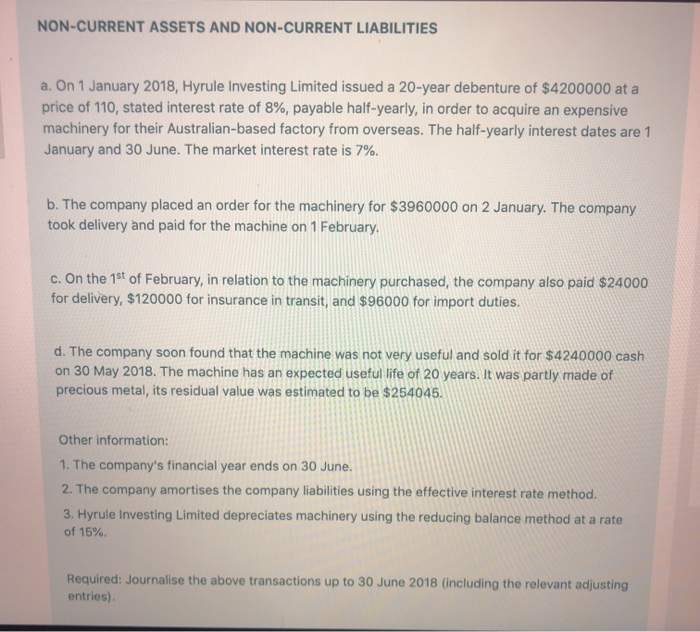

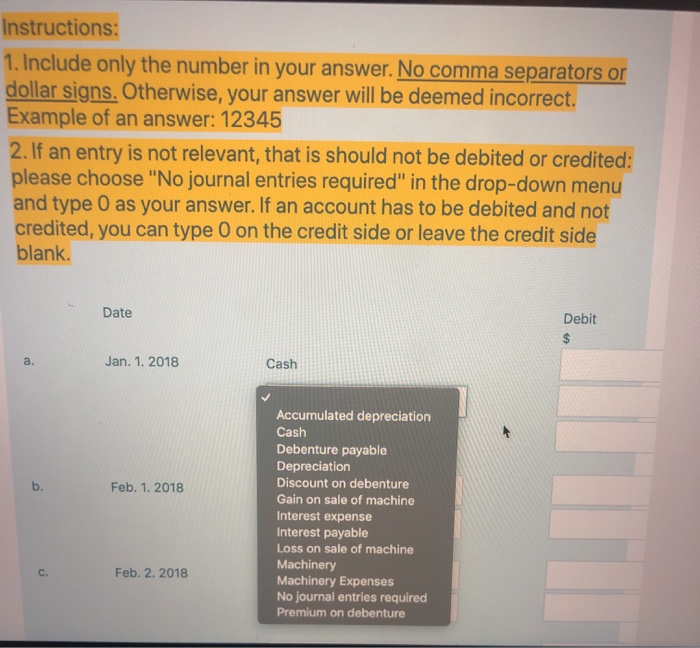

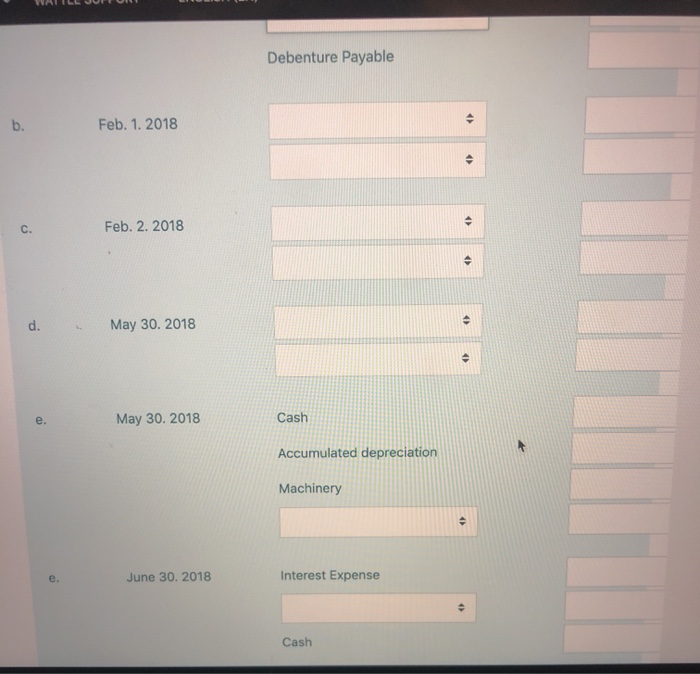

NON-CURRENT ASSETS AND NON-CURRENT LIABILITIES a. On 1 January 2018, Hyrule Investing Limited issued a 20-year debenture of $4200000 at a price of 110, stated interest rate of 8%, payable half-yearly, in order to acquire an expensive machinery for their Australian-based factory from overseas. The half-yearly interest dates are 1 January and 30 June. The market interest rate is 7%. b. The company placed an order for the machinery for $3960000 on 2 January. The company took delivery and paid for the machine on 1 February c. On the 1st of February, in relation to the machinery purchased, the company also paid $24000 for delivery, $120000 for insurance in transit, and $96000 for import duties. d. The company soon found that the machine was not very useful and sold it for $4240000 cash on 30 May 2018. The machine has an expected useful life of 20 years. It was partly made of precious metal, its residual value was estimated to be $254045. Other information: 1. The company's financial year ends on 30 June. 2. The company amortises the company liabilities using the effective interest rate method. 3. Hyrule Investing Limited depreciates machinery using the reducing balance method at a rate of 15% Required: Journalise the above transactions up to 30 June 2018 (including the relevant adjusting entries). Instructions: 1. Include only the number in your answer. No comma separators or dollar signs. Otherwise, your answer will be deemed incorrect. Example of an answer: 12345 2. If an entry is not relevant, that is should not be debited or credited: please choose "No journal entries required" in the drop-down menu and type 0 as your answer. If an account has to be debited and not credited, you can type 0 on the credit side or leave the credit side blank. Date Debit $ a. Jan. 1. 2018 Cash b . Feb. 1. 2018 Accumulated depreciation Cash Debenture payable Depreciation Discount on debenture Gain on sale of machine Interest expense Interest payable Loss on sale of machine Machinery Machinery Expenses No journal entries required Premium on debenture c . Feb. 2. 2018 Debenture Payable b. Feb. 1. 2018 . C. Feb. 2. 2018 . d. May 30, 2018 . . e. May 30. 2018 Cash Accumulated depreciation Machinery e. June 30, 2018 Interest Expense Cash