no need for part (a) only the calculation for part (b).

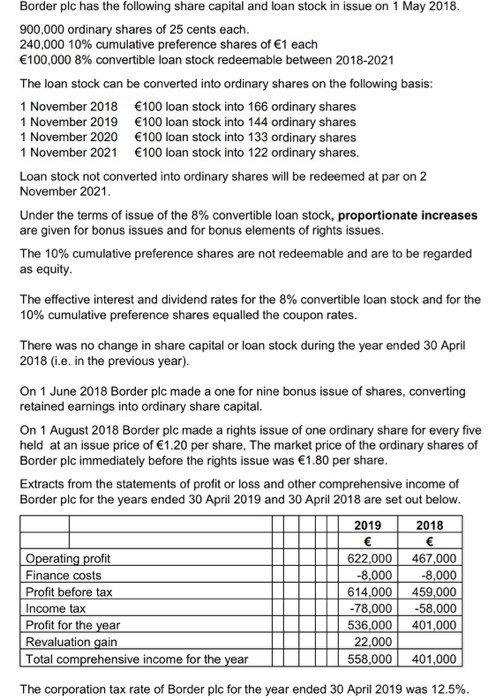

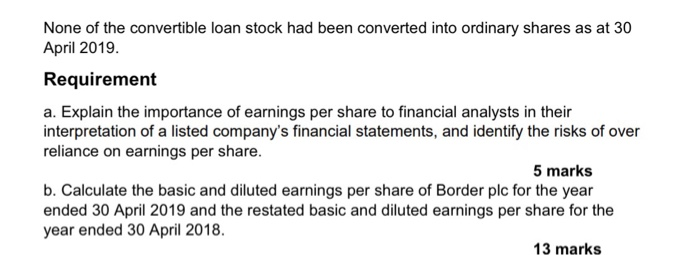

Border plc has the following share capital and loan stock in issue on 1 May 2018. 900.000 ordinary shares of 25 cents each 240,000 10% cumulative preference shares of 1 each 100,000 8% convertible loan stock redeemable between 2018-2021 The loan stock can be converted into ordinary shares on the following basis: 1 November 2018 100 loan stock into 166 ordinary shares 1 November 2019 100 loan stock into 144 ordinary shares 1 November 2020 100 loan stock into 133 ordinary shares 1 November 2021 100 loan stock into 122 ordinary shares. Loan stock not converted into ordinary shares will be redeemed at par on 2 November 2021. Under the terms of issue of the 8% convertible loan stock, proportionate increases are given for bonus issues and for bonus elements of rights issues. The 10% cumulative preference shares are not redeemable and are to be regarded as equity. The effective interest and dividend rates for the 8% convertible loan stock and for the 10% cumulative preference shares equalled the coupon rates. There was no change in share capital or loan stock during the year ended 30 April 2018 (.e. in the previous year). On 1 June 2018 Border plc made a one for nine bonus issue of shares, converting retained earnings into ordinary share capital. On 1 August 2018 Border plc made a rights issue of one ordinary share for every five held at an issue price of 1.20 per share. The market price of the ordinary shares of Border plc immediately before the rights issue was 1.80 per share Extracts from the statements of profit or loss and other comprehensive income Border plc for the years ended 30 April 2019 and 30 April 2018 are set out below. 2019 2018 Operating profit Finance costs Profit before tax Income tax Profit for the year Revaluation gain Total comprehensive income for the year 622,000 -8.000 614.000 -78.000 536,000 22,000 558,000 467,000 -8.000 459,000 -58.000 401,000 401,000 The corporation tax rate of Border plc for the year ended 30 April 2019 was 12.5%. None of the convertible loan stock had been converted into ordinary shares as at 30 April 2019. Requirement a. Explain the importance of earnings per share to financial analysts in their interpretation of a listed company's financial statements, and identify the risks of over reliance on earnings per share. 5 marks b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earnings per share for the year ended 30 April 2018. 13 marks Border plc has the following share capital and loan stock in issue on 1 May 2018. 900.000 ordinary shares of 25 cents each 240,000 10% cumulative preference shares of 1 each 100,000 8% convertible loan stock redeemable between 2018-2021 The loan stock can be converted into ordinary shares on the following basis: 1 November 2018 100 loan stock into 166 ordinary shares 1 November 2019 100 loan stock into 144 ordinary shares 1 November 2020 100 loan stock into 133 ordinary shares 1 November 2021 100 loan stock into 122 ordinary shares. Loan stock not converted into ordinary shares will be redeemed at par on 2 November 2021. Under the terms of issue of the 8% convertible loan stock, proportionate increases are given for bonus issues and for bonus elements of rights issues. The 10% cumulative preference shares are not redeemable and are to be regarded as equity. The effective interest and dividend rates for the 8% convertible loan stock and for the 10% cumulative preference shares equalled the coupon rates. There was no change in share capital or loan stock during the year ended 30 April 2018 (.e. in the previous year). On 1 June 2018 Border plc made a one for nine bonus issue of shares, converting retained earnings into ordinary share capital. On 1 August 2018 Border plc made a rights issue of one ordinary share for every five held at an issue price of 1.20 per share. The market price of the ordinary shares of Border plc immediately before the rights issue was 1.80 per share Extracts from the statements of profit or loss and other comprehensive income Border plc for the years ended 30 April 2019 and 30 April 2018 are set out below. 2019 2018 Operating profit Finance costs Profit before tax Income tax Profit for the year Revaluation gain Total comprehensive income for the year 622,000 -8.000 614.000 -78.000 536,000 22,000 558,000 467,000 -8.000 459,000 -58.000 401,000 401,000 The corporation tax rate of Border plc for the year ended 30 April 2019 was 12.5%. None of the convertible loan stock had been converted into ordinary shares as at 30 April 2019. Requirement a. Explain the importance of earnings per share to financial analysts in their interpretation of a listed company's financial statements, and identify the risks of over reliance on earnings per share. 5 marks b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earnings per share for the year ended 30 April 2018. 13 marks