Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO MISSING DATA IN SERIOUS EXAM PREPARATION. CORRECT ANSWERS ARE REQUIRED. PQR Ltd. is the company which has performed well in the past but one

NO MISSING DATA

IN SERIOUS EXAM PREPARATION. CORRECT ANSWERS ARE REQUIRED.

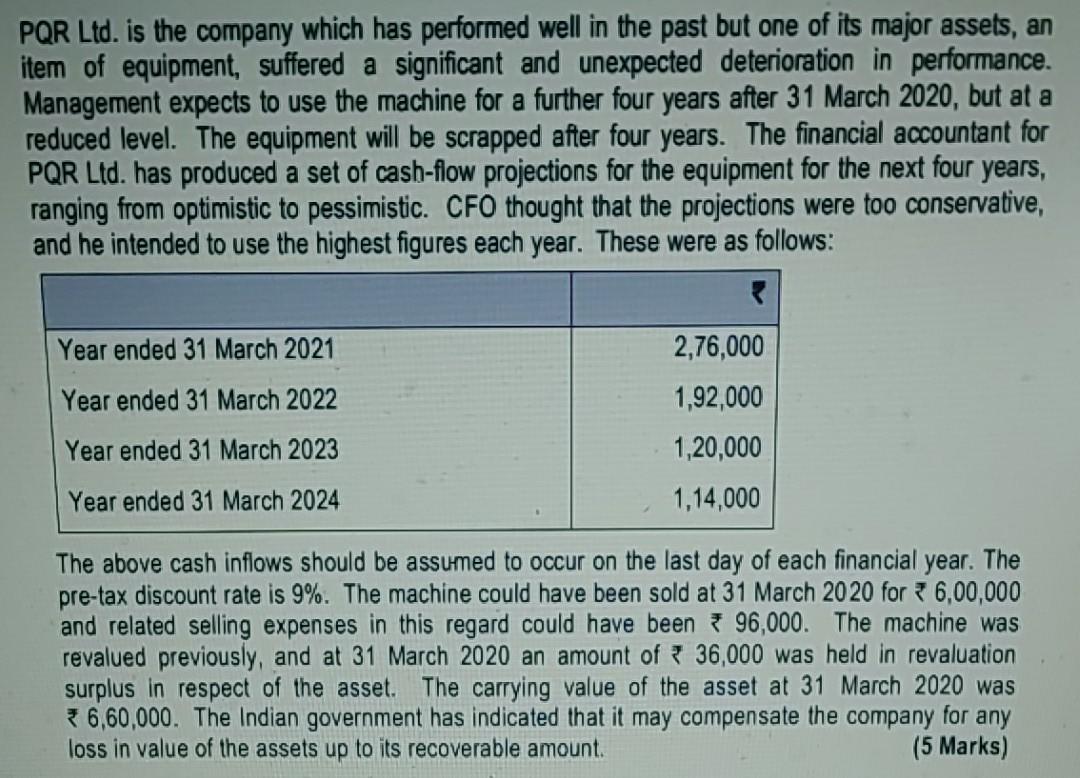

PQR Ltd. is the company which has performed well in the past but one of its major assets, an item of equipment, suffered a significant and unexpected deterioration in performance. Management expects to use the machine for a further four years after 31 March 2020, but at a reduced level. The equipment will be scrapped after four years. The financial accountant for PQR Ltd. has produced a set of cash-flow projections for the equipment for the next four years, ranging from optimistic to pessimistic. CFO thought that the projections were too conservative, and he intended to use the highest figures each year. These were as follows: Year ended 31 March 2021 Year ended 31 March 2022 2,76,000 1,92,000 1,20,000 1,14,000 Year ended 31 March 2023 Year ended 31 March 2024 The above cash inflows should be assumed to occur on the last day of each financial year. The pre-tax discount rate is 9%. The machine could have been sold at 31 March 2020 for 6,00,000 and related selling expenses in this regard could have been 96,000. The machine was revalued previously, and at 31 March 2020 an amount of 36,000 was held in revaluation surplus in respect of the asset. The carrying value of the asset at 31 March 2020 was 36,60,000. The Indian government has indicated that it may compensate the company for any loss in value of the assets up to its recoverable amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started