None

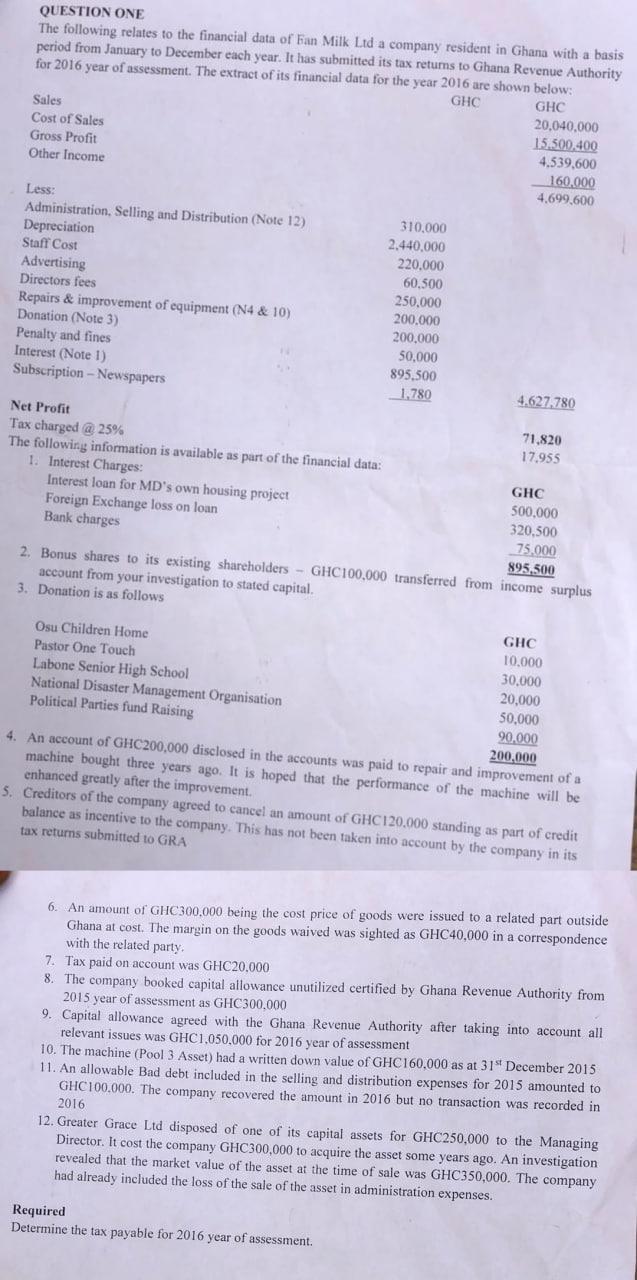

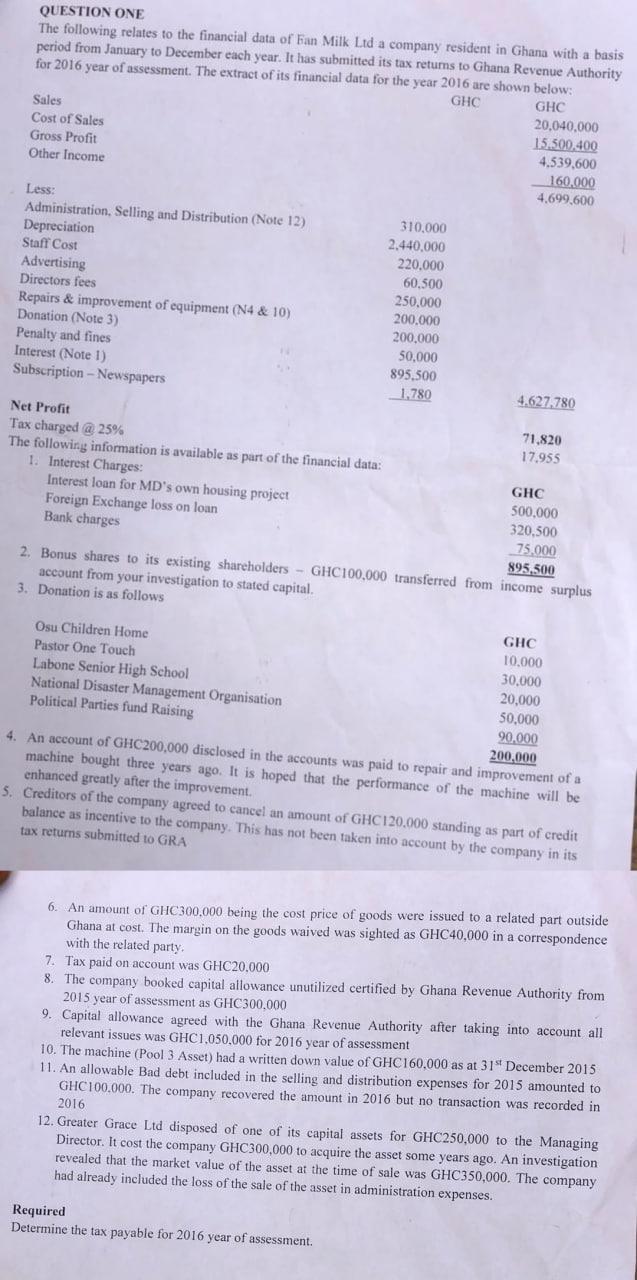

QUESTION ONE The following relates to the financial data of Kan Milk Ltd a company resident in Ghana with a basis period from January to December each year. It has submitted its tax returns to Ghana Revenue Authority for 2016 year of assessment. The extract of its financial data for the year 2016 are shown below: GHC GHC Sales 20.040.000 Cost of Sales 15.500,400 Gross Profit 4.539,600 Other Income 160.000 4,699,600 Less: Administration. Selling and Distribution (Note 12) 310.000 Depreciation 2.440.000 Staff Cost 220.000 Advertising 60.500 Directors fees 250,000 Repairs & improvement of equipment (N4 & 10) 200.000 Donation (Note 3) 200.000 Penalty and fines 50.000 Interest (Note 1) 895,500 Subscription - Newspapers _1,780 4.627.780 Net Profit 71,820 Tax charged @ 25% 17.955 The following information is available as part of the financial data: 1. Inter Charges: GHC Interest loan for MD's own housing project 500.000 Foreign Exchange loss on loan 320,500 Bank charges 75.000 895,500 2. Bonus shares to its existing shareholders - GHC100,000 transferred from income surplus account from your investigation to stated capital 3. Donation is as follows GHC Osu Children Home 10.000 Pastor One Touch 30.000 Labone Senior High School 20,000 National Disaster Management Organisation 50,000 Political Parties fund Raising 90.000 200,000 4. An account of GHC200,000 disclosed in the accounts was paid to repair and improvement of a machine bought three years ago. It is hoped that the performance of the machine will be enhanced greatly after the improvement. 5. Creditors of the company agreed to cancel an amount of GHC120.000 standing as part of credit balance as incentive to the company. This has not been taken into account by the company in its tax retums submitted to GRA 6. An amount of GHC300,000 being the cost price of goods were issued to a related part outside Ghana at cost. The margin on the goods waived was sighted as GHC40,000 in a correspondence with the related party 7. Tax paid on account was GHC20.000 8. The company booked capital allowance unutilized certified by Ghana Revenue Authority from 2015 year of assessment as GHC300,000 9. Capital allowance agreed with the Ghana Revenue Authority after taking into account all relevant issues was GHC1,050,000 for 2016 year of assessment 10. The machine (Pool 3 Asset) had a written down value of GHC160,000 as at 31" December 2015 11. An allowable Bad debt included in the selling and distribution expenses for 2015 amounted to GHC100.000. The company recovered the amount in 2016 but no transaction was recorded in 2016 12. Greater Grace Ltd disposed of one of its capital assets for GHC250,000 to the Managing Director. It cost the company GHC300,000 to acquire the asset some years ago. An investigation revealed that the market value of the asset at the time of sale was GHC350,000. The company had already included the loss of the sale of the asset in administration expenses. Required Determine