Non-for-profit Accounting

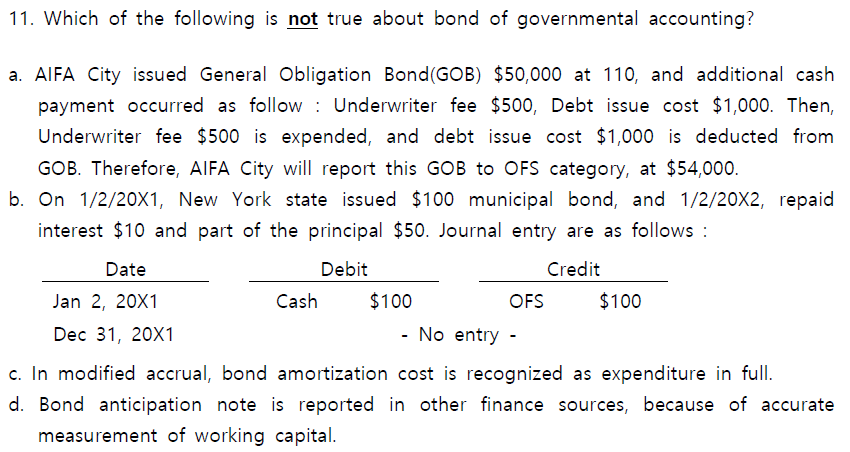

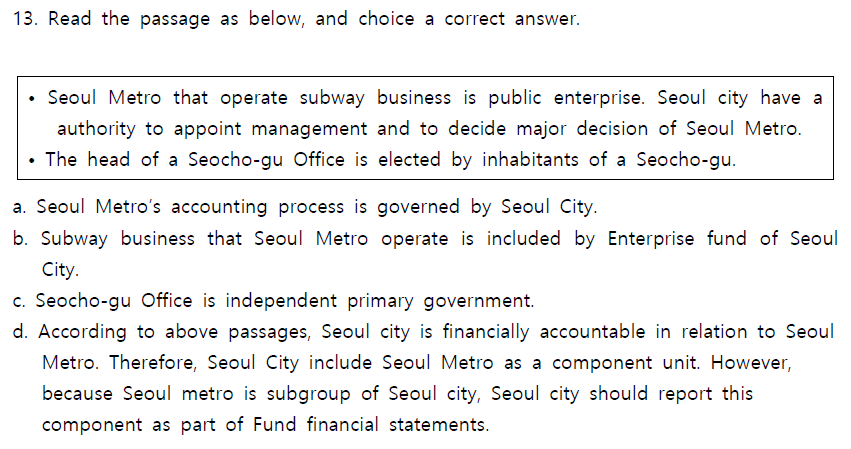

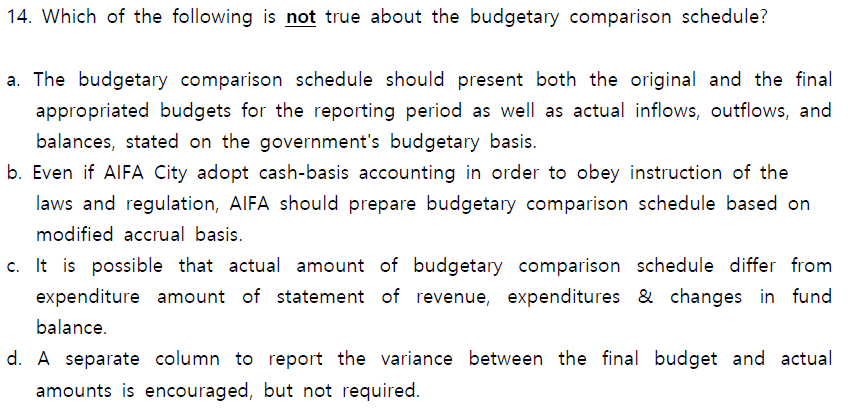

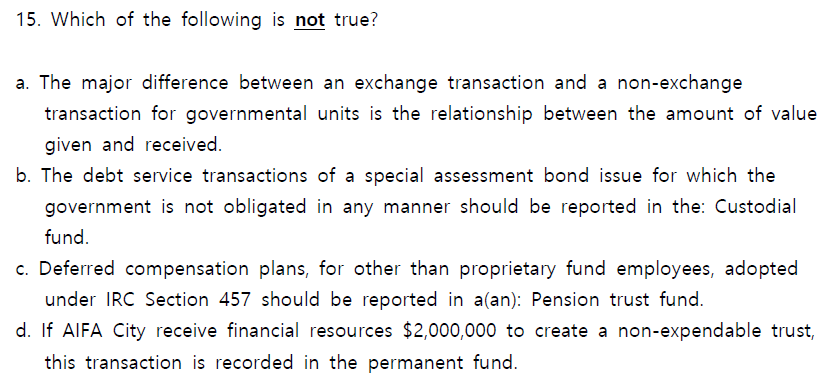

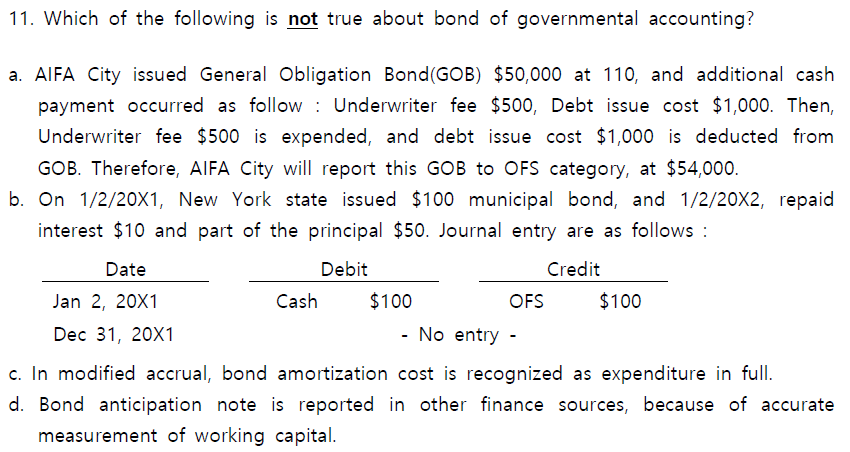

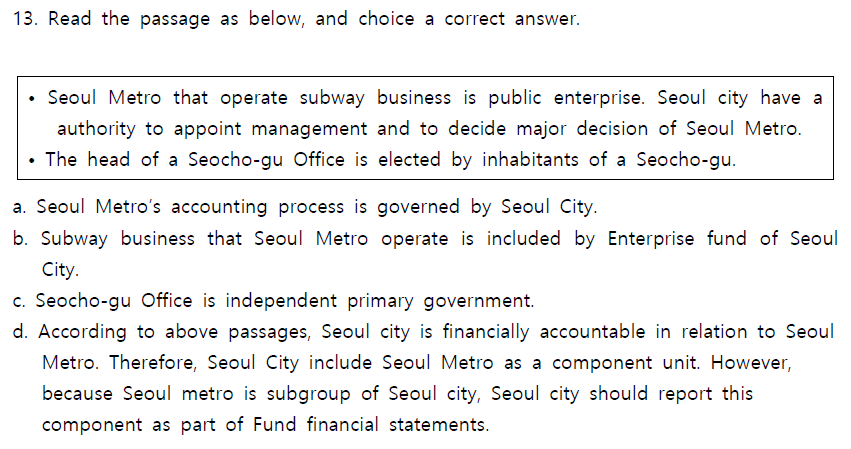

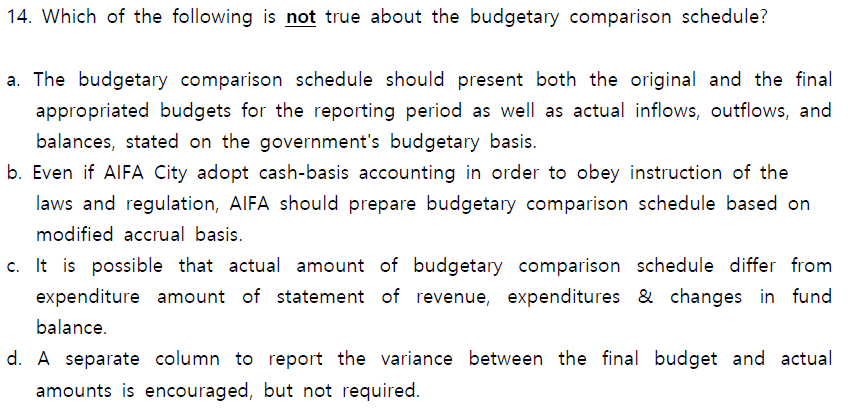

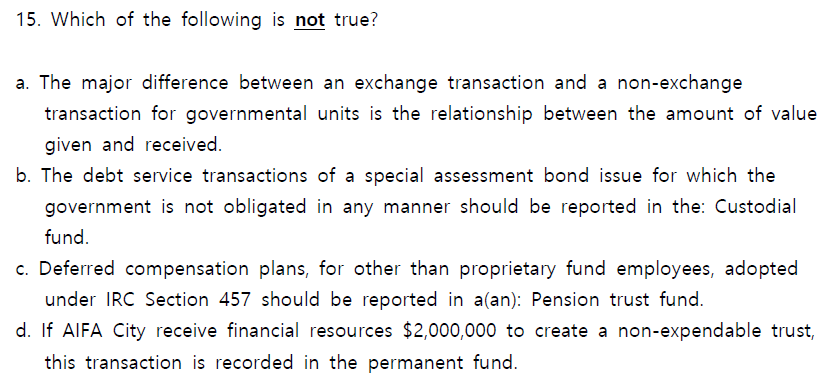

11. Which of the following is not true about bond of governmental accounting? a. AIFA City issued General Obligation Bond(GOB) $50,000 at 110, and additional cash payment occurred as follow : Underwriter fee $500, Debt issue cost $1,000. Then, Underwriter fee $500 is expended, and debt issue cost $1,000 is deducted from GOB. Therefore, AIFA City will report this GOB to OFS category, at $54,000. b. On 1/2/20X1, New York state issued $100 municipal bond, and 1/2/20X2, repaid interest $10 and part of the principal $50. Journal entry are as follows : Date Debit Credit Jan 2, 20X1 Cash $100 OFS $100 Dec 31, 20X1 No entry - c. In modified accrual, bond amortization cost is recognized as expenditure in full. d. Bond anticipation note is reported in other finance sources, because of accurate measurement of working capital. 13. Read the passage as below, and choice a correct answer. Seoul Metro that operate subway business is public enterprise. Seoul city have a authority to appoint management and to decide major decision of Seoul Metro. The head of a Seocho-gu Office is elected by inhabitants of a Seocho-gu. a. Seoul Metro's accounting process is governed by Seoul City. b. Subway business that Seoul Metro operate is included by Enterprise fund of Seoul City. c. Seocho-gu Office is independent primary government. d. According to above passages, Seoul city is financially accountable in relation to Seoul Metro. Therefore, Seoul City include Seoul Metro as a component unit. However, because Seoul metro is subgroup of Seoul city, Seoul city should report this component as part of Fund financial statements. 