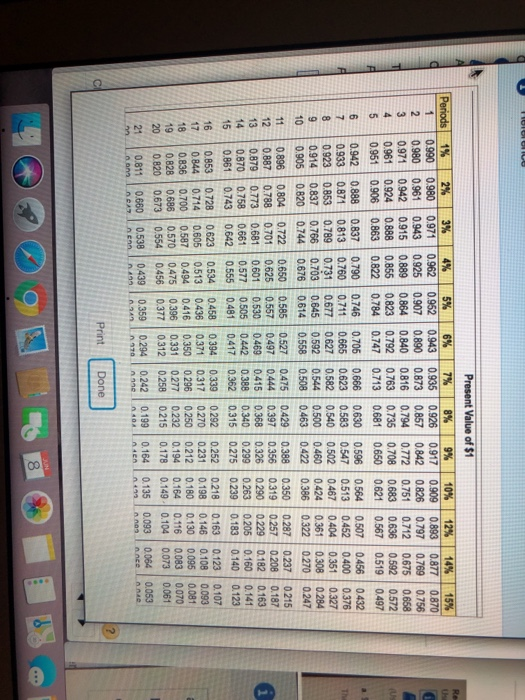

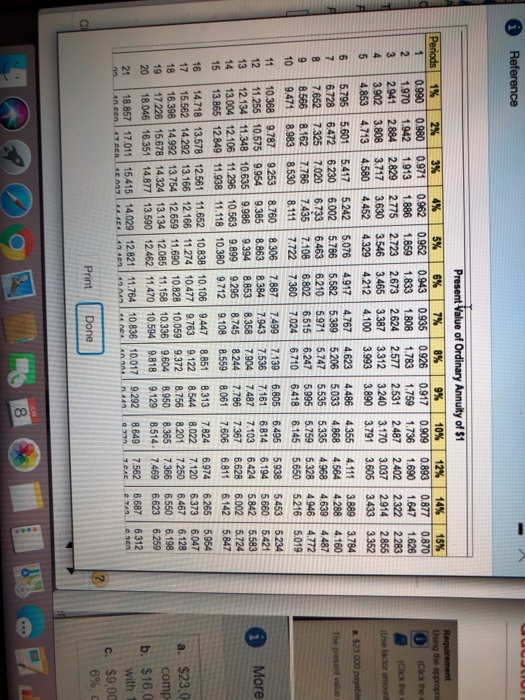

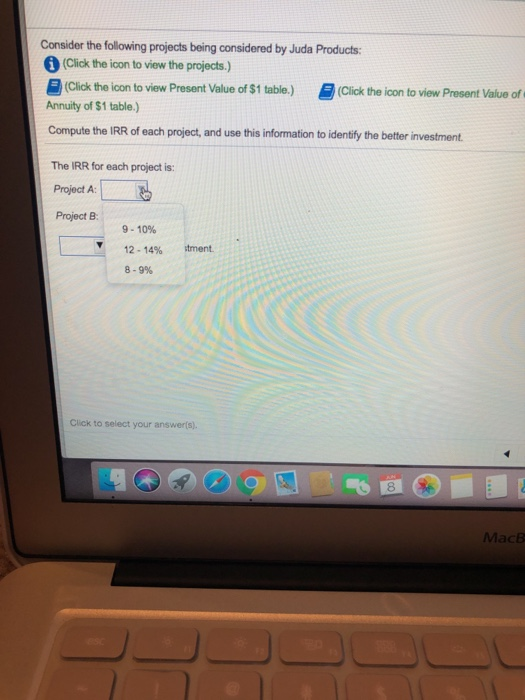

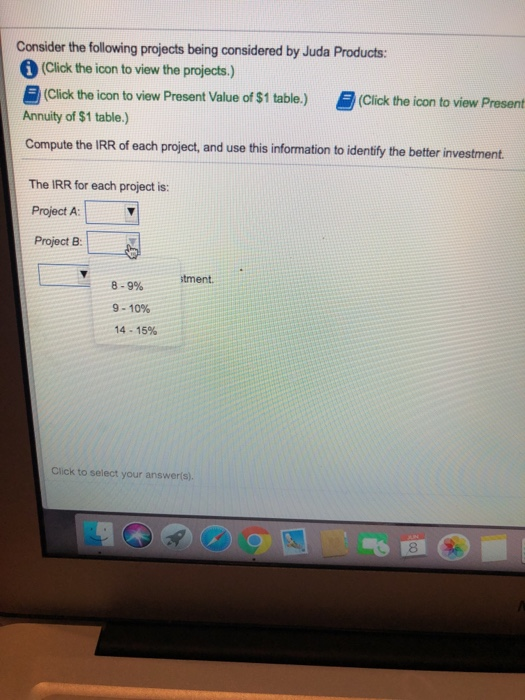

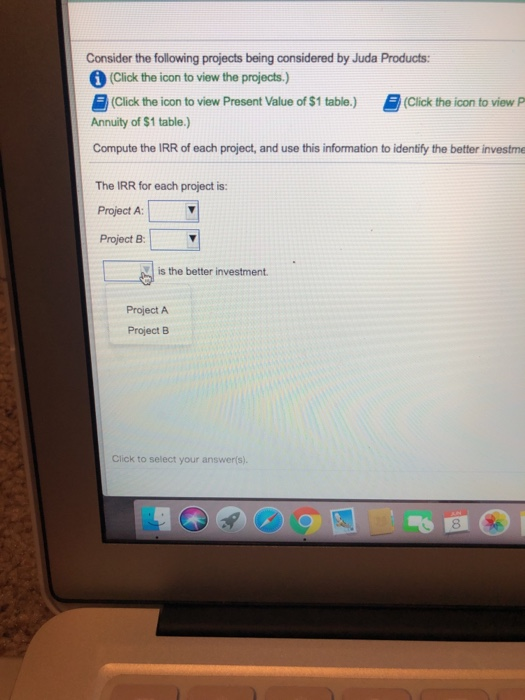

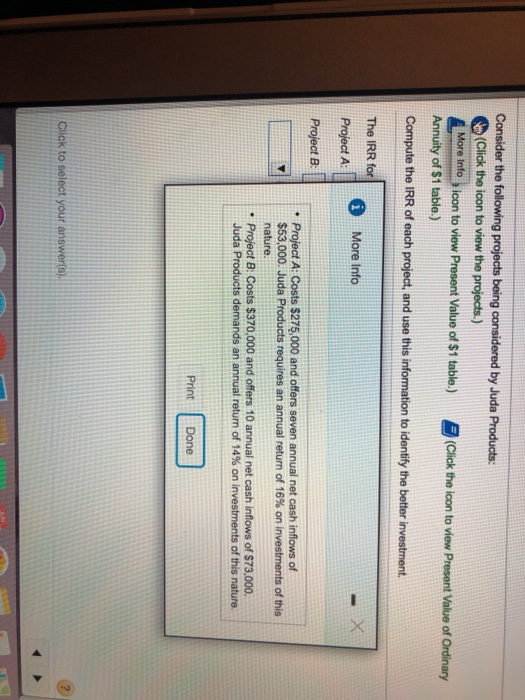

nome Qu Consider the following projects being considered by Juda Products: (Click the icon to view the projects.) Click the icon to view Present Value of $1 table.) Annuity of $1 table.) (Click the icon to view Present Value of Ordinary Reg Compute the IRR of each project, and use this information to identify the better investment Usin The IRR for each project is: (Use Project A Project B is the better investment i Click to select your answer(s). Establishing Present Value of $1 Re 8% 0.926 0.857 0.794 0.763 0.735 0.708 0.681 15% 5% 0.952 6 % 0.943 0.890 0.840 0.792 0.747 Periods 3% 4% 7% 9% 10% 12% 14% 1% 0.990 0.980 0.971 0.961 0.951 2% 0.893 0.797 0.935 0.917 0.909 0.877 0.870 0.971 0.943 0.915 0.888 0.980 0.962 0769 0.675 0.592 0.756 0.658 0.873 0.842 0.772 2 0.961 0.925 0.907 0.826 0.889 0.816 0.712 0.751 0.683 0.942 0.864 4 0.924 0.855 0.823 0.636 0.572 0.906 0.863 0.822 0.784 0.713 0.650 0.621 0.567 0.519 0.497 0.432 0.507 0.452 0.630 0.456 0.596 0.547 0.502 0.564 0.513 0.706 0.666 0.623 0.583 0.540 0.942 0.837 0.790 0.746 0.888 0.871 0.400 0.376 0.760 0.731 0.703 0.676 0.813 0.789 0.665 0.627 7 0.933 0.711 0.404 0.361 0.327 0.284 0.351 0.582 0.544 0.467 0.424 0.386 8 0.923 0.853 0.677 0.460 0.422 0.308 0.270 0.500 0.592 0.558 0.914 0.837 0.766 0.645 10 0.905 0.820 0.744 0.614 0.508 0.463 0.322 0.247 0.237 0.208 0.182 0.160 0.140 0215 0.388 0.356 0.326 0.299 0.475 0.429 0.350 0.287 0.896 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.650 0.625 0.601 0.585 0.557 0.530 0.505 0.481 0.527 0.497 0.469 0.442 0.417 11 0.187 0.444 0.397 0.368 0.340 0.315 0.257 0.229 0.205 0.183 0.319 12 13 0.887 0.163 0.141 0415 0.290 0.879 0.870 0.861 0.577 0.388 0.263 14 0.642 0.555 0.362 0.275 0.239 0.123 15 0.123 0.107 0.292 0.270 0.250 0.232 0.252 0.163 0.146 0.130 0.116 0458 0.436 0.416 0.396 0.377 0.339 0.317 0.218 0.198 0.180 0.623 