costs Number of machine hours Machine set up costs Number of machine set ups Material storage costs Number of material handling requests Quality control Number of inspections Ordering costs Number of orders executed The numbers of cost drivers required last period for each product line is shown below: B D E 10 8 4 Machine set ups Inspections Orders executed Material handling requests an Question 2 Instructions: a) Calculate the cost of each product (A-E) using: i. Traditional Absorption Costing ii. Activity Based Costing b) Calculate the profit of each product (A-E) using: iii. Traditional Absorption Costing iv. Activity Based Costing c) Comment in detail on why there would be differences in: i. Profits between a marginal costing and an absorption costing system? ii. Product Costs between a Traditional Absorption costing and Activity Based Costing system? Note: Actual and Budgeted Overheads are identical. Furthermore Actual and Budgeted Machine Hours are identical. Note: Calculations are required for a and b. Answers for ci and cii should have written responses of approximately 100 words each

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started