Answered step by step

Verified Expert Solution

Question

1 Approved Answer

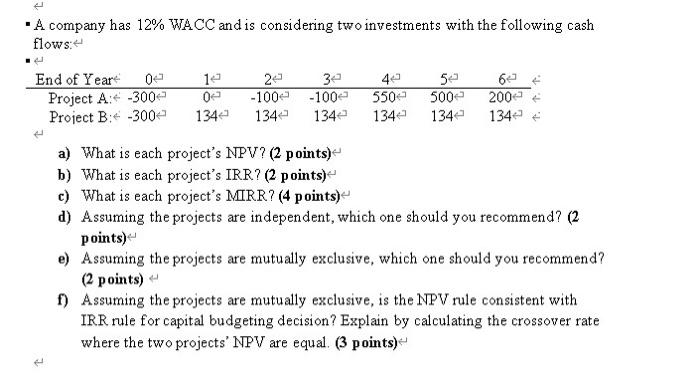

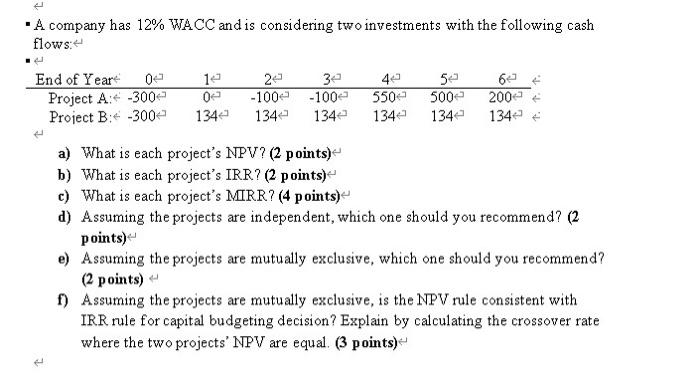

no excel plz A company has 12% WACC and is considering two investments with the following cash flows: End of Year 04 Project A: -3000

no excel plz

A company has 12% WACC and is considering two investments with the following cash flows: End of Year 04 Project A: -3000 Project B: -3000 le 02 134 24 -100 1342 3e -1000 1342 40 5500 1342 52 500 1344 6 2004 1344 a) What is each project's NPV? (2 points) b) What is each project's IRR? (2 points) c) What is each project's MIRR? (4 points) d) Assuming the projects are independent, which one should you recommend? (2 points) e) Assuming the projects are mutually exclusive, which one should you recommend? (2 points) f) Assuming the projects are mutually exclusive, is the NPV rule consistent with IRR rule for capital budgeting decision? Explain by calculating the crossover rate where the two projects' NPV are equal. (3 points) A company has 12% WACC and is considering two investments with the following cash flows: End of Year 04 Project A: -3000 Project B: -3000 le 02 134 24 -100 1342 3e -1000 1342 40 5500 1342 52 500 1344 6 2004 1344 a) What is each project's NPV? (2 points) b) What is each project's IRR? (2 points) c) What is each project's MIRR? (4 points) d) Assuming the projects are independent, which one should you recommend? (2 points) e) Assuming the projects are mutually exclusive, which one should you recommend? (2 points) f) Assuming the projects are mutually exclusive, is the NPV rule consistent with IRR rule for capital budgeting decision? Explain by calculating the crossover rate where the two projects' NPV are equal. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started