Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(NO EXCEL) PLEASE SHOW FULL WORKING OUT WHERE POSSIBLE b) What is Du Pont system (decomposition of ROE)? Using below data to assess the investment

(NO EXCEL)

(NO EXCEL)

PLEASE SHOW FULL WORKING OUT WHERE POSSIBLE

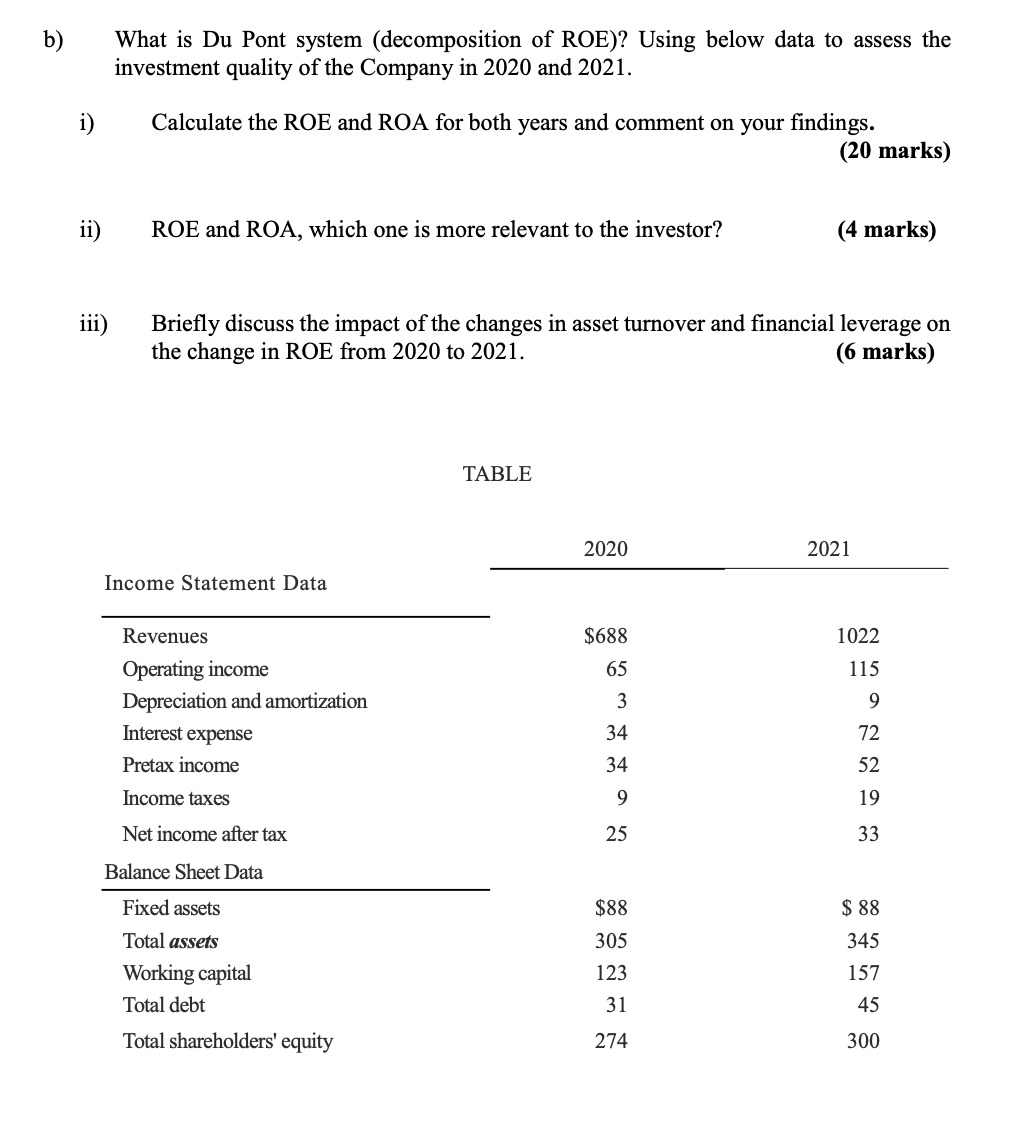

b) What is Du Pont system (decomposition of ROE)? Using below data to assess the investment quality of the Company in 2020 and 2021. i) Calculate the ROE and ROA for both years and comment on your findings. (20 marks) 11) ROE and ROA, which one is more relevant to the investor? (4 marks) iii) Briefly discuss the impact of the changes in asset turnover and financial leverage on the change in ROE from 2020 to 2021. (6 marks) TABLE 2020 2021 Income Statement Data $688 1022 Revenues Operating income Depreciation and amortization 115 65 3 34 9 Interest expense 72 52 Pretax income 34 Income taxes 9 19 Net income after tax 25 33 Balance Sheet Data Fixed assets $88 Total assets Working capital Total debt Total shareholders' equity 305 123 31 $ 88 345 157 45 274 300 b) What is Du Pont system (decomposition of ROE)? Using below data to assess the investment quality of the Company in 2020 and 2021. i) Calculate the ROE and ROA for both years and comment on your findings. (20 marks) 11) ROE and ROA, which one is more relevant to the investor? (4 marks) iii) Briefly discuss the impact of the changes in asset turnover and financial leverage on the change in ROE from 2020 to 2021. (6 marks) TABLE 2020 2021 Income Statement Data $688 1022 Revenues Operating income Depreciation and amortization 115 65 3 34 9 Interest expense 72 52 Pretax income 34 Income taxes 9 19 Net income after tax 25 33 Balance Sheet Data Fixed assets $88 Total assets Working capital Total debt Total shareholders' equity 305 123 31 $ 88 345 157 45 274 300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started