Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO EXPLANATION NEEDED, please just post answers to these 10 easy Multiple Choice questions, again NO EXPLANATION NEEDED, would be greatly appreciated (thumbs up guaranteed)!

NO EXPLANATION NEEDED, please just post answers to these 10 easy Multiple Choice questions, again NO EXPLANATION NEEDED, would be greatly appreciated (thumbs up guaranteed)! :)

NO EXPLANATION NEEDED, please just post answers to these 10 easy Multiple Choice questions, again NO EXPLANATION NEEDED, would be greatly appreciated (thumbs up guaranteed)! :)

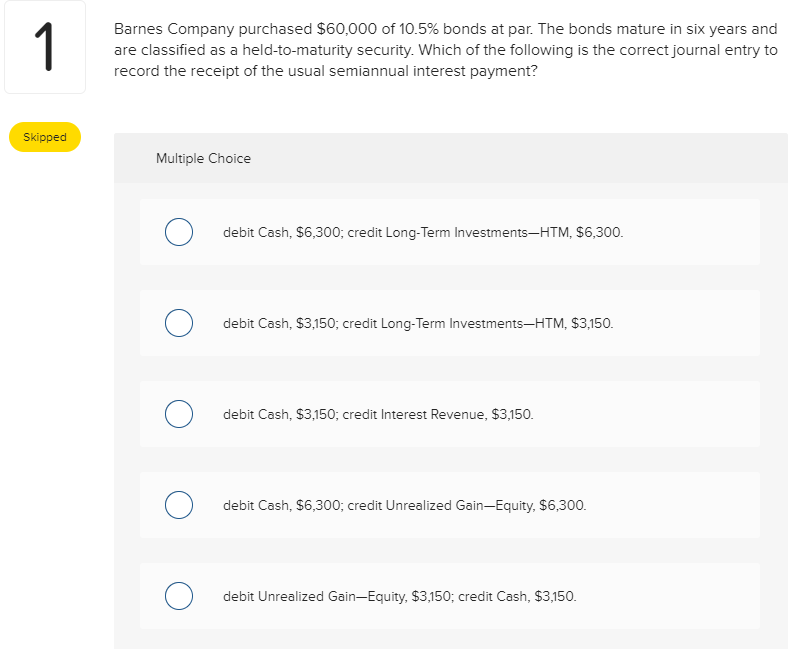

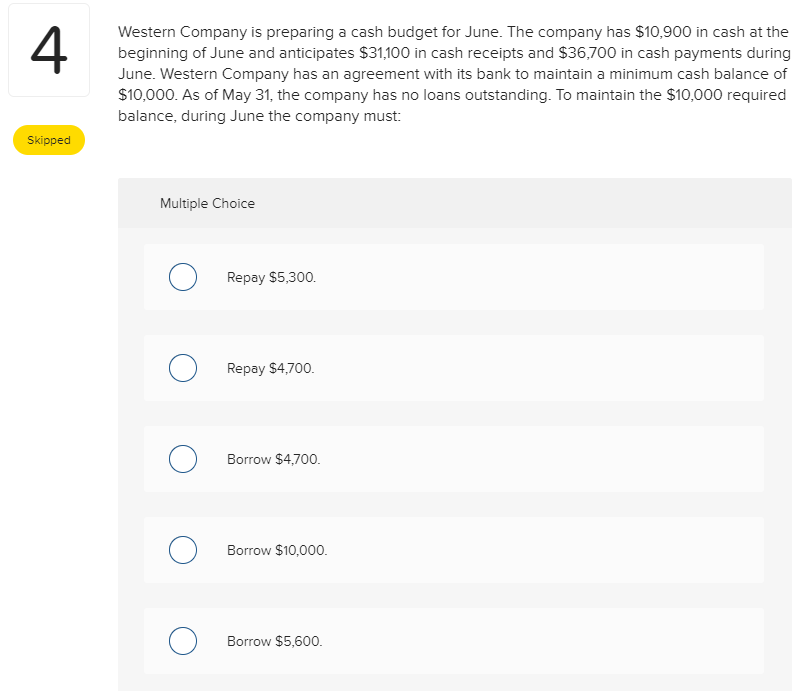

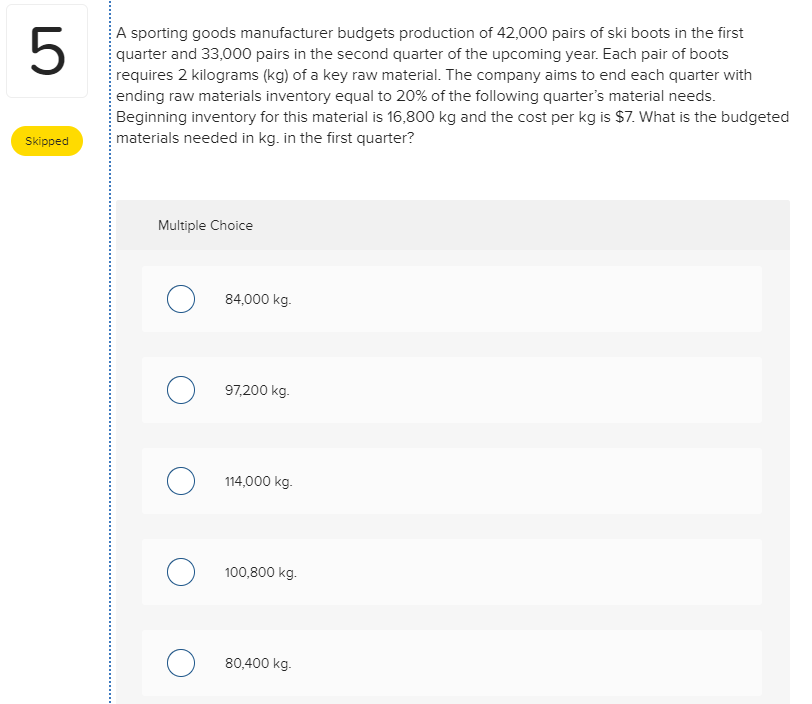

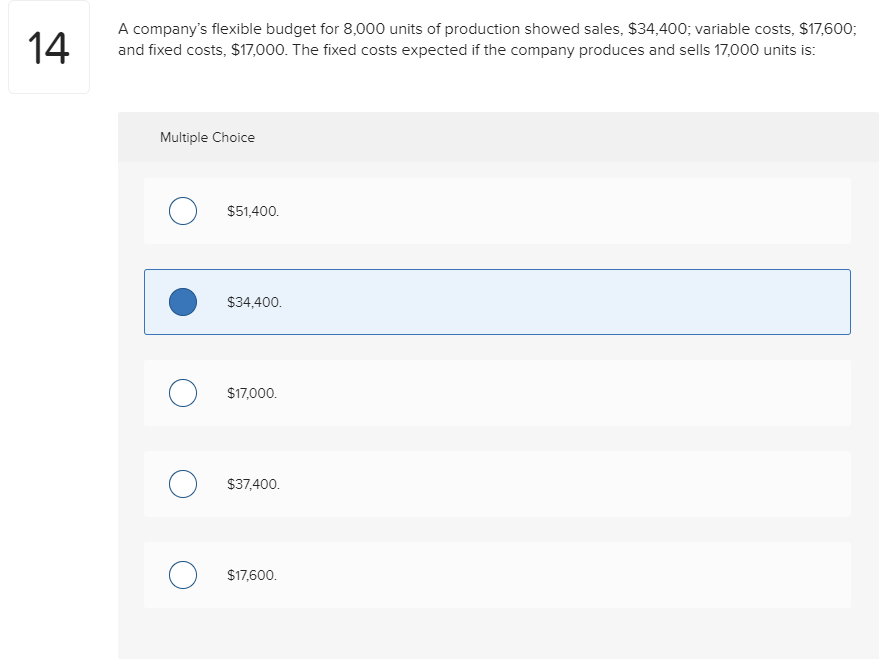

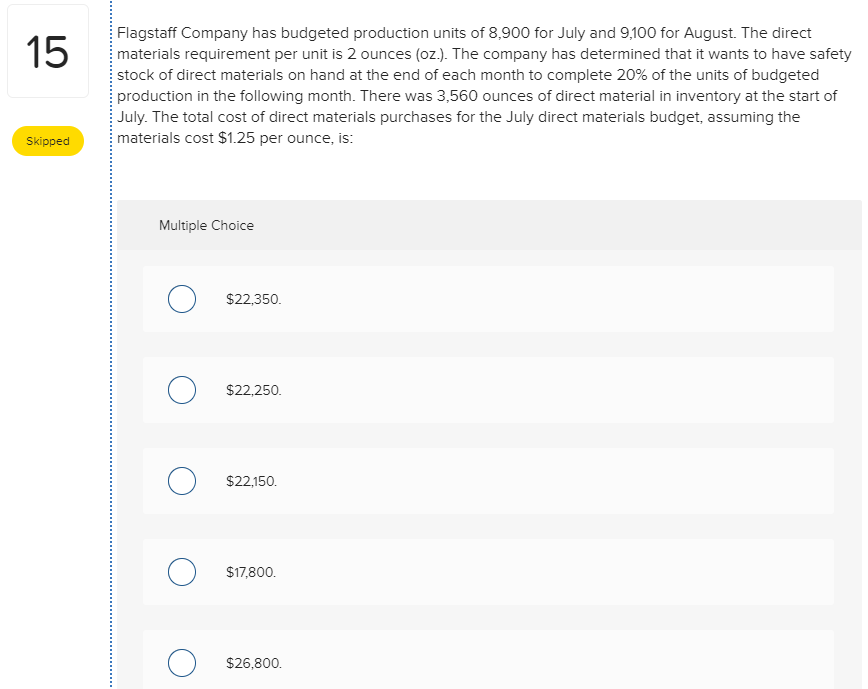

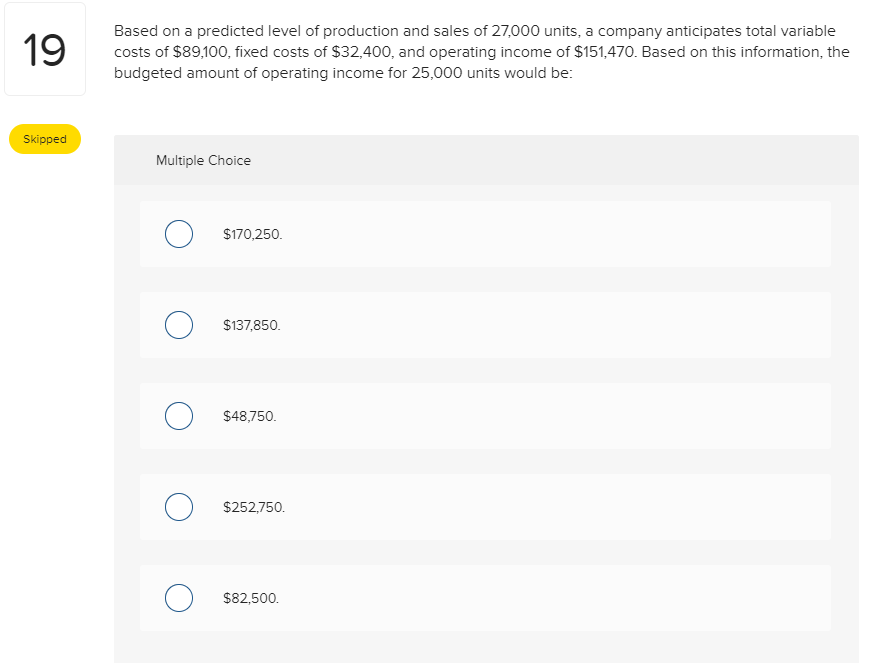

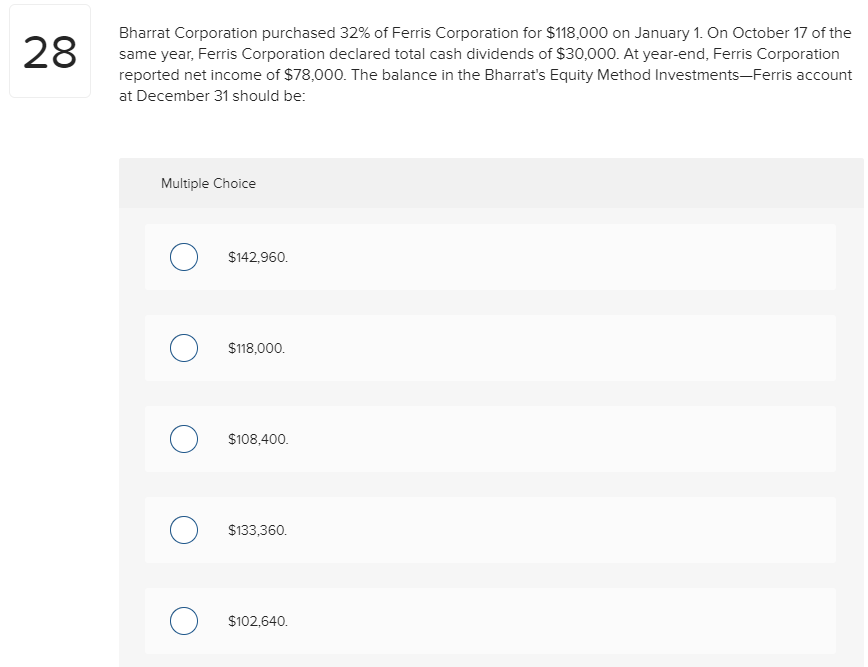

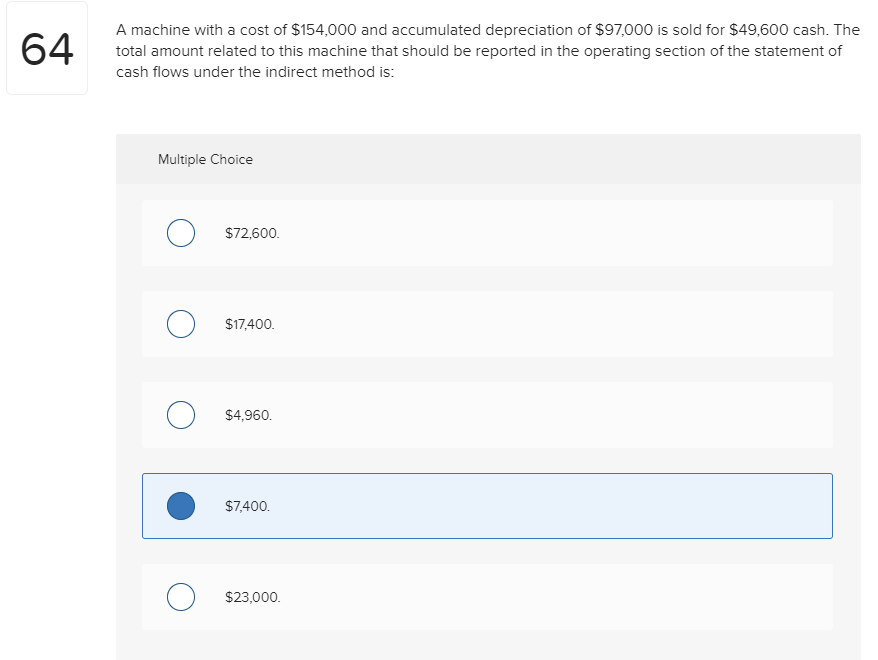

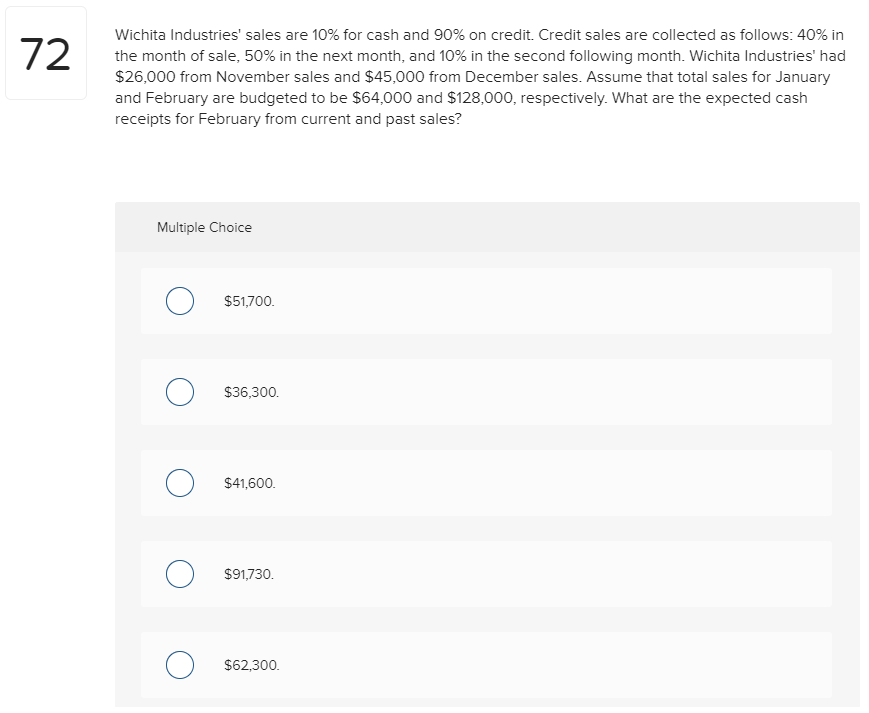

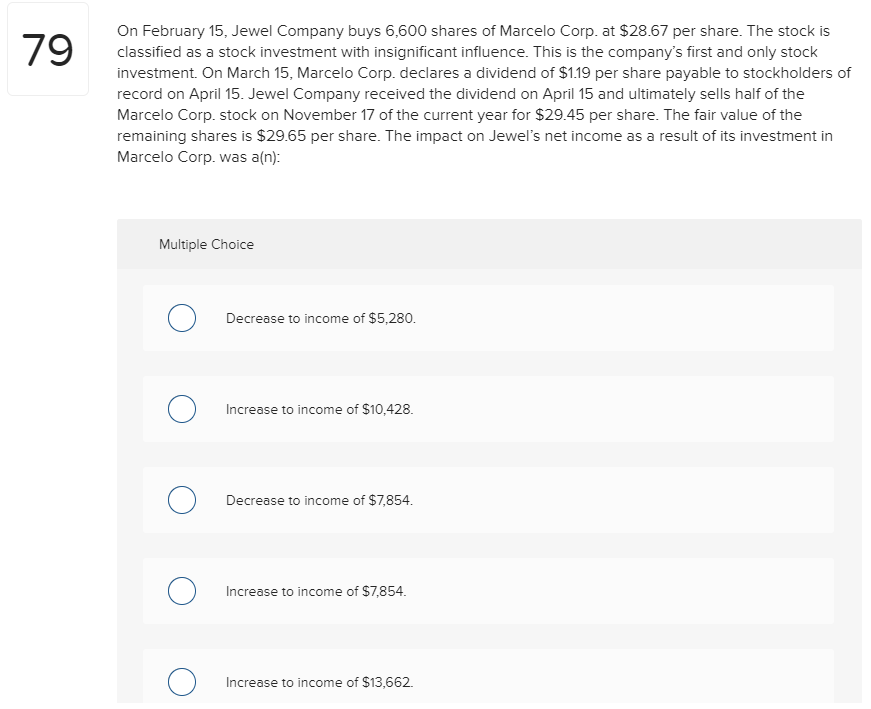

