Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- - - Normal 1 No Space Heading 1 Heading 2 The Subtitle Stem Engas Paragraph Styles A transportation company fedex or US has a

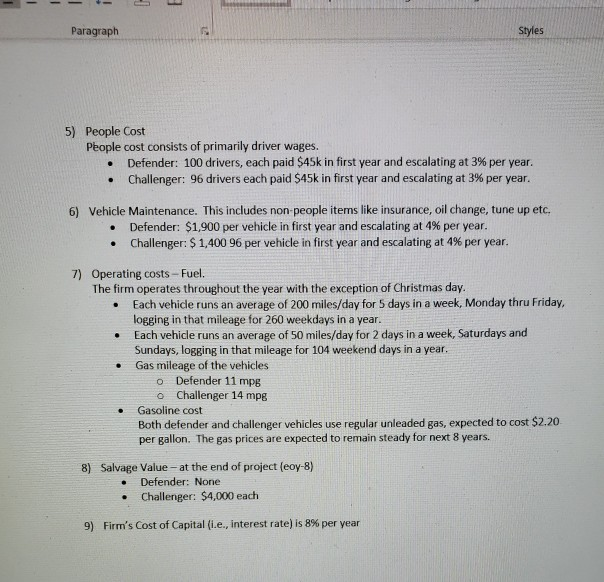

- - - Normal 1 No Space Heading 1 Heading 2 The Subtitle Stem Engas Paragraph Styles A transportation company fedex or US has a total delivery whicles de package to customer location in a certain in the has 150 which that were bought pors Purchase price of the vehicles (12 s e formation of the way it carried out on alter ex bas e , we will carry out before any such information is not useful and thus is not given these vehicl e value Both defender and change which wer per the perdor d t for ened to e at the end of toy The mis contemplating replacing those vehicles with fewer chargerrew whicles. The per can be carried out with only 14 vehicles instead of 150 because these are larger size wch icon. The new vehicles cost $40,000 cach stra Borrowing terminowe will calling feet wider and the new challenger Question. From economic perspective who wins? Defender or Challenger? More Imurtant to should the replace the feet? Relevant Data: 1) Project Life - years typicale of delivery whiclesi 2) Defender's current salvage a trade in value 53,300 each or 5145.000 3] Challenger's purchase price $40.000 each or 55.6 milion 4) Velide Upgrade Defender need to be upgradeda kind of make Upgrade cost-$,000 per vehide or $12 milion and the upgrades essential 5) People Cost People cost consists of p arily driver wegen Defender 100 drivers, each aid skin first year and can o pery . Challenger drivers mach pod 545 infot year and escalating at per year b) vehide Maintenance. This includes non people items like insurance, change, tune up . Defender $1,000 per vehicle in first year and scalatingat per year . Challenger $ 1.400 per vehicle in first year and escalating to per year. 7] Operating costs-fuel. The firm operates throughout the year with the pion of Chnstaday Each vehicle runs an average of 200 ml/day for days in a week, Monday to Friday losing in that mig for 260 weekdays in a year tach vehicle runs an average of 50mles/day for 2 days in a week, Saturdays and Sunday, logging in that mig for 104 weekend days in a year Gas mileage of the vehides Defender 11 ME Challenger 14 mpg Gasoline cost A transportation company (like FedEx or UPS) has a fleet of small delivery vehicles used to deliver packages to customers' location. In a certain location the firm has 150 vehicles that were bought 12 years ago. Purchase price of the vehicles (12 years ago) is useful information if the analysis is carried out on an after-tax basis; however, since we will carry out before tax analysis only, such information is not useful and thus is not given. Those vehicles carry a salvage value of $2,300 each. The firm is contemplating replacing those vehicles with fewer slightly larger new vehicles. The operations can be carried out with only 140 vehides (instead of 150) because these are larger size vehicles. The new vehicles cost $40,000 each. Borrowing sports terminology, we will call existing fleet as defender and the new fleet as challenger. Question: From economic perspective who wins? Defender or Challenger? More important Question: Should the firm replace the fleet? Relevant Data: 1) Project Ufe = 8 years (typical life of delivery vehicles) 2) Defender's current salvage value (trade in value) $2,300 each or $345,000 3) Challenger's purchase price $40,000 each or $5.6 million 4) Vehicle Upgrade Defender need to be upgraded (a kind of makeover and the upgrade is essential Upgrade cost-$8,000 per vehicle or $1.2 million. Paragraph Styles 5) People Cost People cost consists of primarily driver wages. Defender: 100 drivers, each paid $45k in first year and escalating at 3% per year. Challenger: 96 drivers each paid $45k in first year and escalating at 3% per year. 6) Vehicle Maintenance. This includes non people items like insurance, oil change, tune up etc. Defender: $1,900 per vehicle in first year and escalating at 4% per year. Challenger: $ 1,400 96 per vehicle in first year and escalating at 4% per year. 7) Operating costs - Fuel. The firm operates throughout the year with the exception of Christmas day Each vehide runs an average of 200 miles/day for 5 days in a week, Monday thru Friday, logging in that mileage for 260 weekdays in a year. Each vehicle runs an average of 50 miles/day for 2 days in a week, Saturdays and Sundays, logging in that mileage for 104 weekend days in a year, Gas mileage of the vehicles o Defender 11 mpg o Challenger 14 mpg Gasoline cost Both defender and challenger vehicles use regular unleaded gas, expected to cost $2.20 per gallon. The gas prices are expected to remain steady for next 8 years. 