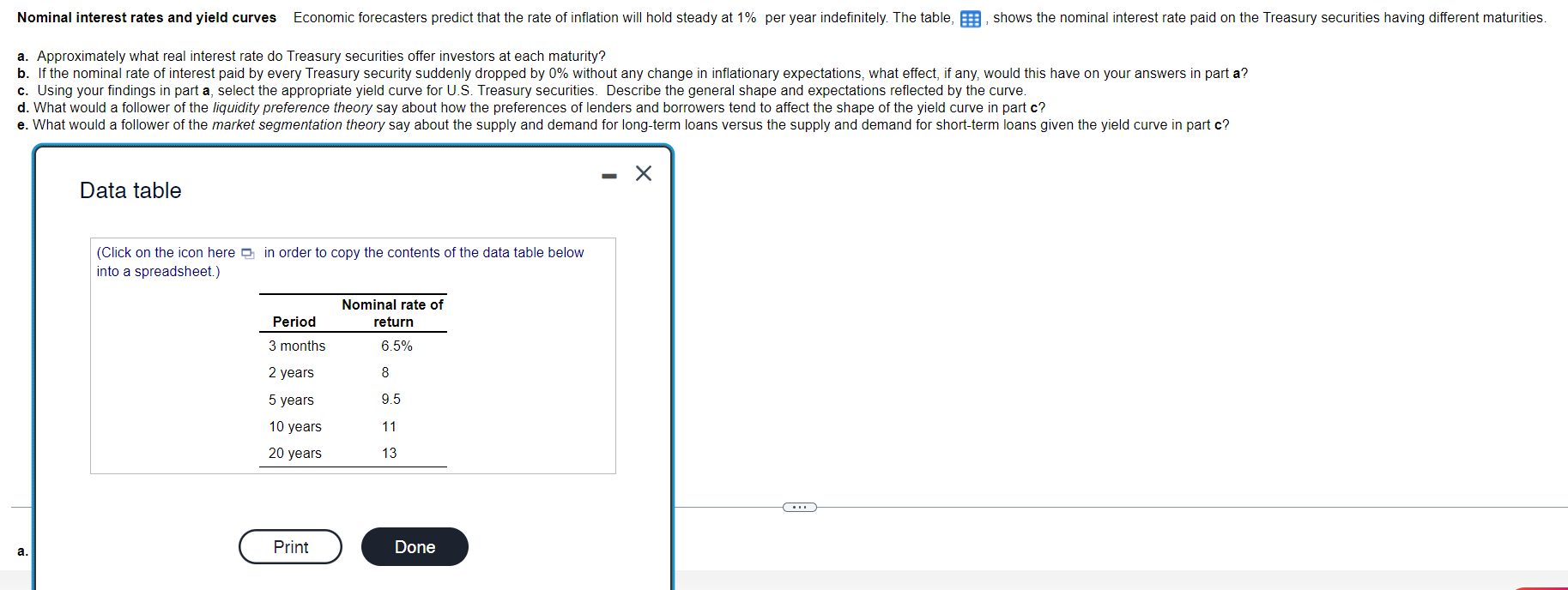

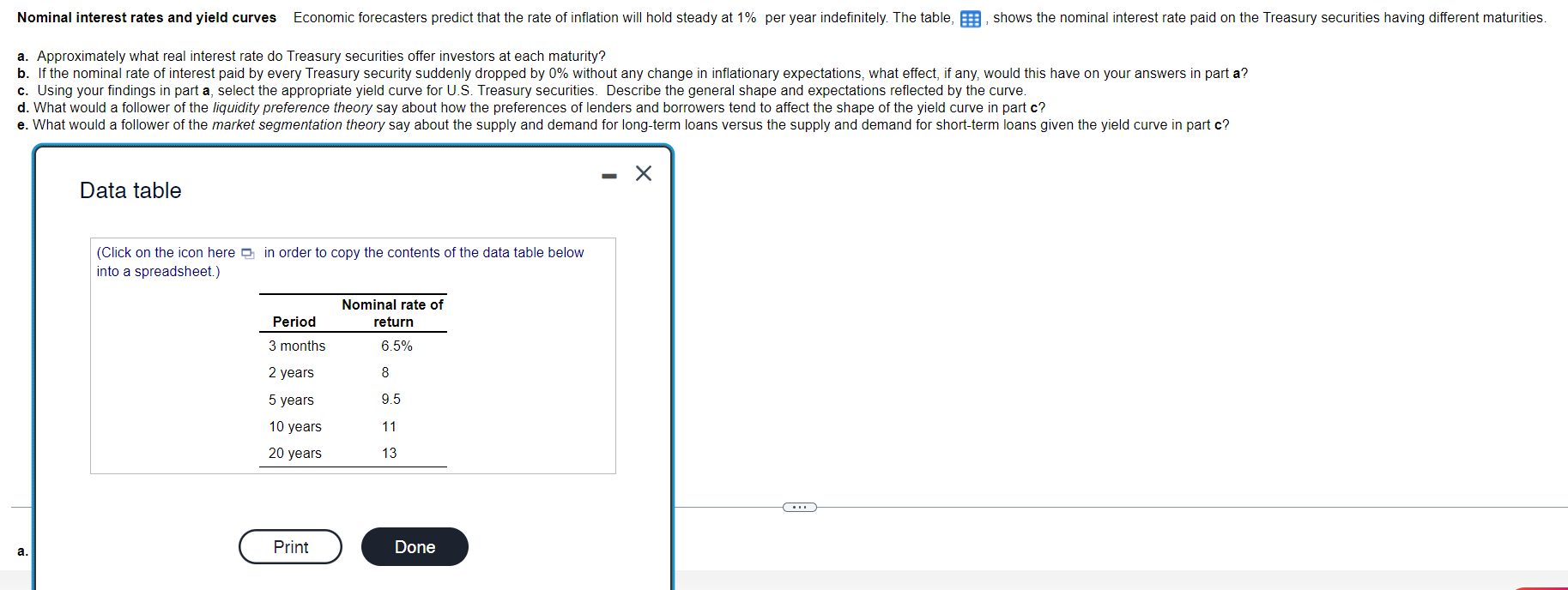

Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation will hold steady at 1% per year indefinitely. The table,, shows the nominal interest rate paid on the Treasury securities having different maturities. a. Approximately what real interest rate do Treasury securities offer investors at each maturity? b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 0% without any change in inflationary expectations, what effect, if any, would this have on your answers in part a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tend to affect the shape of the yield curve in part c? e. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve in part c? - X Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Nominal rate of Period return 3 months 6.5% 2 years 8 5 years 9.5 10 years 11 20 years 13 Print a. Done Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation will hold steady at 1% per year indefinitely. The table,, shows the nominal interest rate paid on the Treasury securities having different maturities. a. Approximately what real interest rate do Treasury securities offer investors at each maturity? b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 0% without any change in inflationary expectations, what effect, if any, would this have on your answers in part a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tend to affect the shape of the yield curve in part c? e. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve in part c? - X Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Nominal rate of Period return 3 months 6.5% 2 years 8 5 years 9.5 10 years 11 20 years 13 Print a. Done