Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No need to answer question 11 !!! Remember!!! 11. Assume the risk-free rate is 5% and that the market risk premium is 7%. If a

No need to answer question 11 !!!

Remember!!!

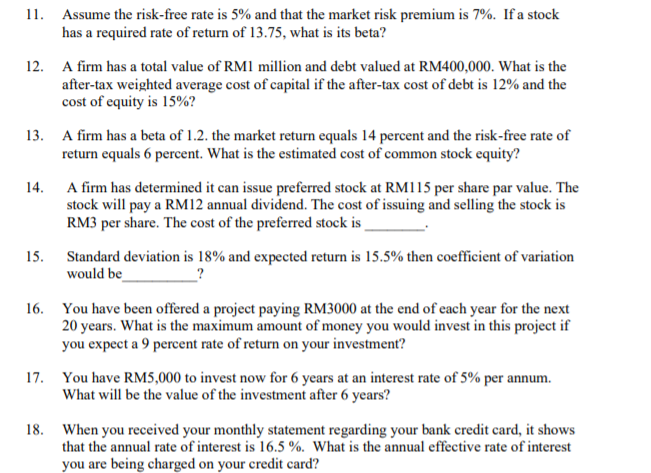

11. Assume the risk-free rate is 5% and that the market risk premium is 7%. If a stock has a required rate of return of 13.75, what is its beta? 12. A firm has a total value of RM1 million and debt valued at RM400,000. What is the after-tax weighted average cost of capital if the after-tax cost of debt is 12% and the cost of equity is 15%? 13. A firm has a beta of 1.2. the market return equals 14 percent and the risk-free rate of return equals 6 percent. What is the estimated cost of common stock equity? 14. A firm has determined it can issue preferred stock at RM115 per share par value. The stock will pay a RM12 annual dividend. The cost of issuing and selling the stock is RM3 per share. The cost of the preferred stock is 15. Standard deviation is 18% and expected return is 15.5% then coefficient of variation would be 16. You have been offered a project paying RM3000 at the end of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you expect a 9 percent rate of return on your investment? 17. You have RM5,000 to invest now for 6 years at an interest rate of 5% per annum. What will be the value of the investment after 6 years? 18. When you received your monthly statement regarding your bank credit card, it shows that the annual rate of interest is 16.5 %. What is the annual effective rate of interest you are being charged on your credit card? 11. Assume the risk-free rate is 5% and that the market risk premium is 7%. If a stock has a required rate of return of 13.75, what is its beta? 12. A firm has a total value of RM1 million and debt valued at RM400,000. What is the after-tax weighted average cost of capital if the after-tax cost of debt is 12% and the cost of equity is 15%? 13. A firm has a beta of 1.2. the market return equals 14 percent and the risk-free rate of return equals 6 percent. What is the estimated cost of common stock equity? 14. A firm has determined it can issue preferred stock at RM115 per share par value. The stock will pay a RM12 annual dividend. The cost of issuing and selling the stock is RM3 per share. The cost of the preferred stock is 15. Standard deviation is 18% and expected return is 15.5% then coefficient of variation would be 16. You have been offered a project paying RM3000 at the end of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you expect a 9 percent rate of return on your investment? 17. You have RM5,000 to invest now for 6 years at an interest rate of 5% per annum. What will be the value of the investment after 6 years? 18. When you received your monthly statement regarding your bank credit card, it shows that the annual rate of interest is 16.5 %. What is the annual effective rate of interest you are being charged on your credit cardStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started