No hand writtens answer both please.

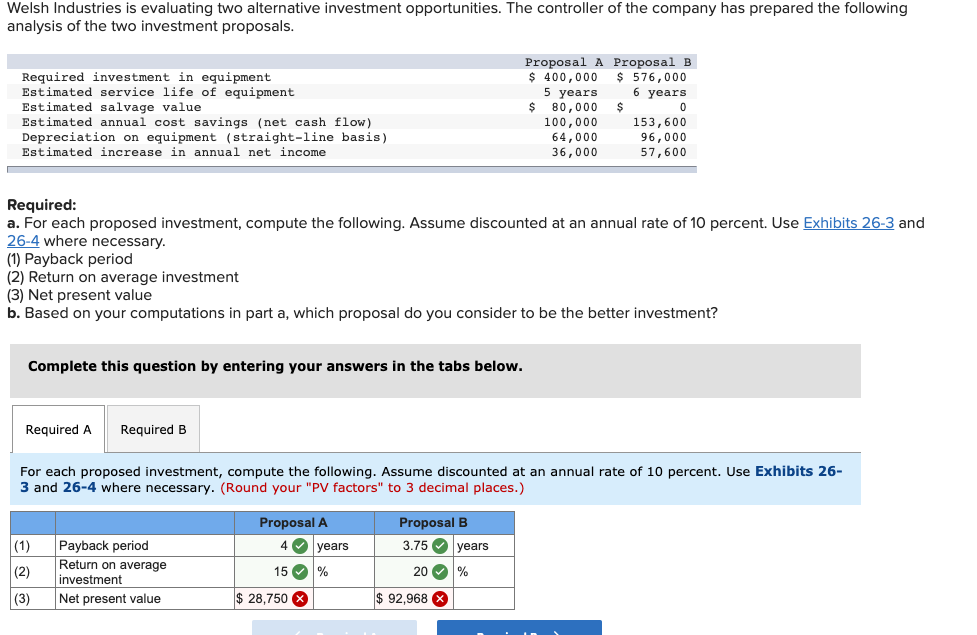

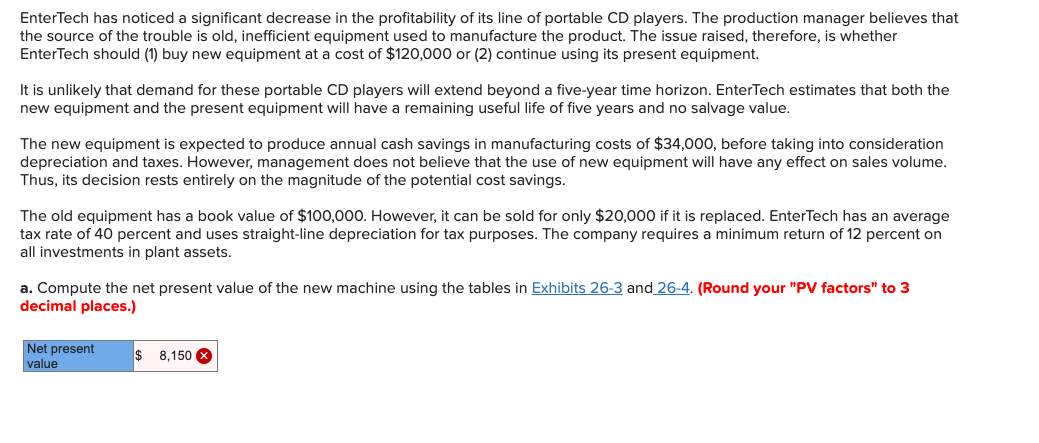

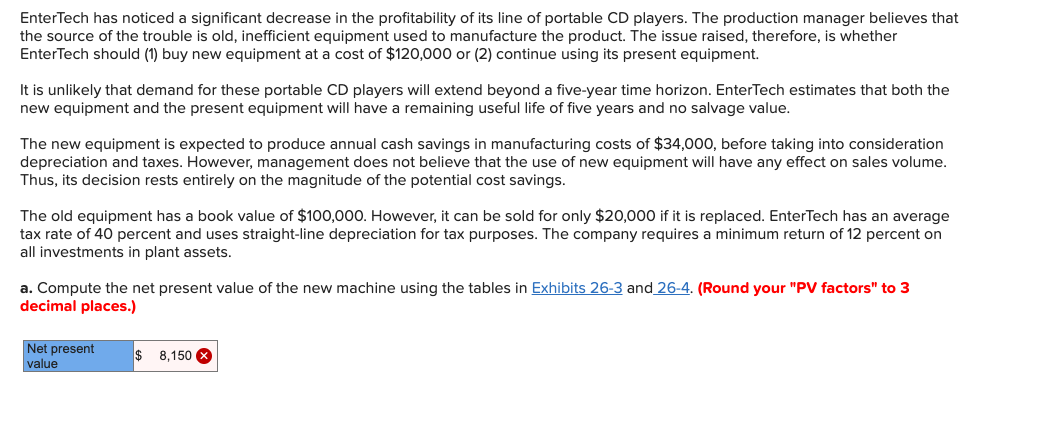

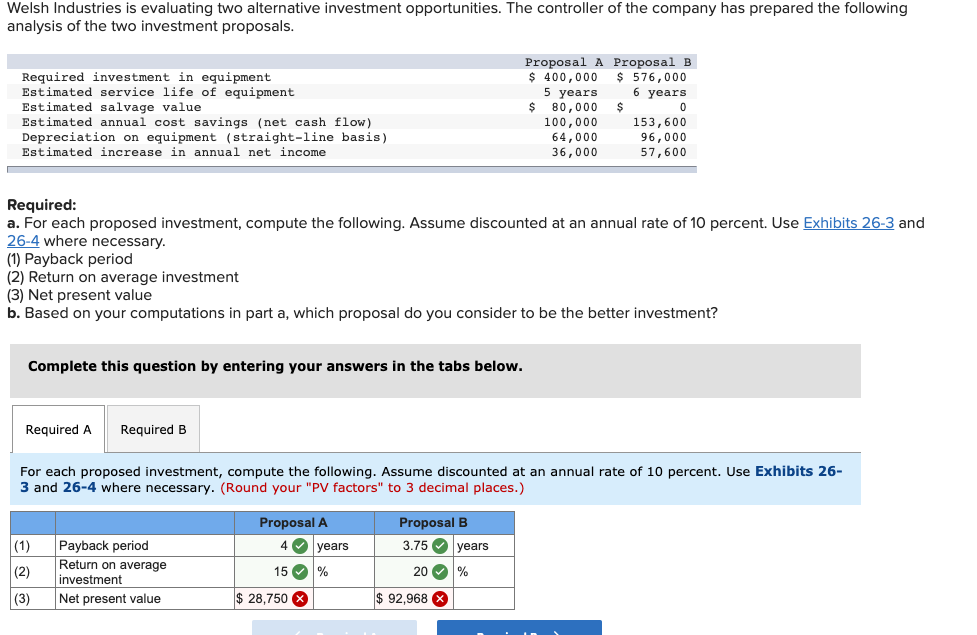

Welsh Industries is evaluating two alternative investment opportunities. The controller of the company has prepared the following analysis of the two investment proposals. Required investment in equipment Estimated service life of equipment Estimated salvage value Estimated annual cost savings (net cash flow) Depreciation on equipment (straight-line basis) Estimated increase in annual net income Proposal A Proposal B $ 400,000 $ 576,000 5 years 6 years $ 80,000 $ 0 100,000 153,600 64,000 96,000 36,000 57,600 Required: a. For each proposed investment, compute the following. Assume discounted at an annual rate of 10 percent. Use Exhibits 26-3 and 26-4 where necessary. (1) Payback period (2) Return on average investment (3) Net present value b. Based on your computations in part a, which proposal do you consider to be the better investment? Complete this question by entering your answers in the tabs below. Required A Required B For each proposed investment, compute the following. Assume discounted at an annual rate of 10 percent. Use Exhibits 26- 3 and 26-4 where necessary. (Round your "PV factors" to 3 decimal places.) posal B (1) Payback period Return on average investment Net present value Proposal A 4 years 15 % $ 28,750 Proposal B 3.75 years 20 % $ 92,968 EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The production manager believes that the source of the trouble is old, inefficient equipment used to manufacture the product. The issue raised, therefore, is whether EnterTech should (1) buy new equipment at a cost of $120,000 or (2) continue using its present equipment. It is unlikely that demand for these portable CD players will extend beyond a five-year time horizon. EnterTech estimates that both the new equipment and the present equipment will have a remaining useful life of five years and no salvage value. The new equipment is expected to produce annual cash savings in