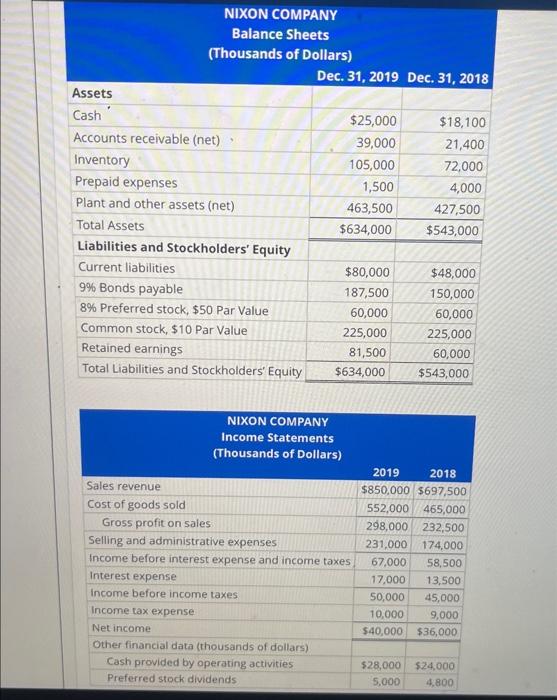

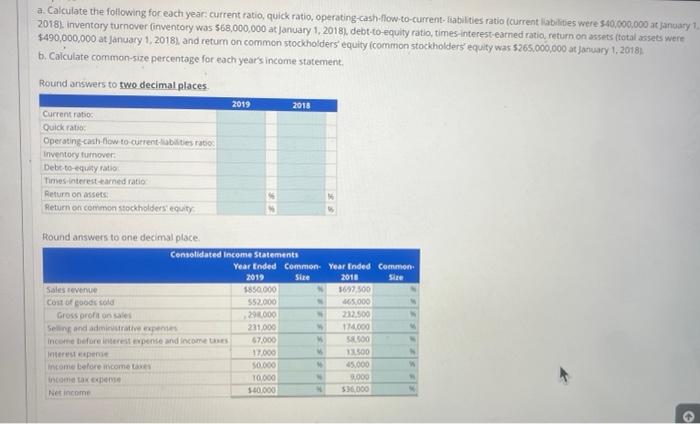

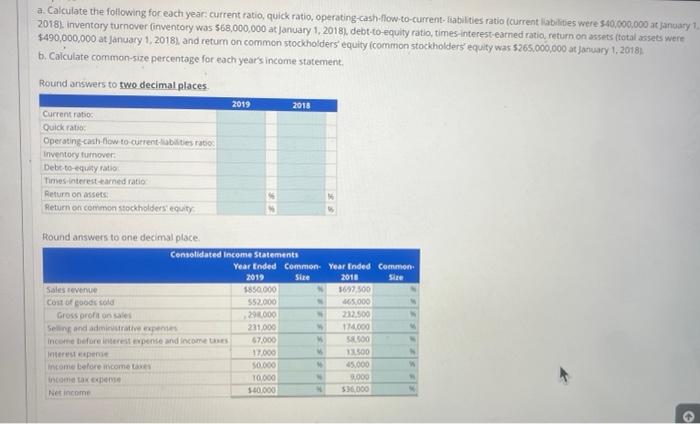

NIXON COMPANY Balance Sheets (Thousands of Dollars) Dec. 31, 2019 Dec. 31, 2018 Assets \begin{tabular}{|l|r|r|} \hline Cash ' & $25,000 & $18,100 \\ \hline Accounts receivable (net) & 39,000 & 21,400 \\ \hline Inventory & 105,000 & 72,000 \\ \hline Prepaid expenses & 1,500 & 4,000 \\ \hline Plant and other assets (net) & 463,500 & 427,500 \\ \hline Total Assets & $634,000 & $543,000 \\ \hline Liabilities and Stockholders' Equity & & \\ \hline Current liabilities & $80,000 & $48,000 \\ \hline 9% Bonds payable & 187,500 & 150,000 \\ \hline 8% Preferred stock, \$50 Par Value & 60,000 & 60,000 \\ \hline Common stock, $10 Par Value & 225,000 & 225,000 \\ \hline Retained earnings & 81,500 & 60,000 \\ \hline Total Liabilities and Stockholders' Equity & $634,000 & $543,000 \\ \hline \end{tabular} NIXON COMPANY Income Statements (Thousands of Dollars) \begin{tabular}{|l|r|r|} \hline Sales revenue & \multicolumn{1}{|c|}{2019} & \multicolumn{1}{c|}{2018} \\ \hline Cost of goods sold & $850,000 & 5697,500 \\ \hline Gross profit on sales & 552,000 & 465,000 \\ \hline Selling and administrative expenses & 298,000 & 232,500 \\ \hline Income before interest expense and income taxes & 231,000 & 174,000 \\ \hline Interest expense & 67,000 & 58,500 \\ \hline Income before income taxes & 17,000 & 13,500 \\ \hline Income tax expense & 50,000 & 45,000 \\ \hline Net income & 10,000 & 9,000 \\ \hline other financial data (thousands of dollars) & 540,000 & $36,000 \\ \hline Cash provided by operating activities & $28,000 & 524,000 \\ \hline Preferred stock dividends & 5,000 & 4,800 \\ \hline \end{tabular} a. Calculate the following foreach year; current ratio, quick ratio, operating-cash-flow-to-current-fiabilties ratio (current liabelities were sa0,oow,ocos at january 1. 2018. inventory turnover (inventory was 568,000,000 at january 1, 2018), debt-to-equity ratio, times-interest-earned ratio, return on assets itotal assats were $490,000,000 at january 1, 2018), and retum on commen stockhoiders equity (common stockholders equity was 5265,000,000 atjanuary 1,2018 . b. Calculate common-size percentage for each year's income statement. Round answers to two decimal places. fround answers to one decimal place