8) Salvage Value - at the end of project (eoy-8) Defender: None Challenger: $4,000 each 9) Firm's Cost of Capital (i.e., interest rate) is 8% per year - - - Normal 1 No Space Heading 1 Heading 2 The Subtitle Stem Engas Paragraph Styles A transportation company fedex or US has a total delivery whicles de package to customer location in a certain in the has 150 which that were bought pors Purchase price of the vehicles (12 s e formation of the way it carried out on alter ex bas e , we will carry out before any such information is not useful and thus is not given these vehicl e value Both defender and change which wer per the perdor d t for ened to e at the end of toy The mis contemplating replacing those vehicles with fewer chargerrew whicles. The per can be carried out with only 14 vehicles instead of 150 because these are larger size wch icon. The new vehicles cost $40,000 cach stra Borrowing terminowe will calling feet wider and the new challenger Question. From economic perspective who wins? Defender or Challenger? More Imurtant to should the replace the feet? Relevant Data: 1) Project Life - years typicale of delivery whiclesi 2) Defender's current salvage a trade in value 53,300 each or 5145.000 3] Challenger's purchase price $40.000 each or 55.6 milion 4) Velide Upgrade Defender need to be upgradeda kind of make Upgrade cost-$,000 per vehide or $12 milion and the upgrades essential 5) People Cost People cost consists of p arily driver wegen Defender 100 drivers, each aid skin first year and can o pery . Challenger drivers mach pod 545 infot year and escalating at per year b) vehide Maintenance. This includes non people items like insurance, change, tune up . Defender $1,000 per vehicle in first year and scalatingat per year . Challenger $ 1.400 per vehicle in first year and escalating to per year. 7] Operating costs-fuel. The firm operates throughout the year with the pion of Chnstaday Each vehicle runs an average of 200 ml/day for days in a week, Monday to Friday losing in that mig for 260 weekdays in a year tach vehicle runs an average of 50mles/day for 2 days in a week, Saturdays and Sunday, logging in that mig for 104 weekend days in a year Gas mileage of the vehides Defender 11 ME Challenger 14 mpg Gasoline cost A transportation company (like FedEx or UPS) has a fleet of small delivery vehicles used to deliver packages to customers' location. In a certain location the firm has 150 vehicles that were bought 12 years ago. Purchase price of the vehicles (12 years ago) is useful information if the analysis is carried out on an after-tax basis; however, since we will carry out before tax analysis only, such information is not useful and thus is not given. Those vehicles carry a salvage value of $2,300 each. The firm is contemplating replacing those vehicles with fewer slightly larger new vehicles. The operations can be carried out with only 140 vehides (instead of 150) because these are larger size vehicles. The new vehicles cost $40,000 each. Borrowing sports terminology, we will call existing fleet as defender and the new fleet as challenger. Question: From economic perspective who wins? Defender or Challenger? More important Question: Should the firm replace the fleet? Relevant Data: 1) Project Ufe = 8 years (typical life of delivery vehicles) 2) Defender's current salvage value (trade in value) $2,300 each or $345,000 3) Challenger's purchase price $40,000 each or $5.6 million 4) Vehicle Upgrade Defender need to be upgraded (a kind of makeover and the upgrade is essential Upgrade cost-$8,000 per vehicle or $1.2 million. Paragraph Styles 5) People Cost People cost consists of primarily driver wages. Defender: 100 drivers, each paid $45k in first year and escalating at 3% per year. Challenger: 96 drivers each paid $45k in first year and escalating at 3% per year. 6) Vehicle Maintenance. This includes non people items like insurance, oil change, tune up etc. Defender: $1,900 per vehicle in first year and escalating at 4% per year. Challenger: $ 1,400 96 per vehicle in first year and escalating at 4% per year. 7) Operating costs - Fuel. The firm operates throughout the year with the exception of Christmas day Each vehide runs an average of 200 miles/day for 5 days in a week, Monday thru Friday, logging in that mileage for 260 weekdays in a year. Each vehicle runs an average of 50 miles/day for 2 days in a week, Saturdays and Sundays, logging in that mileage for 104 weekend days in a year, Gas mileage of the vehicles o Defender 11 mpg o Challenger 14 mpg Gasoline cost Both defender and challenger vehicles use regular unleaded gas, expected to cost $2.20 per gallon. The gas prices are expected to remain steady for next 8 years. 8) Salvage Value - at the end of project (eoy-8) Defender: None Challenger: $4,000 each 9) Firm's Cost of Capital (i.e., interest rate) is 8% per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started