Answered step by step

Verified Expert Solution

Question

1 Approved Answer

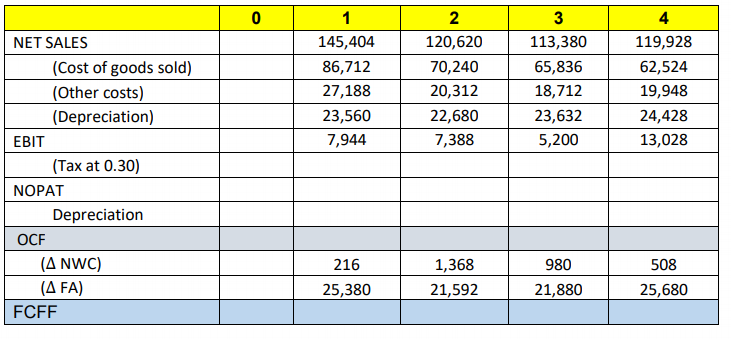

North-Ireland Coolings management has made the projections shown in Table below. Use this table as a starting point to value the company. The WACC for

North-Ireland Coolings management has made the projections shown in Table below. Use this table as a starting point to value the company. The WACC for North-Ireland Cooling is 10% and the long-run growth rate after year 4 is 7%. The company has $15,000 debt and 850 shares outstanding. Tax rate is 0.30.

a) Calculate the free cash flows to the firm

b) What is the firm value?

c) What is the equity value? d) What is the intrinsic value of share?

Show your steps in your calculations.

Please answer as soon as possible

0 1 145,404 86,712 27,188 23,560 7,944 2 120,620 70,240 20,312 22,680 7,388 3 113,380 65,836 18,712 23,632 5,200 4 119,928 62,524 19,948 24,428 13,028 NET SALES (Cost of goods sold) (Other costs) (Depreciation) EBIT (Tax at 0.30) NOPAT Depreciation OCF (ANWC) (AFA) FCFF 216 1,368 21,592 980 21,880 508 25,680 25,380Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started