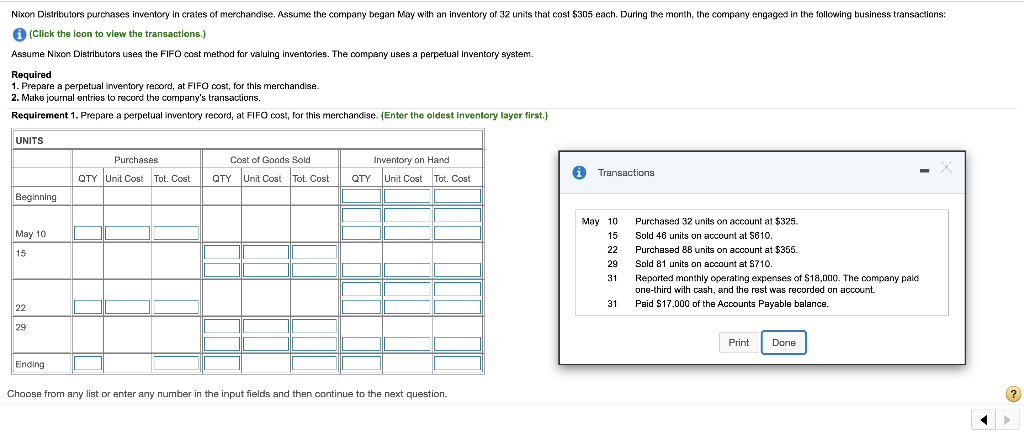

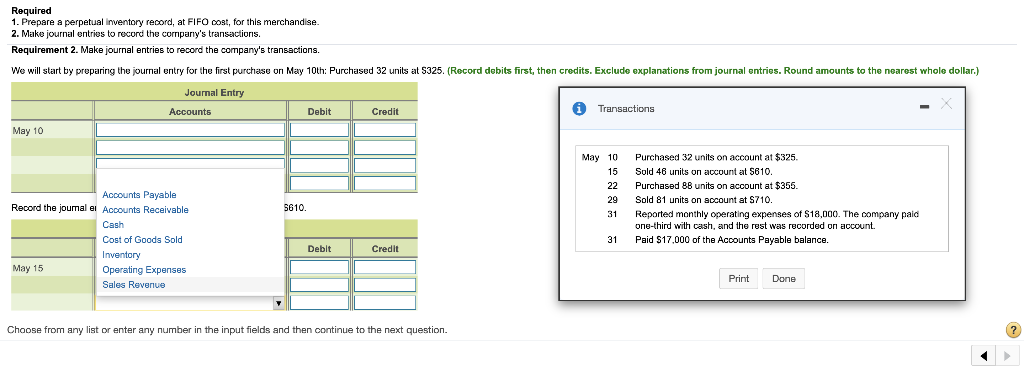

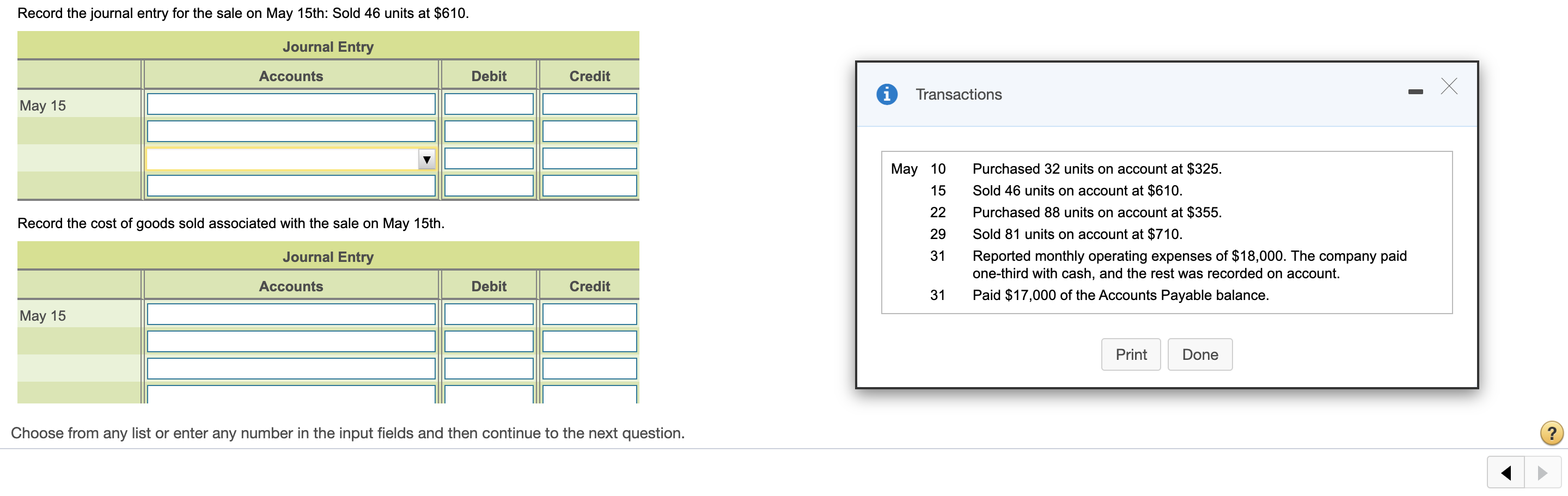

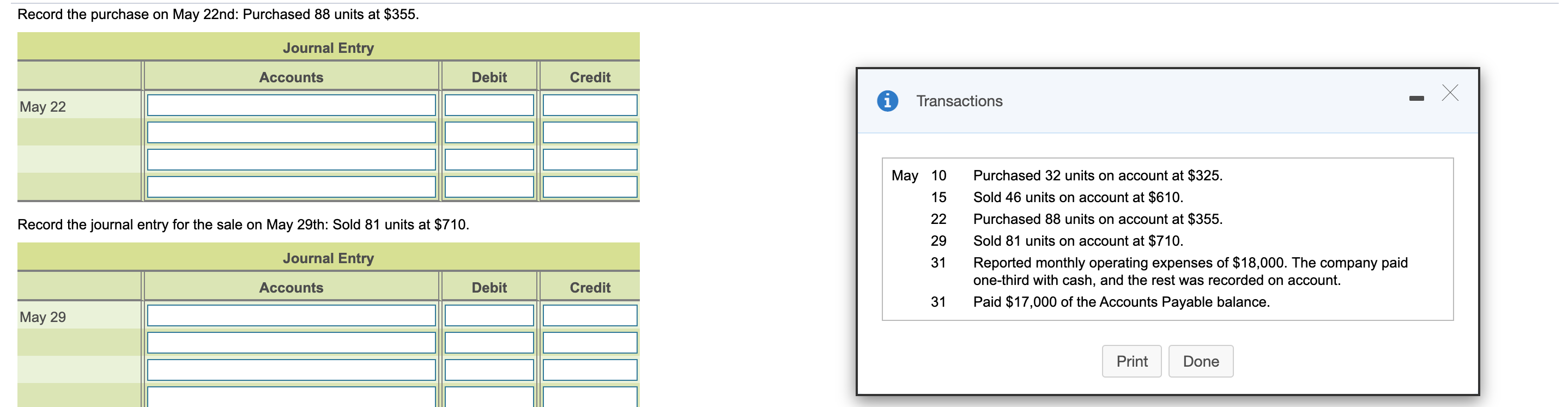

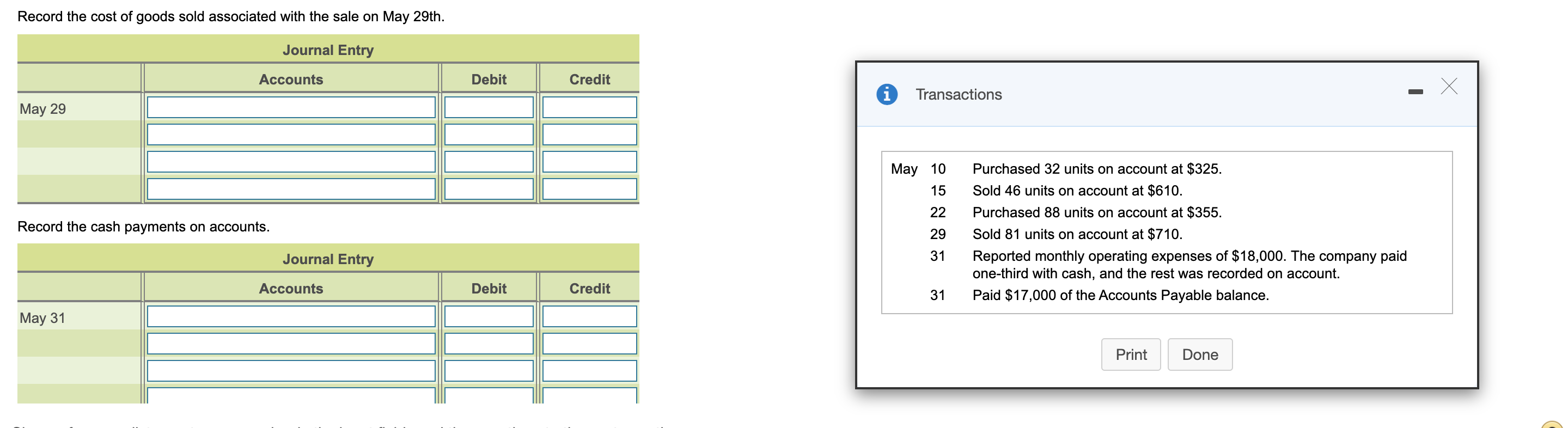

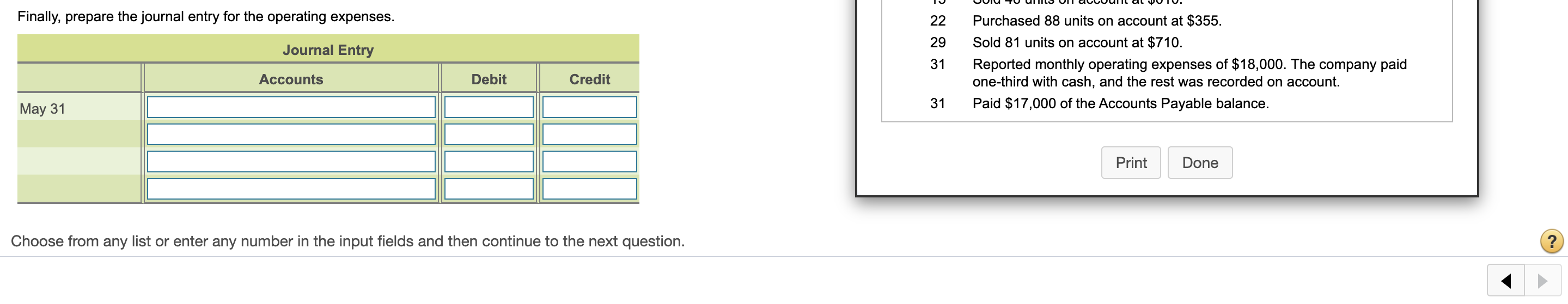

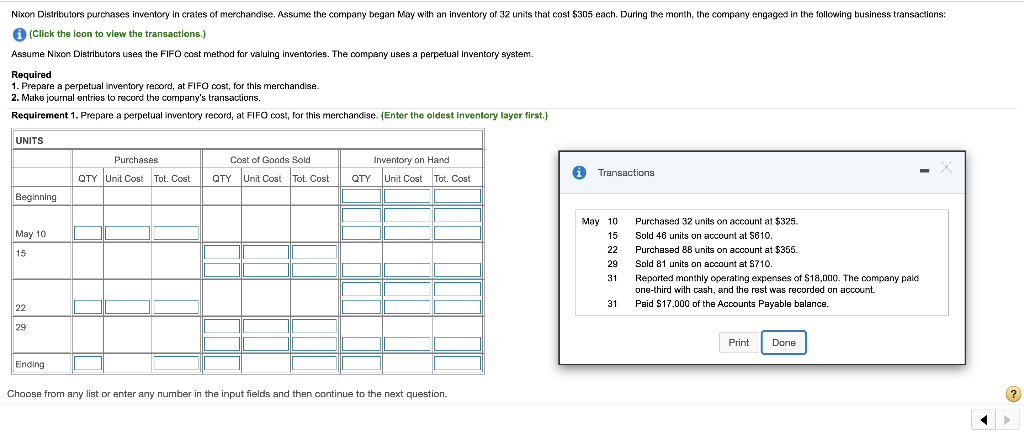

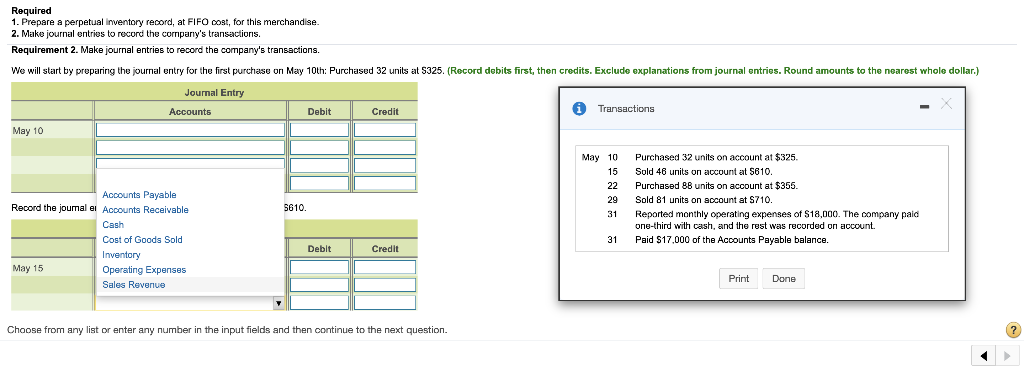

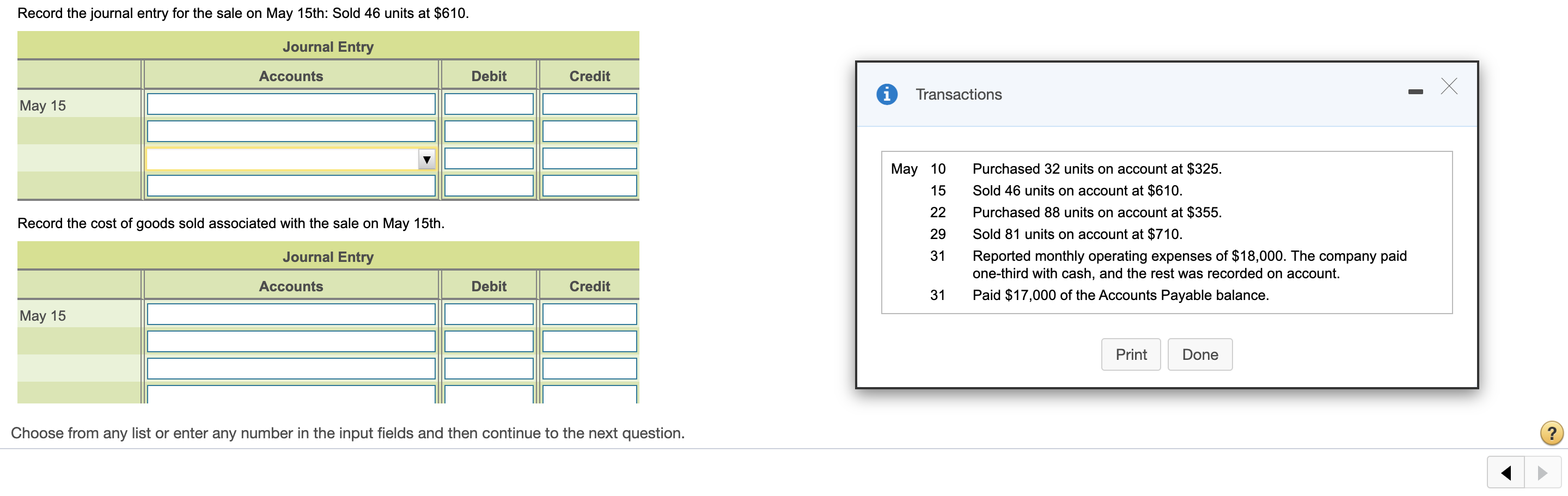

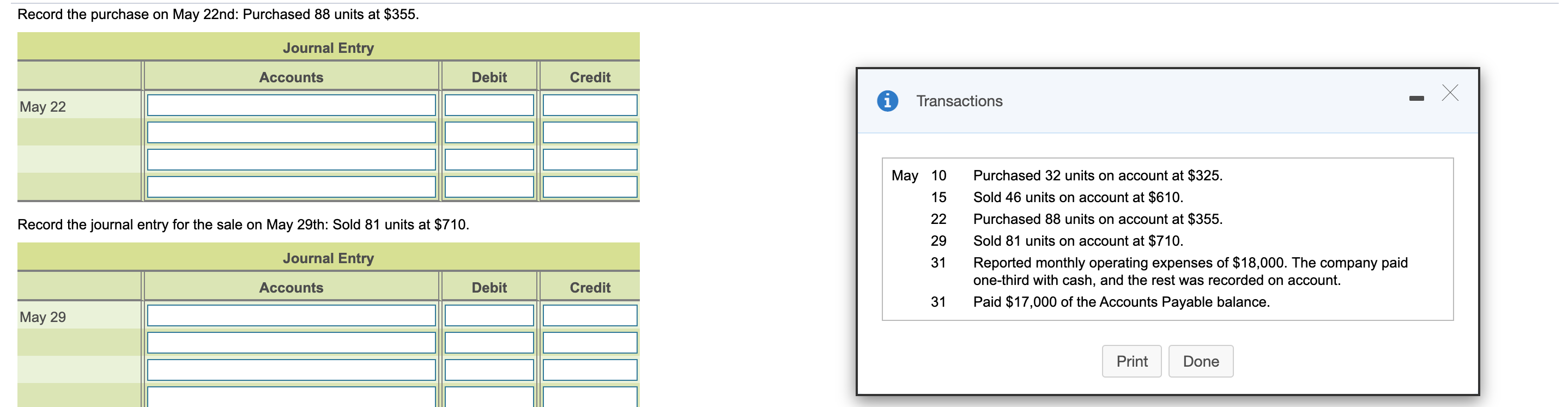

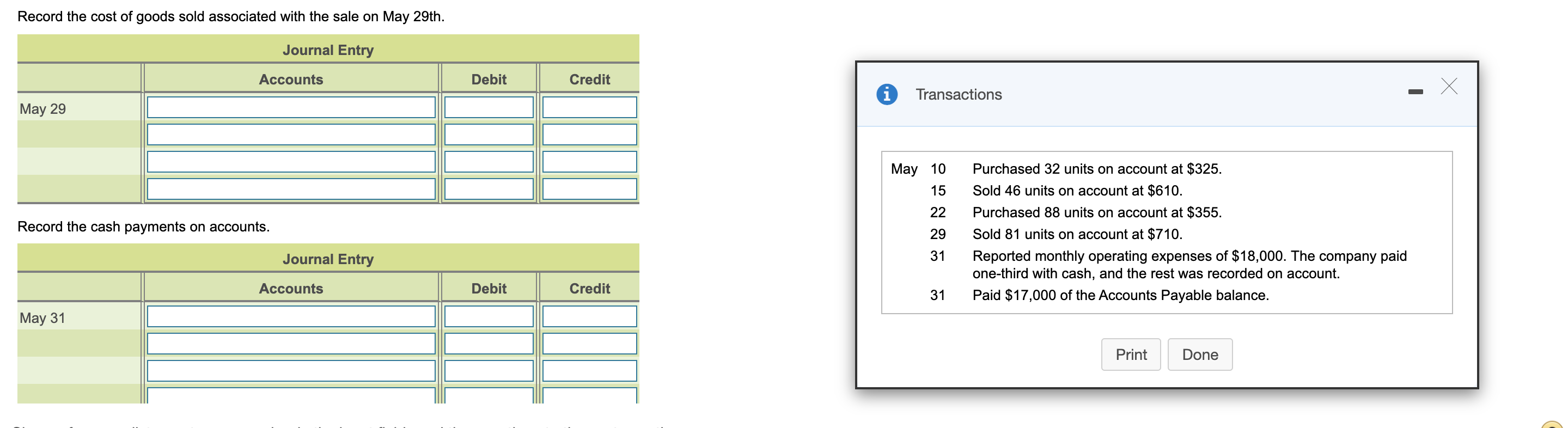

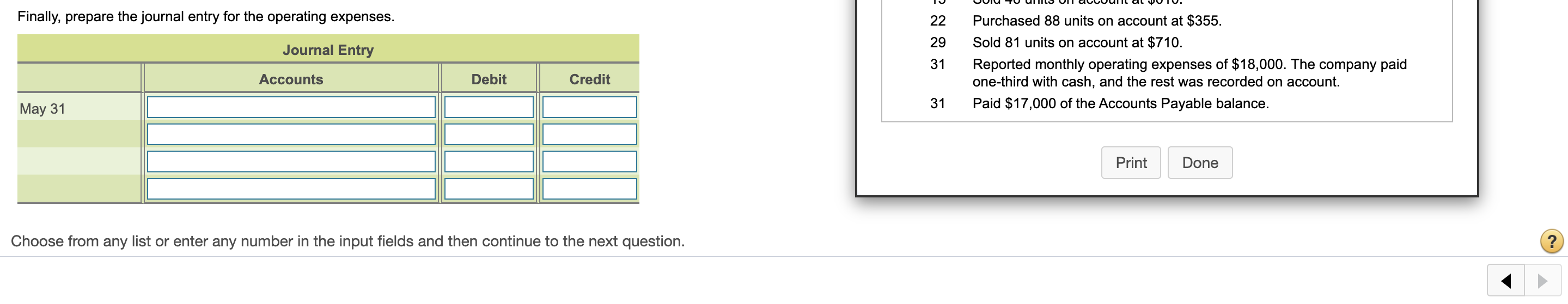

Nixon Distributors purchases inventory in crates of merchandise. Assume the company began May with an inventory of 32 units that cost $305 each. During the month, the company engaged in the following business transactions: A (Click the icon to view the transactions.) Assume Nixon Distributors uses the FIFO cost method