manufacturing costs of $34,000, before taking into consideration depreciation and taxes. However, management does not believe that the use of new equipment will have any effect on sales volume. Thus, its decision rests entirely on the magnitude of the potential cost savings. The old equipment has a book value of $100,000. However, it can be sold for only $20,000 if it is replaced. EnterTech has an average tax rate of 40 percent and uses straight-line depreciation for tax purposes. The company requires a minimum return of 12 percent on all investments in plant assets. a. Compute the net present value of the new machine using the tables in Exhibits 26-3 and 26-4. (Round your "PV factors" to 3 decimal places.) Net present value $ 8,150 EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The production manager believes that the source of the trouble is old, inefficient equipment used to manufacture the product. The issue raised, therefore, is whether EnterTech should (1) buy new equipment at a cost of $120,000 or (2) continue using its present equipment. It is unlikely that demand for these portable CD players will extend beyond a five-year time horizon. EnterTech estimates that both the new equipment and the present equipment will have a remaining useful life of five years and no salvage value. The new equipment is expected to produce annual cash savings in manufacturing costs of $34,000, before taking into consideration depreciation and taxes. However, management does not believe that the use of new equipment will have any effect on sales volume. Thus, its decision rests entirely on the magnitude of the potential cost savings. The old equipment has a book value of $100,000. However, it can be sold for only $20,000 if it is replaced. EnterTech has an average tax rate of 40 percent and uses straight-line depreciation for tax purposes. The company requires a minimum return of 12 percent on all investments in plant assets. a. Compute the net present value of the new machine using the tables in Exhibits 26-3 and 26-4. (Round your "PV factors" to 3 decimal places.) Net present value $ 8,150