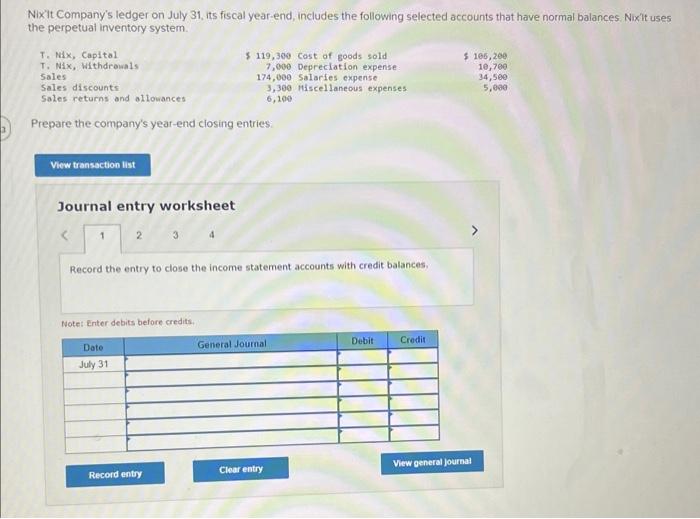

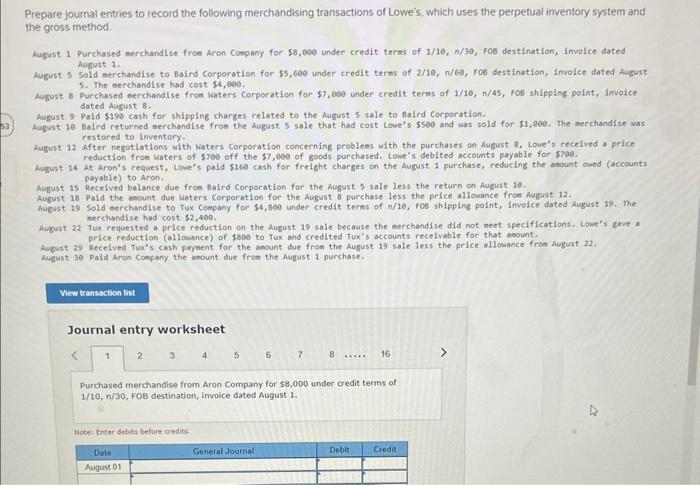

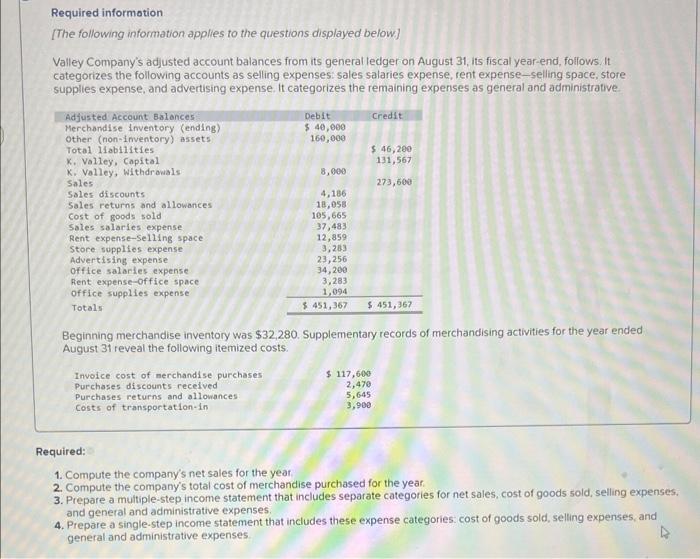

Nix't Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances. Nixit uses the perpetuai inventory system. Prepare the company's year-end closing entries: Journal entry worksheet Record the entry to close the income statement accounts with credit balances. Wotet entor debits before credits. Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and the gross method August 1 Purchased merchandise from Aron Conpany for 56,000 under credit terms of 1/10,n/30, Fos destination, involce dated Augast 1. August 5 sold merchandise to Badrd Corporation fon 55 , 6ee under credit terms of 2/10, n/6e, Fce destination, Invoice dated August 5. The nerchandise had cost $4,000. August 3 purchased merchandise fron Waters Corporation for $7,009 under credit teras of 1/10, n/45, fob: shipping point, Invoice dated August 8 . August 9 Paid $19 cash for shipplng charges related to the August 5 sale to falrd Corporation. August 10 Balrd returned serchandise fron the August 5 sale that had cost Lowe's $50e and was sold for 51 , 600 . The merchandise uas restored to inventory. August.12. After negotiations with Waters corporation concerning probleas with the purchases on August a, lowe's recelved a price reduction froe Maters of $700 off the $7,000 of goods purchased. Lowe's debited accounts payable for $70e. August 14 At Aron's request, Love's paid $160 cash for frelght charges on the August 1 purchase, reducing the anount aued (accounts poyable) to Aron. August 15 Pecelved balance due from Bafrd Corporation for the August 5 sale less the return on August 10. August 16 . Paid the anount doe Waters Corporation for the August 8 purchase less the price allowance frcm August 12 . August 19 Sold merchandise to Tux Company for 54,800 under credit. terms of n/10, roe shipping point, Involce dated August 19 . The merchandise had cost $2,400. August 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specificat lons. Love's gave a price reduction (allovance) of Sabe to Tux and credlted Tux's accounts recelvable far that anount. August 29 Recelved Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. August 30 Paid Aron Company the amount due from the August 1 purchase. Journal entry worksheet 234567816 Purchased merchandise from Aron Company for 58,000 under credit terms of 1/10,n/30,FOB destination, invoice dated August 1 . Hote: Enter debits belore credits. Required information [The following information applies to the questions displayed below] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expensesi sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $32,280. