Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No excel please show your work. Thanks. Problem # 3: Today is period 0, and the length between the periods is one year. In the

No excel please show your work. Thanks.

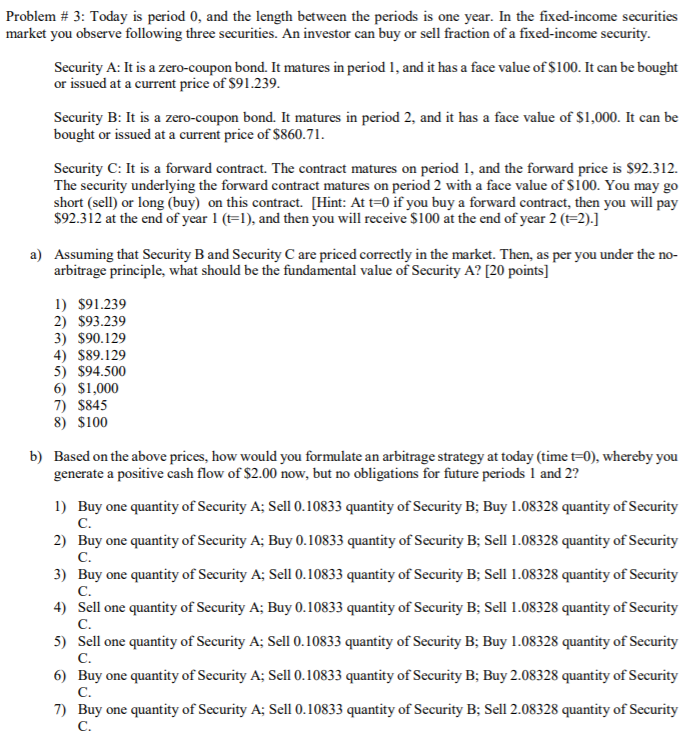

Problem # 3: Today is period 0, and the length between the periods is one year. In the fixed-income securities market you observe following three securities. An investor can buy or sell fraction of a fixed-income security. Security A: It is a zero-coupon bond. It matures in period 1, and it has a face value of $100. It can be bought or issued at a current price of $91.239. Security B: It is a zero-coupon bond. It matures in period 2, and it has a face value of $1,000. It can be bought or issued at a current price of $860.71. Security C: It is a forward contract. The contract matures on period 1, and the forward price is $92.312. The security underlying the forward contract matures on period 2 with a face value of $100. You may go short (sell) or long (buy) on this contract. (Hint: At t=0 if you buy a forward contract, then you will pay $92.312 at the end of year 1 (t1), and then you will receive $100 at the end of year 2 (t2).] a) Assuming that Security B and Security C are priced correctly in the market. Then, as per you under the no- arbitrage principle, what should be the fundamental value of Security A? [20 points] 1) $91.239 2) $93.239 3) $90.129 4) $89.129 5) $94.500 6) $1,000 7) $845 8) $100 b) Based on the above prices, how would you formulate an arbitrage strategy at today (time t=0), whereby you generate a positive cash flow of $2.00 now, but no obligations for future periods 1 and 2? 1) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 1.08328 quantity of Security 2) Buy one quantity of Security A; Buy 0.10833 quantity of Security B; Sell 1.08328 quantity of Security C. 3) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Sell 1.08328 quantity of Security c. 4) Sell one quantity of Security A; Buy 0.10833 quantity of Security B; Sell 1.08328 quantity of Security c. 5) Sell one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 1.08328 quantity of Security C. Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 2.08328 quantity of Security C. 7) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Sell 2.08328 quantity of Security Problem # 3: Today is period 0, and the length between the periods is one year. In the fixed-income securities market you observe following three securities. An investor can buy or sell fraction of a fixed-income security. Security A: It is a zero-coupon bond. It matures in period 1, and it has a face value of $100. It can be bought or issued at a current price of $91.239. Security B: It is a zero-coupon bond. It matures in period 2, and it has a face value of $1,000. It can be bought or issued at a current price of $860.71. Security C: It is a forward contract. The contract matures on period 1, and the forward price is $92.312. The security underlying the forward contract matures on period 2 with a face value of $100. You may go short (sell) or long (buy) on this contract. (Hint: At t=0 if you buy a forward contract, then you will pay $92.312 at the end of year 1 (t1), and then you will receive $100 at the end of year 2 (t2).] a) Assuming that Security B and Security C are priced correctly in the market. Then, as per you under the no- arbitrage principle, what should be the fundamental value of Security A? [20 points] 1) $91.239 2) $93.239 3) $90.129 4) $89.129 5) $94.500 6) $1,000 7) $845 8) $100 b) Based on the above prices, how would you formulate an arbitrage strategy at today (time t=0), whereby you generate a positive cash flow of $2.00 now, but no obligations for future periods 1 and 2? 1) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 1.08328 quantity of Security 2) Buy one quantity of Security A; Buy 0.10833 quantity of Security B; Sell 1.08328 quantity of Security C. 3) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Sell 1.08328 quantity of Security c. 4) Sell one quantity of Security A; Buy 0.10833 quantity of Security B; Sell 1.08328 quantity of Security c. 5) Sell one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 1.08328 quantity of Security C. Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Buy 2.08328 quantity of Security C. 7) Buy one quantity of Security A; Sell 0.10833 quantity of Security B; Sell 2.08328 quantity of SecurityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started