the tax payable for 2016 year of assessment QUESTION ONE The following relates to the financial data of Kan Milk Ltd a company resident in Ghana with a basis period from January to December each year. It has submitted its tax returns to Ghana Revenue Authority for 2016 year of assessment. The extract of its financial data for the year 2016 are shown below: GHC GHC Sales 20.040.000 Cost of Sales 15.500,400 Gross Profit 4.539,600 Other Income 160.000 4,699,600 Less: Administration. Selling and Distribution (Note 12) 310.000 Depreciation 2.440.000 Staff Cost 220.000 Advertising 60.500 Directors fees 250,000 Repairs & improvement of equipment (N4 & 10) 200.000 Donation (Note 3) 200.000 Penalty and fines 50.000 Interest (Note 1) 895,500 Subscription - Newspapers _1,780 4.627.780 Net Profit 71,820 Tax charged @ 25% 17.955 The following information is available as part of the financial data: 1. Inter Charges: GHC Interest loan for MD's own housing project 500.000 Foreign Exchange loss on loan 320,500 Bank charges 75.000 895,500 2. Bonus shares to its existing shareholders - GHC100,000 transferred from income surplus account from your investigation to stated capital 3. Donation is as follows GHC Osu Children Home 10.000 Pastor One Touch 30.000 Labone Senior High School 20,000 National Disaster Management Organisation 50,000 Political Parties fund Raising 90.000 200,000 4. An account of GHC200,000 disclosed in the accounts was paid to repair and improvement of a machine bought three years ago. It is hoped that the performance of the machine will be enhanced greatly after the improvement. 5. Creditors of the company agreed to cancel an amount of GHC120.000 standing as part of credit balance as incentive to the company. This has not been taken into account by the company in its tax retums submitted to GRA 6. An amount of GHC300,000 being the cost price of goods were issued to a related part outside Ghana at cost. The margin on the goods waived was sighted as GHC40,000 in a correspondence with the related party 7. Tax paid on account was GHC20.000 8. The company booked capital allowance unutilized certified by Ghana Revenue Authority from 2015 year of assessment as GHC300,000 9. Capital allowance agreed with the Ghana Revenue Authority after taking into account all relevant issues was GHC1,050,000 for 2016 year of assessment 10. The machine (Pool 3 Asset) had a written down value of GHC160,000 as at 31" December 2015 11. An allowable Bad debt included in the selling and distribution expenses for 2015 amounted to GHC100.000. The company recovered the amount in 2016 but no transaction was recorded in 2016 12. Greater Grace Ltd disposed of one of its capital assets for GHC250,000 to the Managing Director. It cost the company GHC300,000 to acquire the asset some years ago. An investigation revealed that the market value of the asset at the time of sale was GHC350,000. The company had already included the loss of the sale of the asset in administration expenses. Required Determine the tax payable for 2016 year of assessment