for valuing Inventorles. The company uses a perpetual Inventory system. Required 1. Prepare a perpetual inventory record, at FIFO cost, for this merchandise. 2. Make journal entries to record the company's transactions. Requirement 1. Prepare a perpetual inventory record, at FIFO cost, for this merchandise. (Enter the oldest inventory layer first.) UNITS Purchases Cost of Goods Sold QTY Unit Cost Tot. Cost Inventory on Hand QTY Unit Cost Tot. Cost Transactions QTY Unit Cost Tot. Cost Beginning May 10 15 May 10 15 22 29 31 Purchased 32 units on account at $325. Sold 46 units on account at 5610 Purchased 88 units on account at $355. Sold 81 units on account at $710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rust was recorded on account. Paid $17,000 of the Accounts Payable balance. 31 22 29 Print Done Ending Choose from any list or enter any number in the input fields and then continue to the next question. ? Required 1. Prepare a perpetual inventory record, at FIFO cost, for this merchandise. 2. Make journal entries to record the company's transactions. Requirement 2. Make journal entries to record the company's transactions. We will start by preparing the journal entry for the first purchase on May 10th: Purchased 32 units at $325. (Record debits first, then credits. Exclude explanations from journal entries. Round amounts to Journal Entry Accounts Debit Credit Transactions nearest whole dollar.) May 10 May 10 15 22 29 31 Purchased 32 units on account at $325. Sold 46 units on account at 5610. Purchased 88 units on account at $355. Sold 81 units on account at S710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rust