Question

Non-current assets are depreciated or amortized as follows: Furniture & fittings 20% of cost Office equipment, Motor vehicles and intangible assets 10% of cost No

Non-current assets are depreciated or amortized as follows:

Furniture & fittings 20% of cost

Office equipment, Motor vehicles and intangible assets 10% of cost

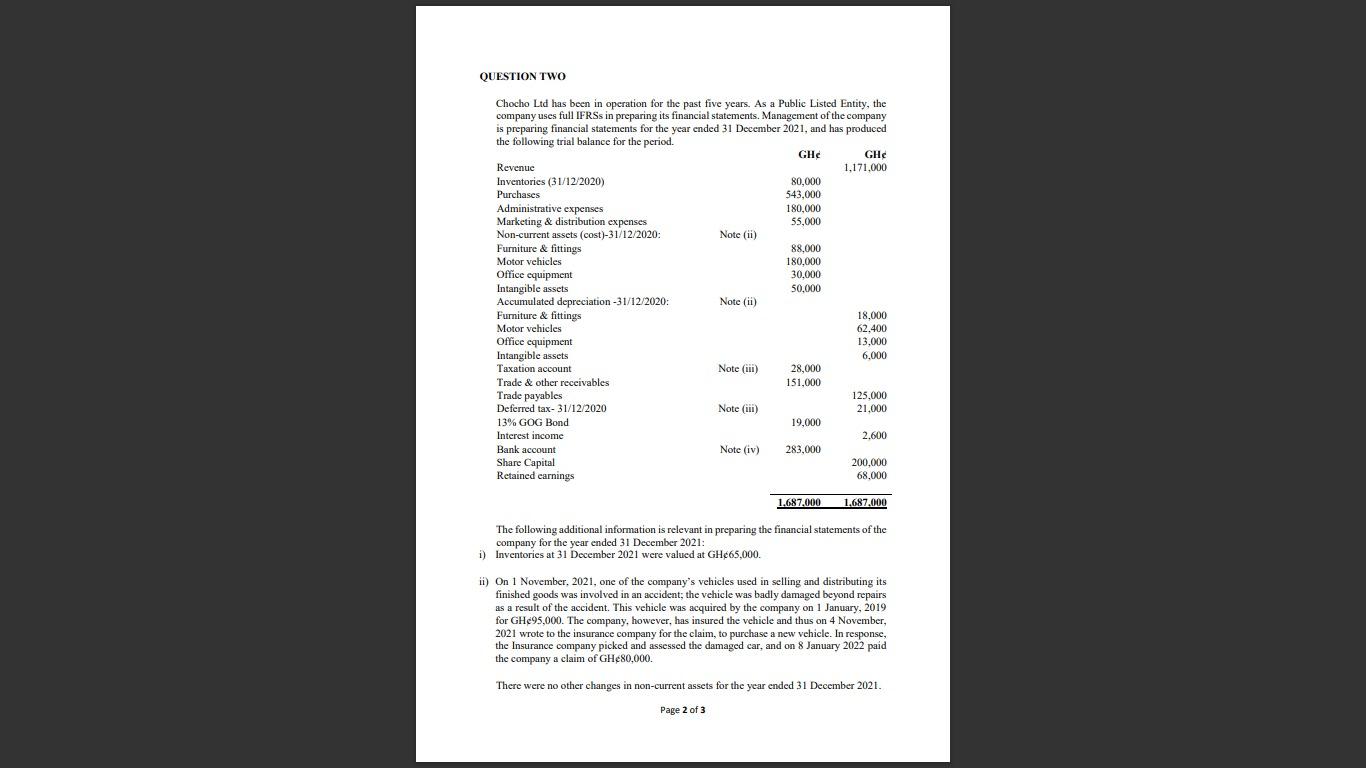

No depreciation is charged on non-current assets in the year of de-recognition. Depreciation or amortisation expense is charged to cost of sales. iii) Taxation account represents the aggregate amount paid by the company as self-assessment tax on its estimated profit for the four-quarters of the 2021 year of assessment. Chocho Ltd in the year 2021, had officers of Ghana Revenue Authority (GRA) auditing its tax records for the 2019 and 2020 years of assessment. All the prior years before the 2019 year of assessment have already been audited by GRA. The audit report of GRA received and agreed by Chocho Ltd in November 2021 revealed the following:

Year of Assessment Current tax provided for the year GHS Tax liability for the year from the tax audit.

2019 45,000 43,000

2020 57,800 67,600

The company paid in full the current tax provided for the years 2019 and 2020 in the first half of the years 2020 and 2021 respectively. However, the differences arising from the tax audit have not been provided for in the above balances and are yet to be settled by the company. Current tax expense and deferred tax liability for the year ended 31 December 2021 have been estimated at GH35,300 and GH3,750 respectively.

iv) Bank account represents the cash book balance as at 31 December 2021. The Bank statement, however, reveals a balance of GH353,000 as at this date. There are only two reconciling differences between the two figures: Cheques recorded at the credit side of the cash book but yet to be presented to Bank for payment and bank charges yet to be recorded in cash book. The value of cheques yet to be presented to Bank for payment is GH72,000. All bank charges are classified as administrative expenses.

Required: Prepare the Statement of Profit or Loss and Other Comprehensive Income of Chocho Ltd for the year ended 31 December, 2021 and the Statement of Financial Position as at that date. Show clearly all relevant workings.

Chocho Ltd has been in operation for the past five years. As a Public Listed Entity, the company uses full IFRSs in preparing its financial statements. Management of the company is preparing financial statements for the year ended 31 December 2021, and has produced the following trial balance for the period. The following additional information is relevant in preparing the financial statements of the company for the year ended 31 December 2021 : i) Inventories at 31 December 2021 were valued at GHe65,000. ii) On 1 November, 2021, one of the company's vehicles used in selling and distributing its finished goods was involved in an accident; the vehicle was badly damaged beyond repairs as a result of the accident. This vehicle was acquired by the company on 1 January, 2019 for GHe95,000. The company, however, has insured the vehicle and thus on 4 November, 2021 wrote to the insurance company for the claim, to purchase a new vehicle. In response, the Insurance company picked and assessed the damaged car, and on 8 January 2022 paid the company a claim of GHe80,000. There were no other changes in non-current assets for the year ended 31 December 2021 . Page 2 of 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started