Answered step by step

Verified Expert Solution

Question

1 Approved Answer

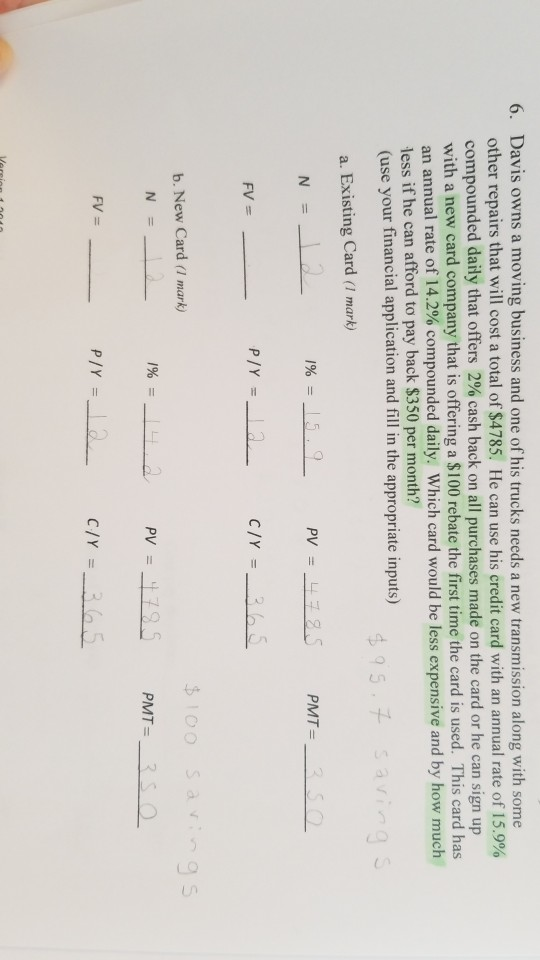

Not sure if I'm on the right track with my financial calculator inputs (using TVM solver). Having difficulties with what N should be. 6. Davis

Not sure if I'm on the right track with my financial calculator inputs (using TVM solver). Having difficulties with what N should be.

6. Davis owns a moving business and one of his trucks needs a new transmission along with some other repairs that will cost a total of $4785. He can use his credit card with an annual rate of 15.9% compounded daily that offers 2% cash back on all purchases made on the card or he can sign up with a new card company that is offering a $100 rebate the first time the card is used. This card has an annual rate of 14.2% compounded daily. Which card would be less expensive and by how much less if he can afford to pay back $350 per month? (use your financial application and fill in the appropriate inputs) $95.7 savings a. Existing Card (1 mark) N 12 1% = 15.2 PV = 478.5 PMT= 3S FV = Ply = 12 C/Y = _ 365 b. New Card (1 mark) $100 savings PMT=_350 N = 1% = PV = 478.5 FV = P/Y = -2 CIY = _365 6. Davis owns a moving business and one of his trucks needs a new transmission along with some other repairs that will cost a total of $4785. He can use his credit card with an annual rate of 15.9% compounded daily that offers 2% cash back on all purchases made on the card or he can sign up with a new card company that is offering a $100 rebate the first time the card is used. This card has an annual rate of 14.2% compounded daily. Which card would be less expensive and by how much less if he can afford to pay back $350 per month? (use your financial application and fill in the appropriate inputs) $95.7 savings a. Existing Card (1 mark) N 12 1% = 15.2 PV = 478.5 PMT= 3S FV = Ply = 12 C/Y = _ 365 b. New Card (1 mark) $100 savings PMT=_350 N = 1% = PV = 478.5 FV = P/Y = -2 CIY = _365Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started