Answered step by step

Verified Expert Solution

Question

1 Approved Answer

not yet av OD 2 WESS mmg sumy. II CICLI ULL DUTIES UIT (ignore any accounts that are not listed). During January, the company

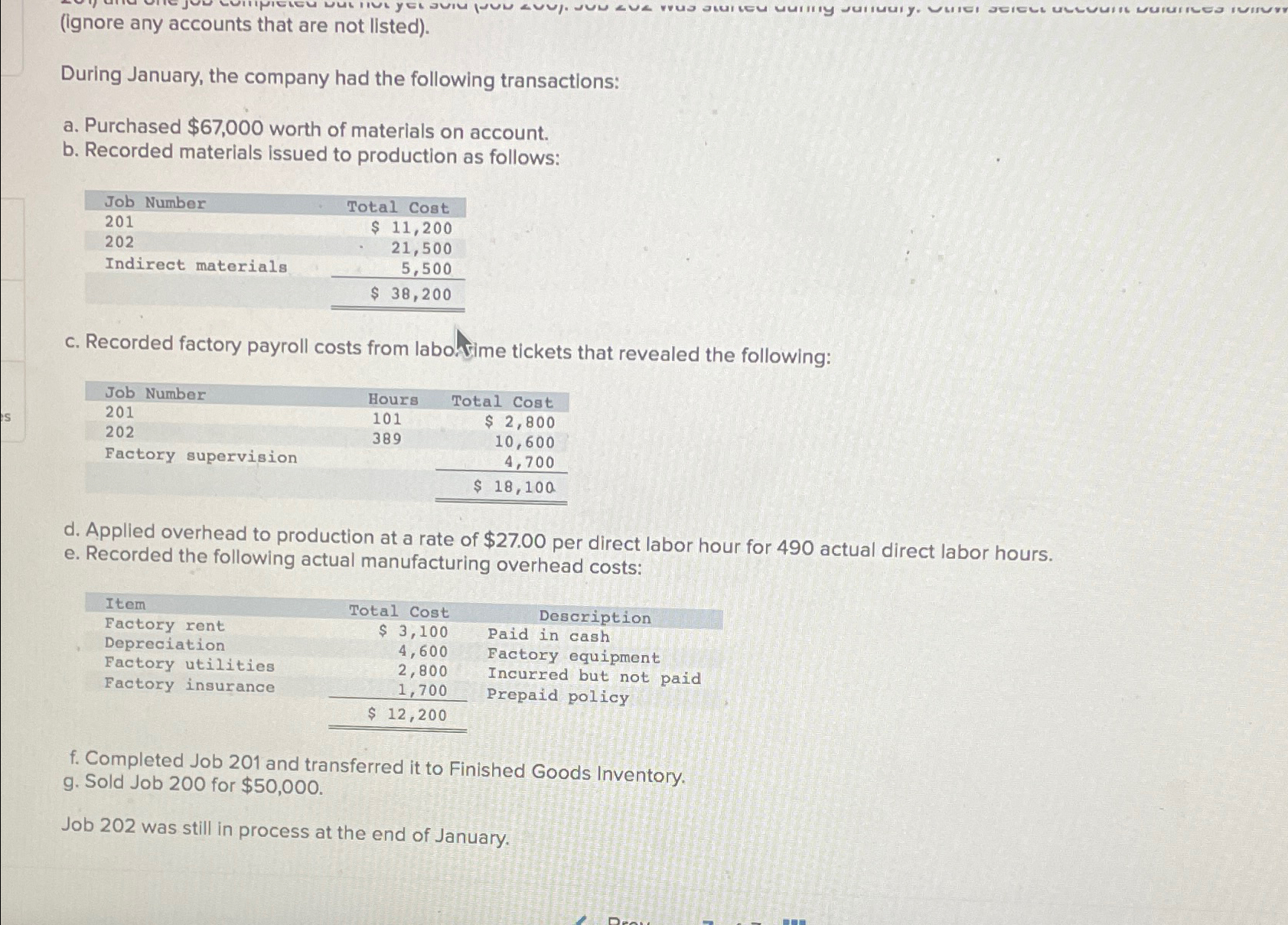

not yet av OD 2 WESS mmg sumy. II CICLI ULL DUTIES UIT (ignore any accounts that are not listed). During January, the company had the following transactions: a. Purchased $67,000 worth of materials on account. b. Recorded materials issued to production as follows: Job Number Total Cost 201 202 Indirect materials $ 11,200 21,500 5,500 $ 38,200 c. Recorded factory payroll costs from labo vime tickets that revealed the following: Job Number 201 S Hours 101 Total Cost 202 389 $ 2,800 10,600 Factory supervision 4,700 $ 18,100 d. Applied overhead to production at a rate of $27.00 per direct labor hour for 490 actual direct labor hours. e. Recorded the following actual manufacturing overhead costs: Item Factory rent Depreciation Factory utilities Factory insurance Total Cost $ 3,100 4,600 2,800 1,700 $ 12,200 Description Paid in cash Factory equipment Incurred but not paid Prepaid policy f. Completed Job 201 and transferred it to Finished Goods Inventory. g. Sold Job 200 for $50,000. Job 202 was still in process at the end of January. Deau

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started