0.394 0.534 0.513 0.494 0.475 0.456 0.728 0.853 0.844 0.836 16 0.108 0.095 0.083 0.093 0.081 0.070 0.231 0.714 0.700 0.686 0.673 0.605 0.587 0.570 0.554 0.371 0.350 0.331 0.312 17 0.296 0.212 18 0.194 0.178 0.277 0.164 19 0.828 0.258 0.149 0.104 0.073 0.061 0.215 20 0.820 0.538 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.093 0.064 0.053 21 0.811 0.660 n.AEn nn03 0.068 0.048 n40A 0FAT nenn 342 0.ann Print Done JUN JtIOI Reference Present Value of Ordinary Annuity of $1 Requirement Using the appropris 6% 7% 8% 9% 10% 12 % 14 % 15% 3% 0.971 1.913 2.829 3.717 Periods 1% 4% 2% 0.980 1.942 0.909 0.877 0.893 1690 0.962 0.870 0.952 1.859 2.723 3.546 0.990 0.943 0.935 0.926 0.917 (Clck the 1.808 1.736 1.647 1626 2283 2 1.970 1.886 1.833 1.783 1.759 2.402 (Cick the 2.322 2.914 2.775 2,673 2.624 2577 2.531 2.487 3 4 2.941 2.884 3.037 2855 3.352 (Use lactor amount 3.240 3.890 3.465 3.387 3.312 3.170 3.902 4.853 3.808 3.630 5 4.713 4.580 4.452 4.329 4212 4.100 3.993 3.791 3.605 3.433 a $23000 payble 3.889 4288 4.111 3.784 4.160 4.767 4.355 4.623 5.206 4.486 5.033 5.242 5.076 5.795 6.728 4.917 5.582 6 5.601 5.417 4564 4.968 4.868 5.389 5.971 6.002 The present value 6472 7.325 6.230 7.020 5.786 6463 7 4.639 4.487 6.733 7.435 6.210 6.802 5.747 6.247 6.710 5.535 5.995 6418 5.335 5.759 7.652 7.108 7.722 6.515 7.024 5.328 5.650 4.946 5.216 4.772 5.019 9 8.566 9.471 7.786 8.162 8.983 10 8.530 8.111 7.360 6.145 5.453 5.660 5.842 6.002 5234 7.499 7.943 8.358 6.495 6.814 7.103 7.367 7.606 5.938 6.194 6.424 6.628 6.811 7.139 7.536 8.306 6.805 7.887 8.384 8.853 9.295 11 10.368 9.787 9.253 8.760 7.161 5.421 11.255 10.575 9.954. 12.134 11.348 10.635 9.986 13.004 12.106 11.296 10.563 13.865 12.849 11.938 11.118 10.380 9.712 8.863 9.394 i More 12 9.385 5.583 5.724 5.847 7.904 7.487 13 9.899 8.745 8.244 7.786 14 9.108 8.559 8.061 6.142 15 6.974 7.120 7.250 6.265 6.373 6.467 6.550 5.954 6.047 6.128 6.198 8.313 7.824 14.718 13.578 12.561 11.652 10.838 10.106 9.447 15.562 14.292 13.166 12.166 11.274 10.477 9.763 18 8.851 9.122 9.372 9.604 9.818 16 8.022 8.544 8.756 8.950 9.129 17 a. $23,0 16.398 14.992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 8.201 8.365 7.366 comp 19 8.514 7.469 6.623 6.259 b. $16,0 with 1 20 9.292 8.649 7.562 6.687 6.312 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 7 CAC e sen 40 0e0. 