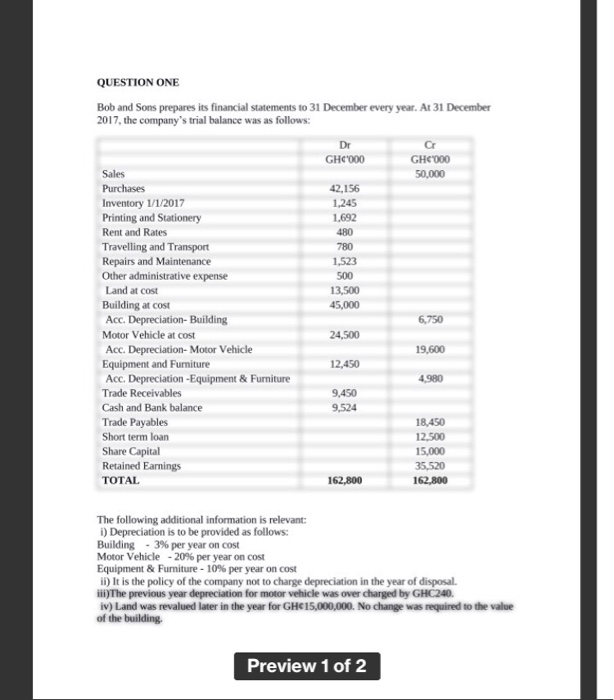

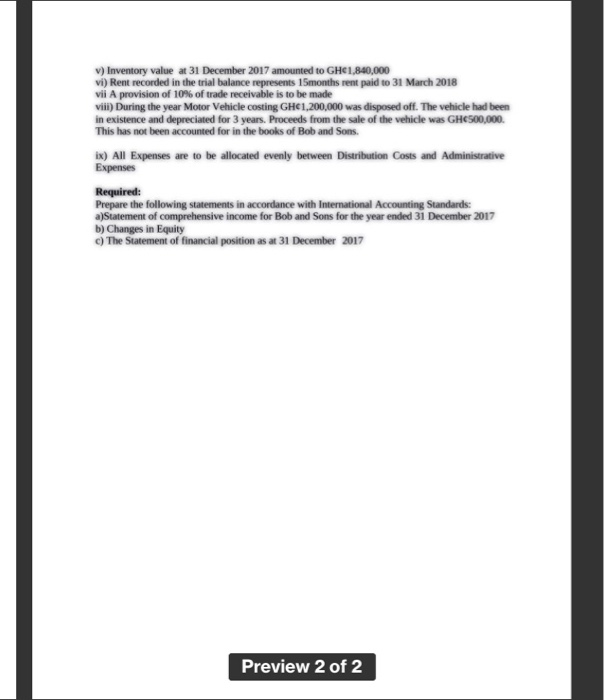

QUESTION ONE Bob and Sons prepares its financial statements to 31 December every year. At 31 December 2017, the company's trial balance was as follows: Dr a GHC000 GHC000 Sales 50,000 Purchases 42,156 Inventory 1/1/2017 1,245 Printing and Stationery 1,692 Rent and Rates 480 Travelling and Transport 780 Repairs and Maintenance 1,523 Other administrative expense 500 Land at cost 13,500 Building at cost 45,000 Acc. Depreciation-Building 6,750 Motor Vehicle at cost 24,500 Acc. Depreciation- Motor Vehicle 19,600 Equipment and Furniture 12,450 Acc. Depreciation -Equipment & Furniture 4.980 Trade Receivables 9,450 Cash and Bank balance 9.524 Trade Payables 18,450 Short term loan 12.500 Share Capital 15,000 Retained Earnings 35,520 TOTAL 162,800 162,800 The following additional information is relevant: 1) Depreciation is to be provided as follows: Building - 3% per year on cost Motor Vehicle -20% per year on cost Equipment & Furniture -10% per year on cost ii) It is the policy of the company not to charge depreciation in the year of disposal. iii) The previous year depreciation for motor vehicle was over charged by GHC240. 1) Land was revalued later in the year for GH15,000,000. No change was required to the value of the building Preview 1 of 2 v) Inventory value at 31 December 2017 amounted to GH 1,840,000 vi) Rent recorded in the trial balance represents 15months rent paid to 31 March 2018 vil A provision of 10% of trade receivable is to be made viii) During the year Motor Vehicle costing GH 1,200,000 was disposed off. The vehicle had been in existence and depreciated for 3 years. Proceeds from the sale of the vehicle was GH500,000 This has not been accounted for in the books of Bob and Sons. ix) All Expenses are to be allocated evenly between Distribution Costs and Administrative Expenses Required: Prepare the following statements in accordance with International Accounting Standards: a)Statement of comprehensive income for Bob and Sons for the year ended 31 December 2017 b) Changes in Equity C) The Statement of financial position as at 31 December 2017 Preview 2 of 2