14. Which of the following is not true about the budgetary comparison schedule? a. The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period as well as actual inflows, outflows, and balances, stated on the government's budgetary basis. b. Even if AIFA City adopt cash-basis accounting in order to obey instruction of the laws and regulation, AIFA should prepare budgetary comparison schedule based on modified accrual basis. C. It is possible that actual amount of budgetary comparison schedule differ from expenditure amount of statement of revenue, expenditures & changes in fund balance. d. A separate column to report the variance between the final budget and actual amounts is encouraged, but not required. 15. Which of the following is not true? a. The major difference between an exchange transaction and a non-exchange transaction for governmental units is the relationship between the amount of value given and received. b. The debt service transactions of a special assessment bond issue for which the government is not obligated in any manner should be reported in the: Custodial fund. c. Deferred compensation plans, for other than proprietary fund employees, adopted under IRC Section 457 should be reported in aan): Pension trust fund. d. If AIFA City receive financial resources $2,000,000 to create a non-expendable trust, this transaction is recorded in the permanent fund. 11. Which of the following is not true about bond of governmental accounting? a. AIFA City issued General Obligation Bond(GOB) $50,000 at 110, and additional cash payment occurred as follow : Underwriter fee $500, Debt issue cost $1,000. Then, Underwriter fee $500 is expended, and debt issue cost $1,000 is deducted from GOB. Therefore, AIFA City will report this GOB to OFS category, at $54,000. b. On 1/2/20X1, New York state issued $100 municipal bond, and 1/2/20X2, repaid interest $10 and part of the principal $50. Journal entry are as follows : Date Debit Credit Jan 2, 20X1 Cash $100 OFS $100 Dec 31, 20X1 No entry - c. In modified accrual, bond amortization cost is recognized as expenditure in full. d. Bond anticipation note is reported in other finance sources, because of accurate measurement of working capital. 