Barnes Company purchased $60,000 of 10.5% bonds at par. The bonds mature in six years and are classified as a held-to-maturity security. Which of the following is the correct journal entry to record the receipt of the usual semiannual interest payment? Skipped Multiple Choice O debit Cash, $6,300; credit Long-Term Investments-HTM, $6,300. O debit Cash, $3,150; credit Long-Term Investments-HTM, $3,150. O debit Cash, $3,150; credit Interest Revenue, $3,150. O debit Cash, $6,300, credit Unrealized Gain-Equity, $6,300. O debit Unrealized Gain-Equity, $3,150; credit Cash, $3,150. Western Company is preparing a cash budget for June. The company has $10,900 in cash at the beginning of June and anticipates $31,100 in cash receipts and $36,700 in cash payments during June. Western Company has an agreement with its bank to maintain a minimum cash balance of $10,000. As of May 31, the company has no loans outstanding. To maintain the $10,000 required balance, during June the company must: Skipped Multiple Choice 0 Repay $5,300. 0 Repay $4,700 0 Borrow $4,700 0 Borrow $10,000 0 Borrow $5,600. A sporting goods manufacturer budgets production of 42,000 pairs of ski boots in the first quarter and 33,000 pairs in the second quarter of the upcoming year. Each pair of boots requires 2 kilograms (kg) of a key raw material. The company aims to end each quarter with ending raw materials inventory equal to 20% of the following quarter's material needs. Beginning inventory for this material is 16,800 kg and the cost per kg is $7. What is the budgeted materials needed in kg. in the first quarter? Skipped Multiple Choice O 84,000 kg. 0 97,200 kg. O 114,000 kg. O 100,800 kg. O 80,400 kg. 14 A company's flexible budget for 8,000 units of production showed sales, $34,400; variable costs, $17,600; and fixed costs, $17,000. The fixed costs expected if the company produces and sells 17,000 units is: Multiple Choice $51,400. $34,400. $17,000. $37,400. $17,600. Flagstaff Company has budgeted production units of 8,900 for July and 