Answered step by step

Verified Expert Solution

Question

1 Approved Answer

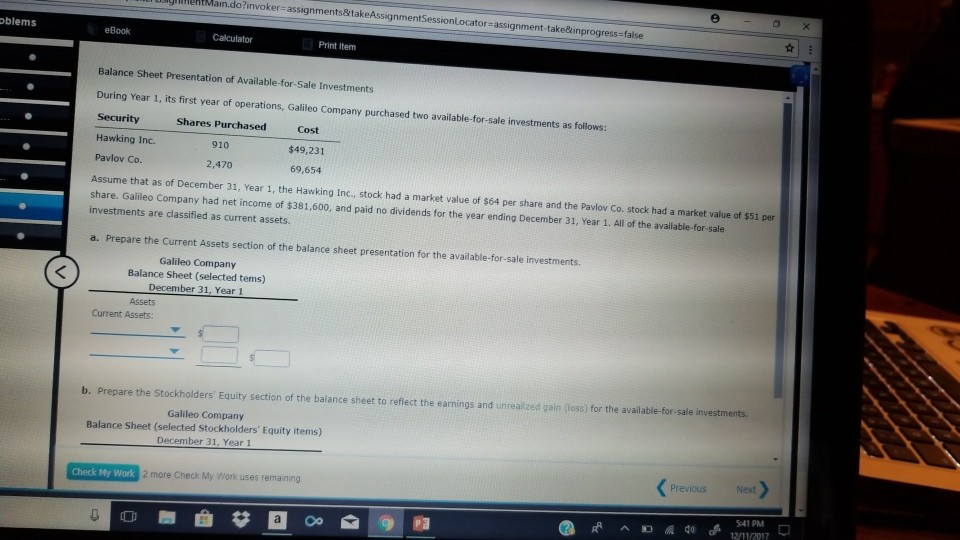

nneHtMain.do?invoker ltMain.do?invoker-assignments&takeAssignmentSessionlocator-assignment-take&inprogress-false oblems eBook Print Item Balance Sheet Presentation of Available-for-Sale Investments During Year 1, its first year of operations, Galileo Company purchased two available-for-sale

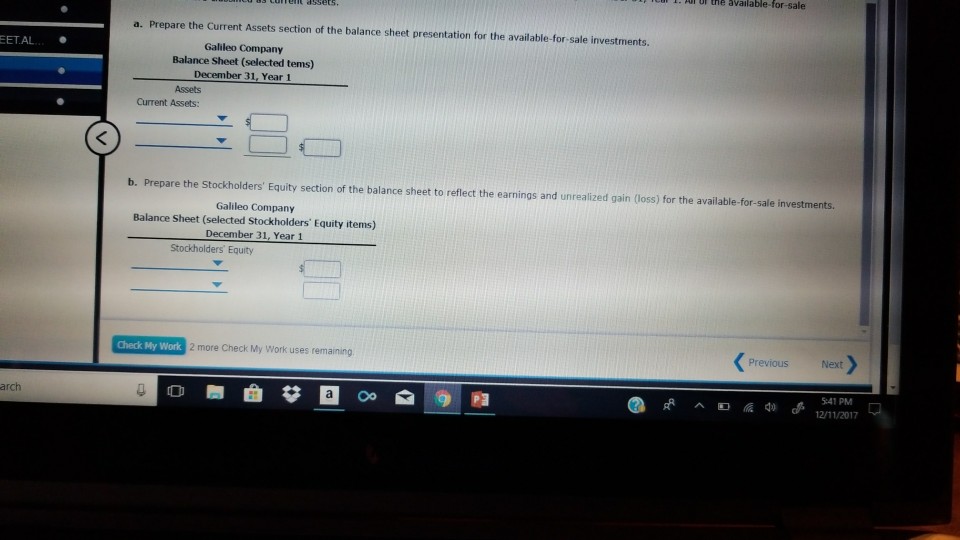

nneHtMain.do?invoker ltMain.do?invoker-assignments&takeAssignmentSessionlocator-assignment-take&inprogress-false oblems eBook Print Item Balance Sheet Presentation of Available-for-Sale Investments During Year 1, its first year of operations, Galileo Company purchased two available-for-sale investments as Security Hawking Inc. Pavlov Co. follows Shares Purchased 910 2,470 Cost $49,231 69,654 Assume that as of December 31, Year 1, the Hawking Inc, stock had a market value of $64 per share and the Pavlov Co. stock had a market value of $51 per share. Galileo Company had net income of $381,600, and paid no dividends for the year ending December 31, Year 1. All of the available-for-sale investments are dlassified as current assets. a. Prepare the Current Assets section of the balance sheet presentation for the available-for-sale investments Galileo Company Balance Sheet (selected tems) December 31, Year 1 Assets Current Assets: b. Prepare the Stockholders' Equity section of the balance sheet to reflect the earnings and unreallzed gain (loss) for the available-for-sale investments Galileo Company Balance Sheet (selected Stockholders' Equity items) December 31, Year 1 Previous Next 2 more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started