13. Read the passage as below, and choice a correct answer. Seoul Metro that operate subway business is public enterprise. Seoul city have a authority to appoint management and to decide major decision of Seoul Metro. The head of a Seocho-gu Office is elected by inhabitants of a Seocho-gu. a. Seoul Metro's accounting process is governed by Seoul City. b. Subway business that Seoul Metro operate is included by Enterprise fund of Seoul City. c. Seocho-gu Office is independent primary government. d. According to above passages, Seoul city is financially accountable in relation to Seoul Metro. Therefore, Seoul City include Seoul Metro as a component unit. However, because Seoul metro is subgroup of Seoul city, Seoul city should report this component as part of Fund financial statements. 14. Which of the following is not true about the budgetary comparison schedule? a. The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period as well as actual inflows, outflows, and balances, stated on the government's budgetary basis. b. Even if AIFA City adopt cash-basis accounting in order to obey instruction of the laws and regulation, AIFA should prepare budgetary comparison schedule based on modified accrual basis. C. It is possible that actual amount of budgetary comparison schedule differ from expenditure amount of statement of revenue, expenditures & changes in fund balance. d. A separate column to report the variance between the final budget and actual amounts is encouraged, but not required. 15. Which of the following is not true? a. The major difference between an exchange transaction and a non-exchange transaction for governmental units is the relationship between the amount of value given and received. b. The debt service transactions of a special assessment bond issue for which the government is not obligated in any manner should be reported in the: Custodial fund. c. Deferred compensation plans, for other than proprietary fund employees, adopted under IRC Section 457 should be reported in aan): Pension trust fund. d. If AIFA City receive financial resources $2,000,000 to create a non-expendable trust, this transaction is recorded in the permanent fund