Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Livingston Ltd has received $4,100,000 from investors, who have applied for shares yet to be issued. However, the company only wanted $3,600,000, which equates

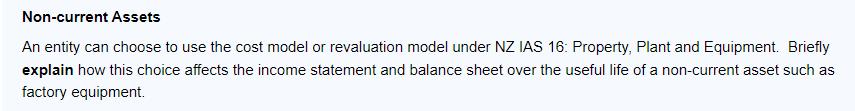

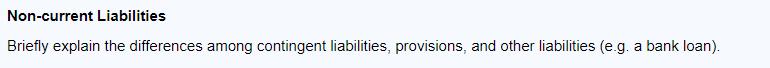

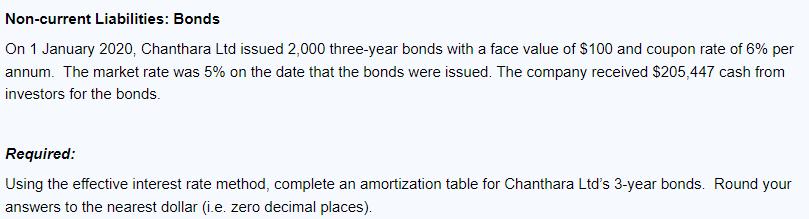

Livingston Ltd has received $4,100,000 from investors, who have applied for shares yet to be issued. However, the company only wanted $3,600,000, which equates to 900,000 shares at $4.00 per share. The following transactions related to the company's equity are yet to be recorded: On 5 January 2023, Livingston Ltd issues 900,000 shares to investors. On 14 January 2023, money from these investors that has been held in trust is transferred to the company's bank account. On 21 January 2023, money is returned to investors who applied for shares but were not issued any shares. Non-current Assets An entity can choose to use the cost model or revaluation model under NZ IAS 16: Property, Plant and Equipment. Briefly explain how this choice affects the income statement and balance sheet over the useful life of a non-current asset such as factory equipment. Non-current Liabilities Briefly explain the differences among contingent liabilities, provisions, and other liabilities (e.g. a bank loan). Non-current Liabilities: Bonds On 1 January 2020, Chanthara Ltd issued 2,000 three-year bonds with a face value of $100 and coupon rate of 6% per annum. The market rate was 5% on the date that the bonds were issued. The company received $205,447 cash from investors for the bonds. Required: Using the effective interest rate method, complete an amortization table for Chanthara Ltd's 3-year bonds. Round your answers to the nearest dollar (i.e. zero decimal places).

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Youve presented several questions related to accounting concepts and bond amortization Lets address each of them accordingly For the scenario with Livingston Ltd The company has received 4100000 from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started