Answered step by step

Verified Expert Solution

Question

1 Approved Answer

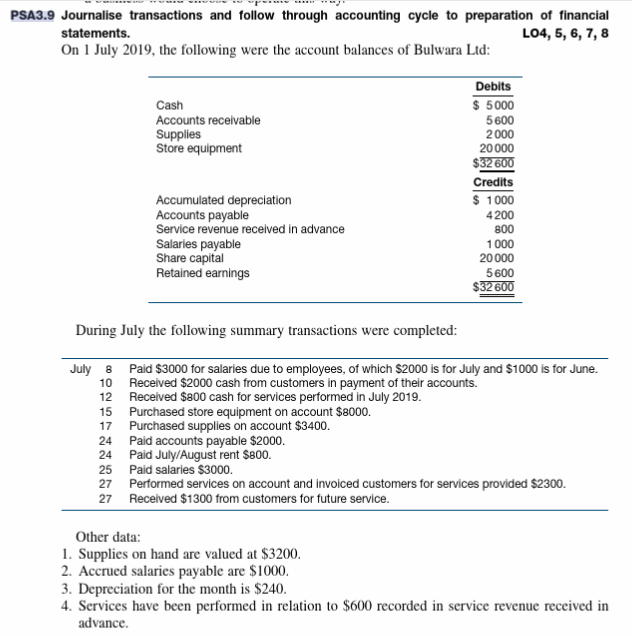

not sure PSA3.9 Journalise transactions and follow through accounting cycle to preparation of financial statements. L04, 5, 6, 7, 8 On 1 July 2019, the

not sure

PSA3.9 Journalise transactions and follow through accounting cycle to preparation of financial statements. L04, 5, 6, 7, 8 On 1 July 2019, the following were the account balances of Bulwara Ltd: Cash Accounts receivable Supplies Store equipment Debits $ 5000 5600 2000 20000 $32600 Credits $ 1000 4200 800 1000 20000 5600 $32 600 Accumulated depreciation Accounts payable Service revenue received in advance Salaries payable Share capital Retained earnings During July the following summary transactions were completed: July 8 Paid $3000 for salaries due to employees, of which $2000 is for July and $1000 is for June. 10 Received $2000 cash from customers in payment of their accounts. 12 Received $800 cash for services performed in July 2019. 15 Purchased store equipment on account $8000. 17 Purchased supplies on account $3400 24 Paid accounts payable $2000. 24 Paid July/August rent $800. 25 Paid salaries $3000. 27 Performed services on account and invoiced customers for services provided $2300. 27 Received $1300 from customers for future service. Other data: 1. Supplies on hand are valued at $3200. 2. Accrued salaries payable are $1000. 3. Depreciation for the month is $240. 4. Services have been performed in relation to $600 recorded in service revenue received in advance. Required (a) Prepare a chart of accounts. (Hint: Refer to Wong Pty Ltd in chapter 2 of this text.) (b) Enter the 1 July balances in the ledger accounts (use T accounts). (c) Journalise the July transactions. (d) Post to the ledger accounts you prepared for part (e) above. Use service revenue, depreci- ation expense, supplies expense, salaries expense and rent expense. (e) Prepare a trial balance at 31 July before adjusting entries. (1) Journalise and post adjusting entries. Financial accounting: Reporting, analysis and decision making (g) Prepare an adjusted trial balance. (h) Prepare a statement of profit or loss and a calculation of retained earnings for July and prepare a statement of financial position as at 31 July 2019. (i) Optional: Using the information in this problem starting at part (e), prepare a worksheet using the format in figure 3.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started