Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO MISSING DATA Om Ltd. purchased an item of property, plant and equipment for US $ 50 lakh on 01.04.2019 and the same was fully

NO MISSING DATA

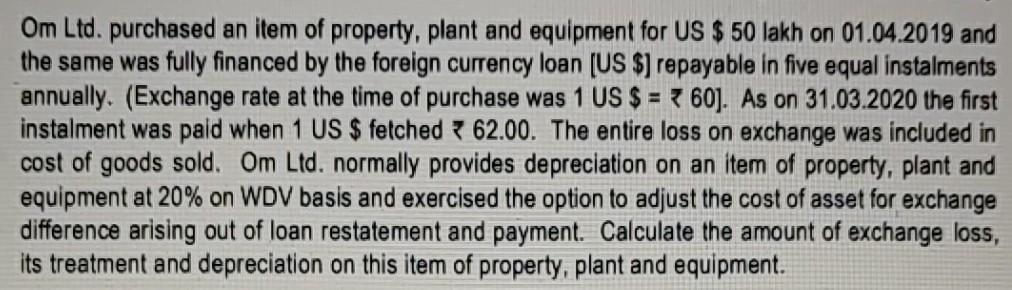

Om Ltd. purchased an item of property, plant and equipment for US $ 50 lakh on 01.04.2019 and the same was fully financed by the foreign currency loan (US $) repayable in five equal instalments annually. (Exchange rate at the time of purchase was 1 US $ = 60). As on 31.03.2020 the first instalment was paid when 1 US $ fetched 62.00. The entire loss on exchange was included in cost of goods sold. Om Ltd. normally provides depreciation on an item of property, plant and equipment at 20% on WDV basis and exercised the option to adjust the cost of asset for exchange difference arising out of loan restatement and payment. Calculate the amount of exchange loss, its treatment and depreciation on this item of property, plant and equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started