Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nongovernment non-for-profit organizations that which to follow gaap in preparation of their financial statements should follow? erences Mailings ReviewView apter 16 - Quiz - Mark

nongovernment non-for-profit organizations that which to follow gaap in preparation of their financial statements should follow?

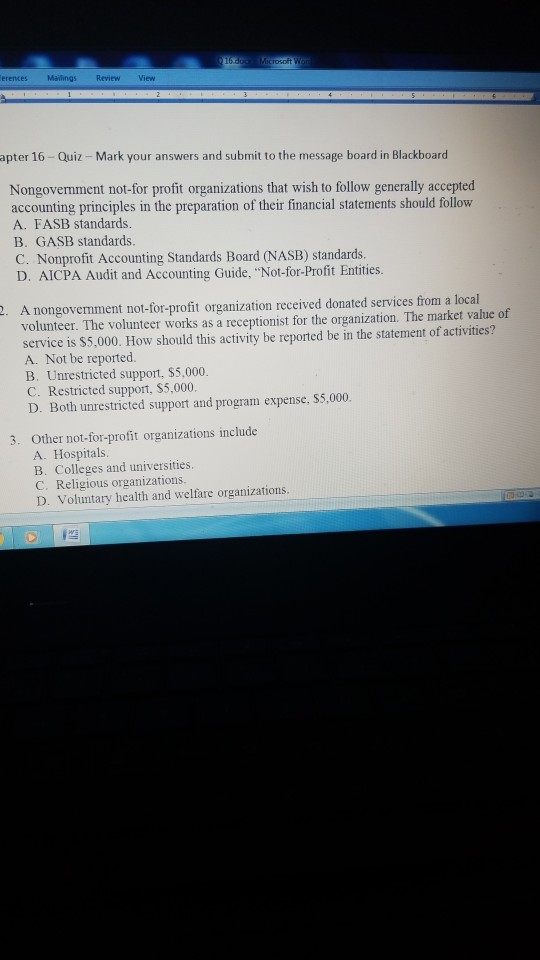

erences Mailings ReviewView apter 16 - Quiz - Mark your answers and submit to the message board in Blackboard Nongovenment not-for profit organizations that wish to follow generally accepted accounting principles in the preparation of their financial statements should follow A. FASB standards. B. GASB standards C. Nonprofit Accounting Standards Board (NASB) standards. D. AICPA Audit and Accounting Guide, "Not-for-Profit Entities. A nongovermment not-for-profit organization received donated services from a local volunteer. The volunteer works as a receptionist for the organization. The market value of service is $5,000. How should this activity be reported be in the statement of activities? A. Not be reported. B. Unrestricted support, $5,000. C. Restricted support, S5,000. 2. D. Both unrestricted support and program expense, $5,000. 3. Other not-for-profit organizations include A. Hospitals B. Colleges and universities. C. Religious organizations D. Voluntary health and welfare organizations erences Mailings ReviewView apter 16 - Quiz - Mark your answers and submit to the message board in Blackboard Nongovenment not-for profit organizations that wish to follow generally accepted accounting principles in the preparation of their financial statements should follow A. FASB standards. B. GASB standards C. Nonprofit Accounting Standards Board (NASB) standards. D. AICPA Audit and Accounting Guide, "Not-for-Profit Entities. A nongovermment not-for-profit organization received donated services from a local volunteer. The volunteer works as a receptionist for the organization. The market value of service is $5,000. How should this activity be reported be in the statement of activities? A. Not be reported. B. Unrestricted support, $5,000. C. Restricted support, S5,000. 2. D. Both unrestricted support and program expense, $5,000. 3. Other not-for-profit organizations include A. Hospitals B. Colleges and universities. C. Religious organizations D. Voluntary health and welfare organizations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started