was recorded on account. Paid $17,000 of the Accounts Payable balance. Accounts Payable Record the joumal al Accounts Receivable Cash Cost of Goods Sold Inventory May 15 Operating Expenses Sales Revenue 5610 31 Debit Credit Print Done Choose from any list or enter any number in the input fields and then continue to the next question. ? Record the journal entry for the sale on May 15th: Sold 46 units at $610. Journal Entry Accounts Debit Credit i X Transactions - May 15 May 10 15 22 Record the cost of goods sold associated with the sale on May 15th. 29 Purchased 32 units on account at $325. Sold 46 units on account at $610. Purchased 88 units on account at $355. Sold 81 units on account at $710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rest was recorded on account. Paid $17,000 of the Accounts Payable balance. Journal Entry 31 Accounts Debit Credit 31 May 15 Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Record the purchase on May 22nd: Purchased 88 units at $355. Journal Entry Accounts Debit Credit X May 22 i Transactions May 10 15 22 Record the journal entry for the sale on May 29th: Sold 81 units at $710. 29 Purchased 32 units on account at $325. Sold 46 units on account at $610. Purchased 88 units on account at $355. Sold 81 units on account at $710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rest was recorded on account. Paid $17,000 of the Accounts Payable balance. Journal Entry 31 Accounts Debit Credit 31 May 29 Print Done Record the cost of goods sold associated with the sale on May 29th. Journal Entry Accounts Debit Credit i X Transactions - May 29 May 10 15 22 Record the cash payments on accounts. 29 Purchased 32 units on account at $325. Sold 46 units on account at $610. Purchased 88 units on account at $355. Sold 81 units on account at $710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rest was recorded on account. Paid $17,000 of the Accounts Payable balance. Journal Entry 31 Accounts Debit Credit 31 May 31 Print Done Finally, prepare the journal entry for the operating expenses. 22 29 Journal Entry 31 Purchased 88 units on account at $355. Sold 81 units on account at $710. Reported monthly operating expenses of $18,000. The company paid one-third with cash, and the rest was recorded on account. Paid $17,000 of the Accounts Payable balance. Accounts Debit Credit 31 May 31 Print Done Choose from any list or enter any number in the input fields and then continue to the next