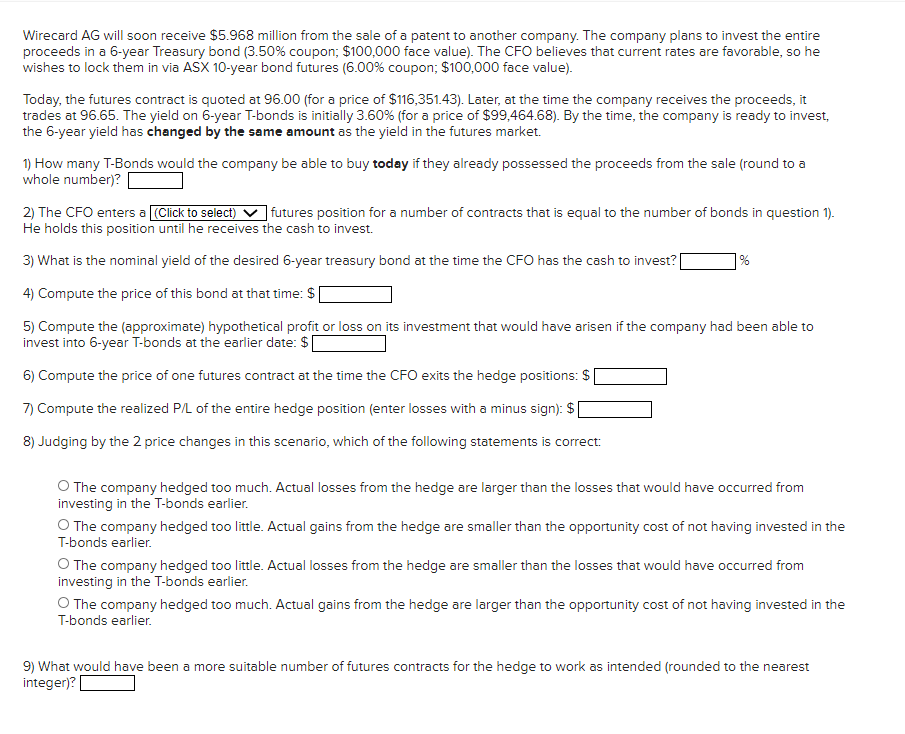

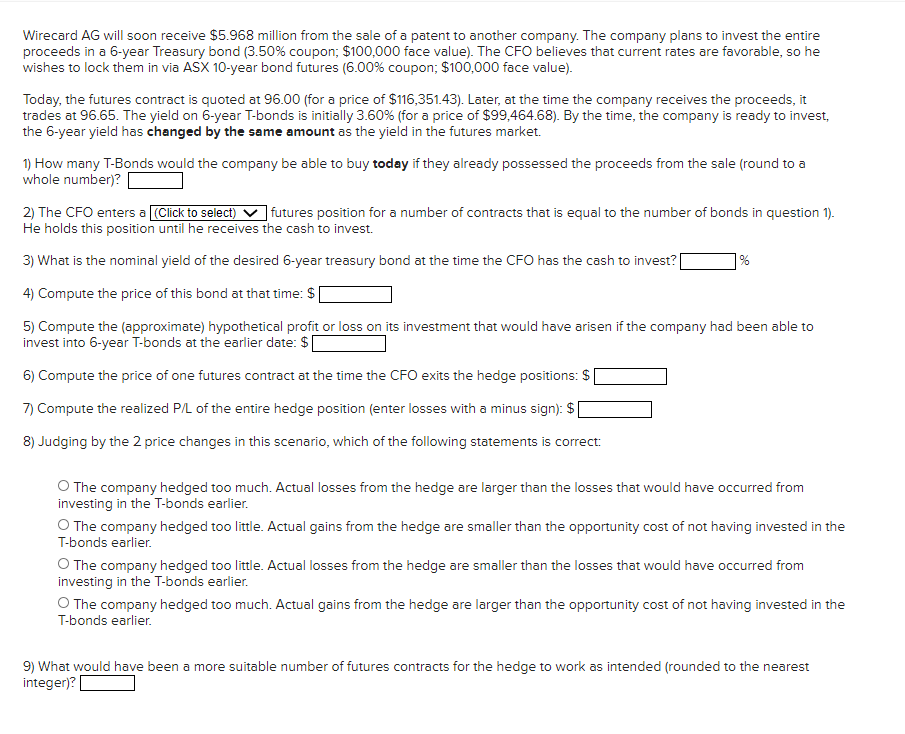

Wirecard AG will soon receive $5.968 million from the sale of a patent to another company. The company plans to invest the entire proceeds in a 6-year Treasury bond (3.50% coupon; $100,000 face value). The CFO believes that current rates are favorable, so he wishes to lock them in via ASX 10-year bond futures (6.00% coupon; $100,000 face value). Today, the futures contract is quoted at 96.00 (for a price of $116,351.43). Later, at the time the company receives the proceeds, it trades at 96.65. The yield on 6-year T-bonds is initially 3.60% (for a price of $99,464.68). By the time, the company is ready to invest, the 6-year yield has changed by the same amount as the yield in the futures market. 1) How many T-Bonds would the company be able to buy today if they already possessed the proceeds from the sale (round to a whole number)? 2) The CFO enters a (Click to select) futures position for a number of contracts that is equal to the number of bonds in question 1). He holds this position until he receives the cash to invest. 3) What is the nominal yield of the desired 6-year treasury bond at the time the CFO has the cash to invest? 4) Compute the price of this bond at that time: $ 5) Compute the approximate) hypothetical profit or loss on its investment that would have arisen if the company had been able to invest into 6-year T-bonds at the earlier date: $ 6) Compute the price of one futures contract at the time the CFO exits the hedge positions: $ 7) Compute the realized P/L of the entire hedge position (enter losses with a minus sign): $ 8) Judging by the 2 price changes in this scenario, which of the following statements is correct: The company hedged too much. Actual losses from the hedge are larger than the losses that would have occurred from investing in the T-bonds earlier. The company hedged too little. Actual gains from the hedge are smaller than the opportunity cost of not having invested in the T-bonds earlier. The company hedged too little. Actual losses from the hedge are smaller than the losses that would have occurred from investing in the T-bonds earlier. The company hedged too much. Actual gains from the hedge are larger than the opportunity cost of not having invested in the T-bonds earlier 9) What would have been a more suitable number of futures contracts for the hedge to work as intended (rounded to the nearest integer)