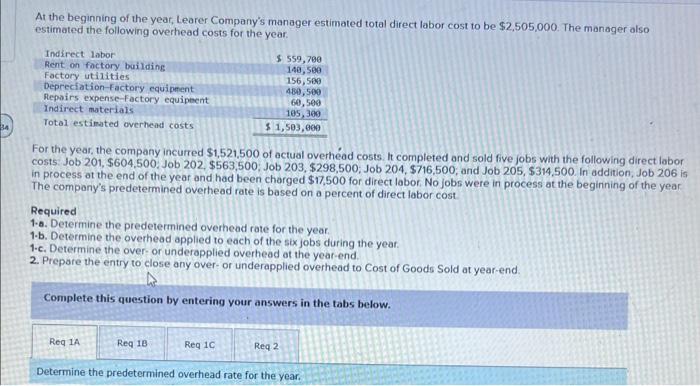

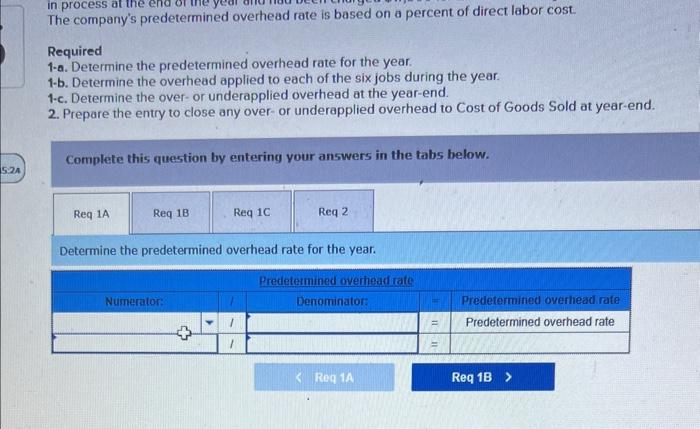

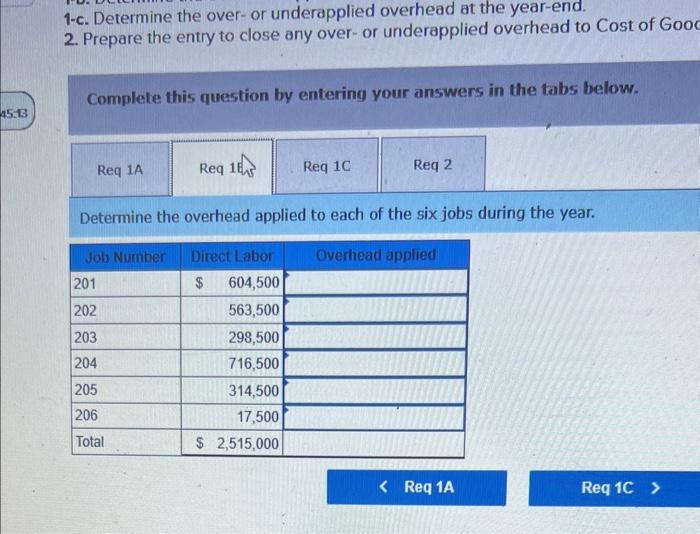

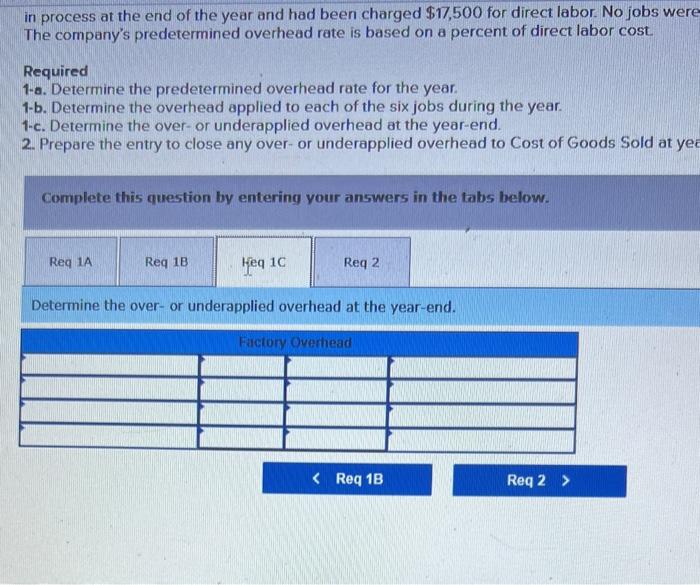

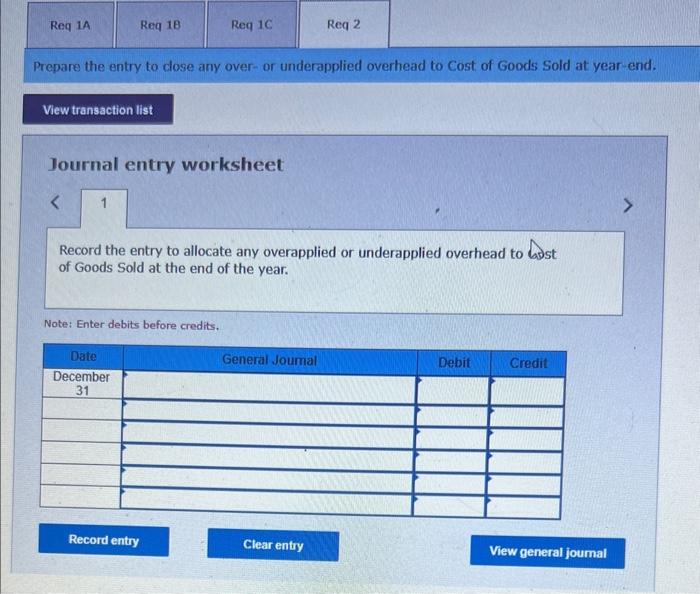

At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,505,000. The manager also estimated the following overhead costs for the year. For the year, the company incurred $1,521,500 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$604,500, Job 202, \$563,500, Job 203, \$298,500; Job 204,\$716,500; and Job 205, $314,500. In addition, Job 206 in process ot the end of the year and had been charged $17,500 for direct labor. No jobs were in process at the beginning of the year The company's predetermined overhead rate is based on a percent of direct labor cost. Required 1.a. Determine the predetermined overhead rate for the year. 1.b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead ot the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over-or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goo Complete this question by entering your answers in the tabs below. Determine the overhead applied to each of the six jobs during the year. in process at the end of the year and had been charged $17,500 for direct labor. No jobs were The company's predetermined overhead rate is based on a percent of direct labor cost Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at ye Complete this question by entering your answers in the tabs below. Determine the over-or underapplied overhead at the year-end. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to last of Goods Sold at the end of the year. Note: Enter debits before credits