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: 1. Compute the company's net sales for the year: 2. Compute the company's total cost of merchandise purchased for the year: 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses. and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Nix't Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances. Nixit uses the perpetuai inventory system. Prepare the company's year-end closing entries: Journal entry worksheet Record the entry to close the income statement accounts with credit balances. Wotet entor debits before credits. Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and the gross method August 1 Purchased merchandise from Aron Conpany for 56,000 under credit terms of 1/10,n/30, Fos destination, involce dated Augast 1. August 5 sold merchandise to Badrd Corporation fon 55 , 6ee under credit terms of 2/10, n/6e, Fce destination, Invoice dated August 5. The nerchandise had cost $4,000. August 3 purchased merchandise fron Waters Corporation for $7,009 under credit teras of 1/10, n/45, fob: shipping point, Invoice dated August 8 . August 9 Paid $19 cash for shipplng charges related to the August 5 sale to falrd Corporation. August 10 Balrd returned serchandise fron the August 5 sale that had cost Lowe's $50e and was sold for 51 , 600 . The merchandise uas restored to inventory. August.12. After negotiations with Waters corporation concerning probleas with the purchases on August a, lowe's recelved a price reduction froe Maters of $700 off the $7,000 of goods purchased. Lowe's debited accounts payable for $70e. August 14 At Aron's request, Love's paid $160 cash for frelght charges on the August 1 purchase, reducing the anount aued (accounts poyable) to Aron. August 15 Pecelved balance due from Bafrd Corporation for the August 5 sale less the return on August 10. August 16 . Paid the anount doe Waters Corporation for the August 8 purchase less the price allowance frcm August 12 . August 19 Sold merchandise to Tux Company for 54,800 under credit. terms of n/10, roe shipping point, Involce dated August 19 . The merchandise had cost $2,400. August 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specificat lons. Love's gave a price reduction (allovance) of Sabe to Tux and credlted Tux's accounts recelvable far that anount. August 29 Recelved Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. August 30 Paid Aron Company the amount due from the August 1 purchase. Journal entry worksheet 234567816 Purchased merchandise from Aron Company for 58,000 under credit terms of 1/10,n/30,FOB destination, invoice dated August 1 . Hote: Enter debits belore credits. Required information [The following information applies to the questions displayed below] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expensesi sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $32,280. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: 1. Compute the company's net sales for the year: 2. Compute the company's total cost of merchandise purchased for the year: 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses. and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses