Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no need for explaintion just answer Q23-Q25 are based on the following article about Aircatle on Nov. 6, 2019: In a deal valued at $7.4

no need for explaintion just answer

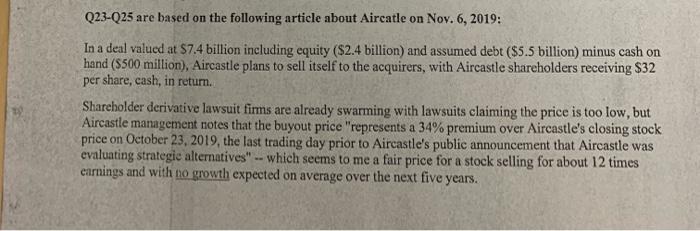

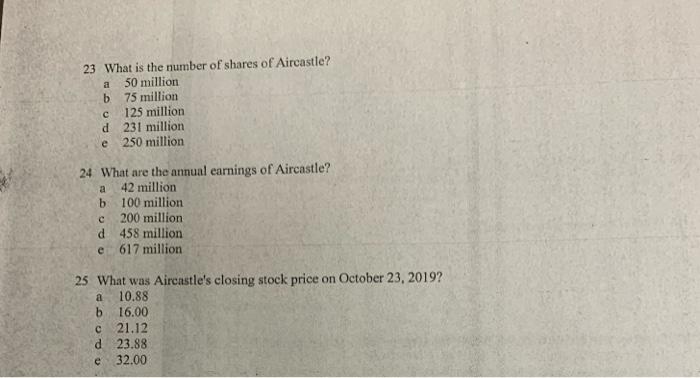

Q23-Q25 are based on the following article about Aircatle on Nov. 6, 2019: In a deal valued at $7.4 billion including equity ( $2.4 billion) and assumed debt ( $5.5 billion) minus cash on hand ( $500 million), Aircastle plans to sell itself to the acquirers, with Aircastle shareholders receiving $32 per share, cash, in return. Shareholder derivative lawsuit firms are already swarming with lawsuits claiming the price is too low, but Aircastle management notes that the buyout price "represents a 34% premium over Aircastle's closing stock price on October 23, 2019, the last trading day prior to Aircastle's public announcement that Aircastle was evaluating strategic alternatives" - which seems to me a fair price for a stock selling for about 12 times carnings and with no growth expected on average over the next five years. 23 What is the number of shares of Aircastle? a 50 million b. 75 million c 125 million d 231 million e 250 million 24 What are the annual earnings of Aircastle? a 42 million b. 100 million c 200 million d 458 million e 617 million 25 What was Aircnstle's closing stock price on October 23, 2019? a 10.88 b 16.00 c 21.12 d 23.88 e 32.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started