** NOICE PARTS A B AND C. THIS IS A PART LEVEL, I JUST DO NOT HAVE THE SCREENSHOT OF ALL PARTS *****

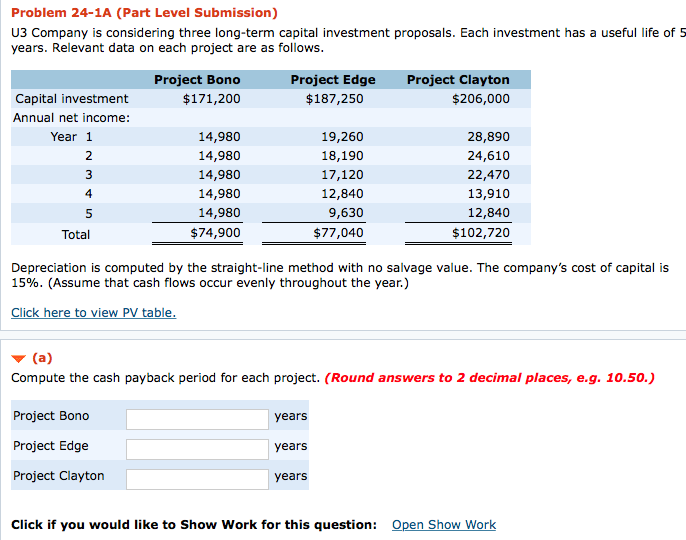

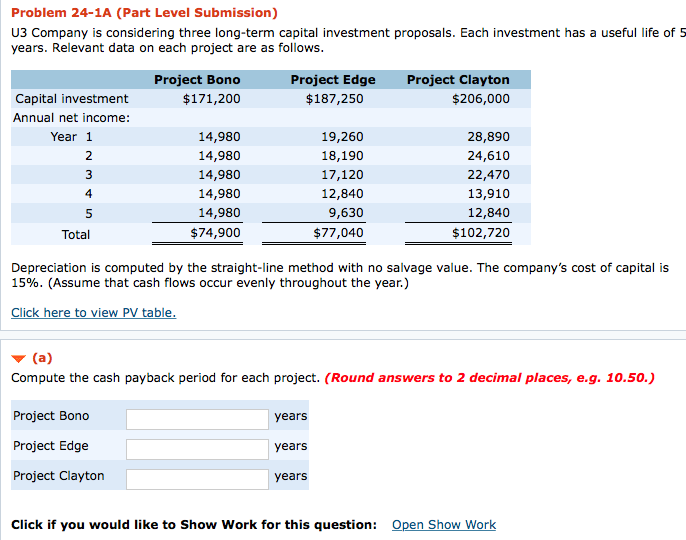

| U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. | | | Project Bono | | Project Edge | Project Clayton | | | Capital investment | | $171,200 | | $187,250 | | $206,000 | | | Annual net income: | | | | | | | | | Year 1 | | 14,980 | | 19,260 | | 28,890 | | | 2 | | 14,980 | | 18,190 | | 24,610 | | | 3 | | 14,980 | | 17,120 | | 22,470 | | | 4 | | 14,980 | | 12,840 | | 13,910 | | | 5 | | 14,980 | | 9,630 | | 12,840 | | | Total | | $74,900 | | $77,040 | | $102,720 | | Depreciation is computed by the straight-line method with no salvage value. The companys cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. IE | | | | | | | (a) Compute the cash payback period for each project. (b) Compute the net present value for each project. (c) Compute the annual rate of return for each prject. (Hint: Use average annual net income in your computation).

| | | |

Problem 24-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Edge Project Clayton Project Bono $171,200 $187,250 Capital investment $206,000 Annual net income: Year 1 14,980 19,260 28,890 14,980 18,190 24,610 17,120 22,470 14,980 14,980 13,910 12,840 12,840 14,980 9,630 $74,900 $77,040 $102,720 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table w (a) Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years click if you would like to show work for this question Open Show Work