Answered step by step

Verified Expert Solution

Question

1 Approved Answer

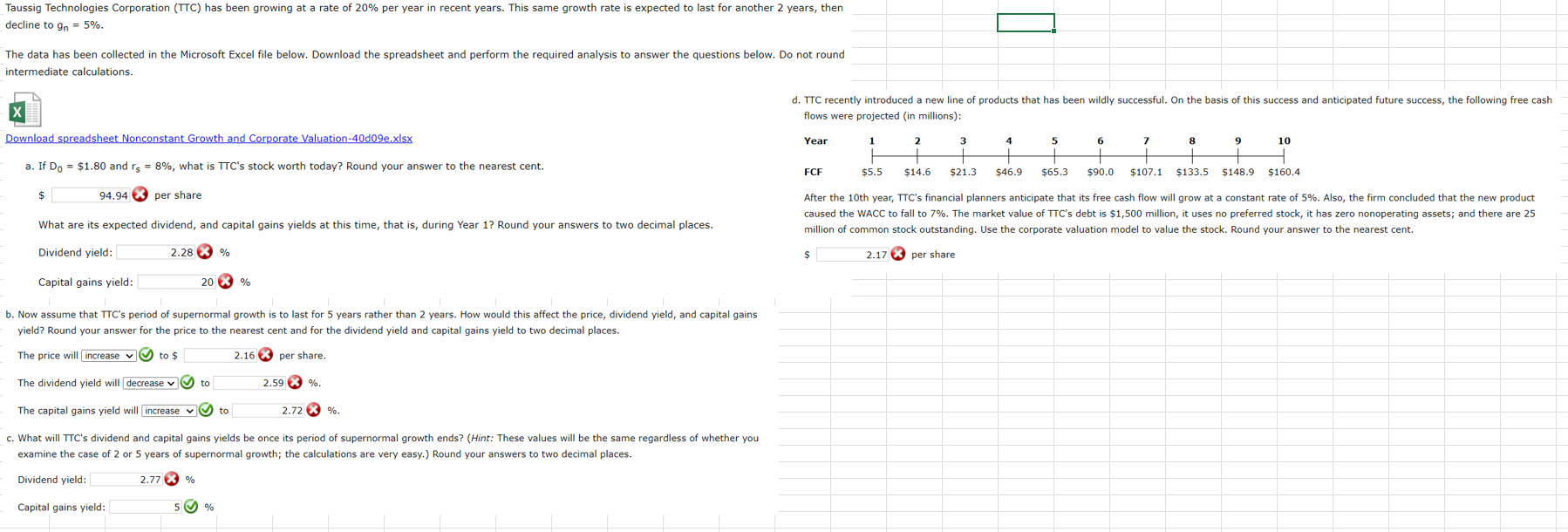

Nonconstant Growth and Corporate Valuation * * CORRECT ANY ANSWERS THAT NEED TO BE CORRECTED PLEASE * * Taussig Technologies Corporation ( TTC ) has

Nonconstant Growth and Corporate Valuation CORRECT ANY ANSWERS THAT NEED TO BE CORRECTED PLEASE Taussig Technologies Corporation TTC has been growing at a rate of per year in recent years. This same growth rate is expected to last for another years, then

decline to

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round

intermediate calculations.

Download spreadsheet Nonconstant Growth and Corporate Valuationdexlsx

a If $ and what is TCs stock worth today? Round your answer to the nearest cent.

$

per share

What are its expected dividend, and capital gains yields at this time, that is during Year Round your answers to two decimal places.

Dividend yield:

Capital gains yield:

b Now assume that TCCs period of supernormal growth is to last for years rather than years. How would this affect the price, dividend yield, and capital gains

yield? Round your answer for the price to the nearest cent and for the dividend yield and capital gains yield to two decimal places.

The price will

to $

per share.

The dividend yield will

decrease

decrease

to

to

The capital gains yield will increase

to

c What will TTCs dividend and capital gains yields be once its period of supernormal growth ends? Hint: These values will be the same regardless of whether you

examine the case of or years of supernormal growth; the calculations are very easy. Round your answers to two decimal places.

Dividend yield:

Capital gains yield:

d recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash

flows weI

Year

FCF

After the th year, TCCs financial planners anticipate that its free cash flow will grow at a constant rate of Also, the firm concluded that the new product

caused the WACC to fall to The market value of TCs debt is $ million, it uses no preferred stock, it has zero nonoperating assets; and there are

million of common stock outstanding. Use the corporate valuation model to value the stock. Round your answer to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started