9,100 for August. The direct materials requirement per unit is 2 ounces (oz.). The company has determined that it wants to have safety stock of direct materials on hand at the end of each month to complete 20% of the units of budgeted production in the following month. There was 3,560 ounces of direct material in inventory at the start of July. The total cost of direct materials purchases for the July direct materials budget, assuming the materials cost $1.25 per ounce, is: Skipped Multiple Choice 0 $22,350. 0 $22,250 0 $22,150. 0 $17,800. 0 $26,800. 19 Based on a predicted level of production and sales of 27,000 units, a company anticipates total variable costs of $89,100, fixed costs of $32,400, and operating income of $151,470. Based on this information, the budgeted amount of operating income for 25,000 units would be: Skipped Multiple Choice O $170,250 0 $137,850. 0 $48,750. 0 $252,750. O $82,500. 28 Bharrat Corporation purchased 32% of Ferris Corporation for $118,000 on January 1. On October 17 of the same year, Ferris Corporation declared total cash dividends of $30,000. At year-end, Ferris Corporation reported net income of $78,000. The balance in the Bharrat's Equity Method Investments-Ferris account at December 31 should be: Multiple Choice $142,960. $118,000. $108,400. $133,360. $102,640. 64 A machine with a cost of $154,000 and accumulated depreciation of $97,000 is sold for $49,600 cash. The total amount related to this machine that should be reported in the operating section of the statement of cash flows under the indirect method is: Multiple Choice o $72,600. $17,400. $4,960. $7,400. $23,000 72 Wichita Industries' sales are 10% for cash and 90% on credit. Credit sales are collected as follows: 40% in the month of sale, 50% in the next month, and 10% in the second following month. Wichita Industries' had $26,000 from November sales and $45,000 from December sales. Assume that total sales for January and February are budgeted to be $64,000 and $128,000, respectively. What are the expected cash receipts for February from current and past sales? Multiple Choice O $51,700. O $36,300 O $41,600. O $91,730. O $62,300 79 On February 15, Jewel Company buys 6,600 shares of Marcelo Corp. at $28.67 per share. The stock is classified as a stock investment with insignificant influence. This is the company's first and only stock investment. On March 15, Marcelo Corp. declares a dividend of $1.19 per share payable to stockholders of record on April 15. Jewel Company received the dividend on April 15 and ultimately sells half of the Marcelo Corp. stock on November 17 of the current year for $29.45 per share. The fair value of the remaining shares is $29.65 per share. The impact on Jewel's net income as a result of its investment in Marcelo Corp. was a(n): Multiple Choice O Decrease to income of $5,280. 0 Increase to income of $10,428. 0 Decrease to income of $7,854. 0 Increase to income of $7,854. 0 Increase to income of $13,662

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started