47 CEO $9,00 6%, c C. Print Done UN 8 Consider the following projects being considered by Juda Products (Click the icon to view the projects.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Annuity of $1 table.) Compute the IRR of each project, and use this information to identify the better investment. The IRR for each project is: Project A: Project B 9-10% itment 12 14% 8-9% Click to select your answer(s) 8 MACB Consider the following projects being considered by Juda Products: (Click the icon to view the projects.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Annuity of $1 table.) Compute the IRR of each project, and use this information to identify the better investment The IRR for each project is: Project A: Project B stment. 8-9% 9-10% 14-15% Click to select your answer(s). AUN Consider the following projects being considered by Juda Products: (Click the icon to view the projects.) (Click the icon to view Present Value of $1 table.) Annuity of $1 table.) (Click the icon to view P Compute the IRR of each project, and use this information to identify the better investme The IRR for each project is: Project A Project B is the better investment Project A Project B Click to select your answer(s). Consider the following projects being considered by Juda Products: (Click the icon to view the projects.) More Info icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Compute the IRR of each project, and use this informmation to identify the better investment. The IRR for X More Info Project A Project B Project A: Costs $275,000 and offers seven annual net cash inflows of $53,000. Juda Products requires an annual return of 16% on investments of this nature. Project B: Costs $370,000 and offers 10 annual net cash inflows of $73,000. Juda Products demands an annual return of 14% on investments of this nature. Print Done Click to select your answer(s)