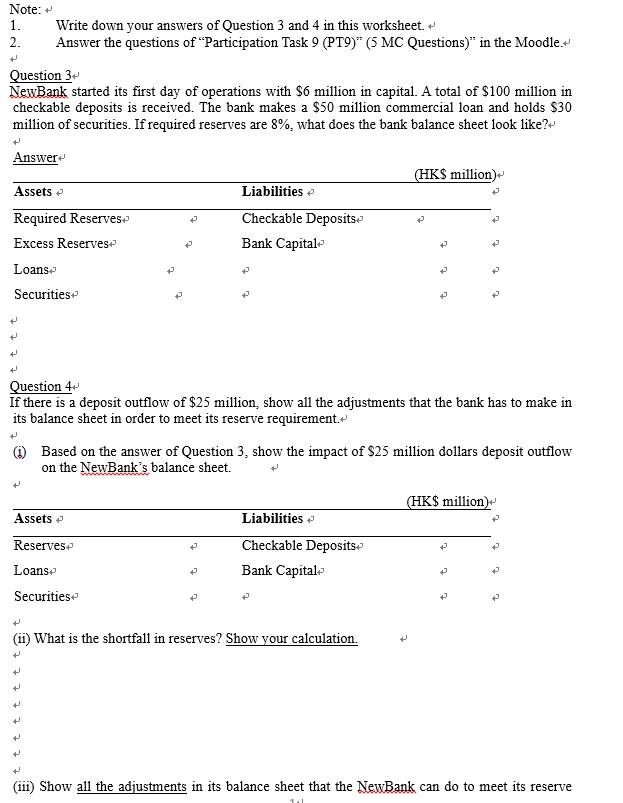

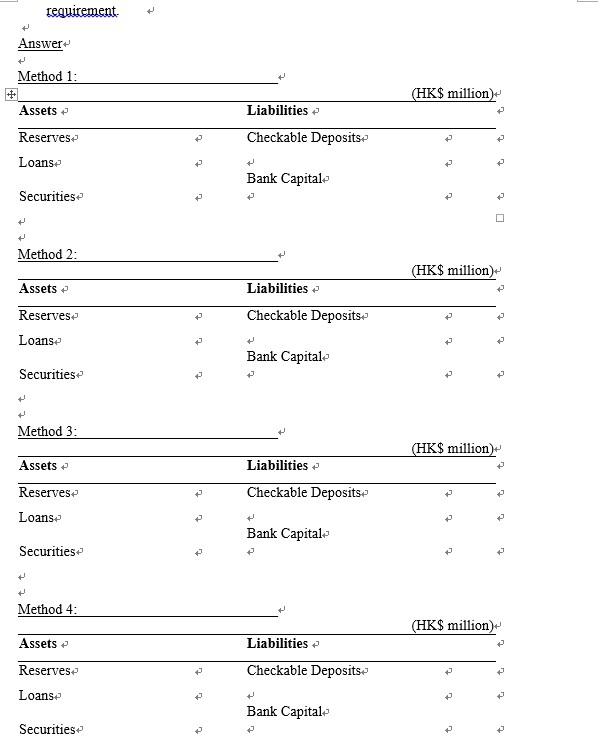

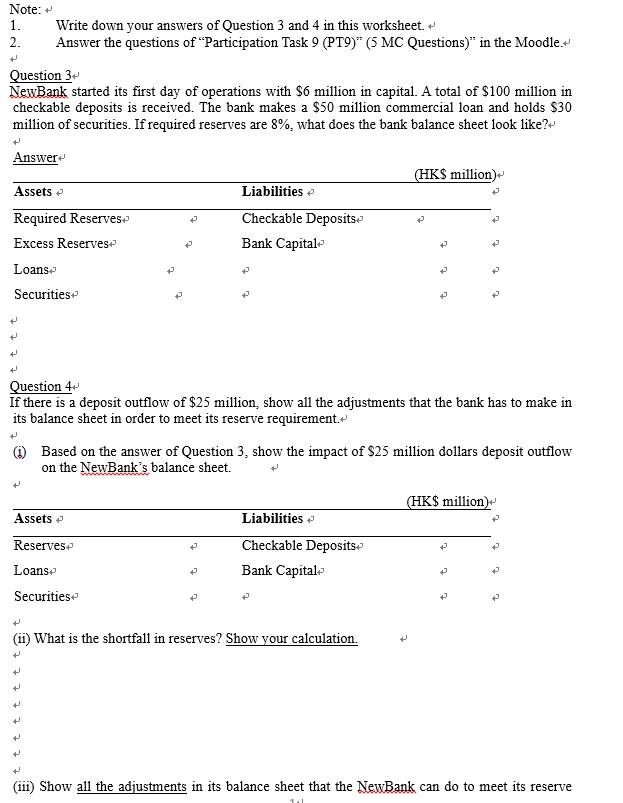

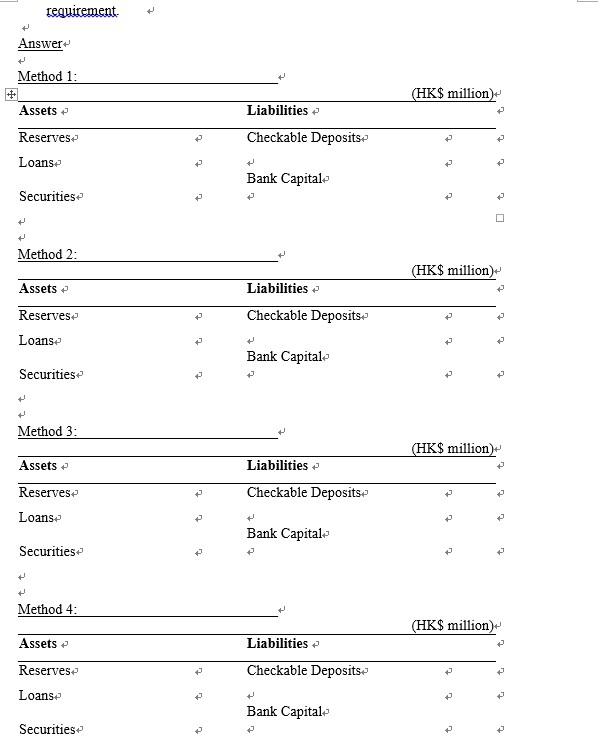

Note: 1. Write down your answers of Question 3 and 4 in this worksheet. 2. Answer the questions of "Participation Task 9 (PT9)" (5 MC Questions)" in the Moodle. Question 3 NewBank started its first day of operations with $6 million in capital. A total of $100 million in checkable deposits is received. The bank makes a $50 million commercial loan and holds $30 million of securities. If required reserves are 8%, what does the bank balance sheet look like? Answer Question 4 If there is a deposit outflow of $25 million, show all the adjustments that the bank has to make in its balance sheet in order to meet its reserve requirement. (i) Based on the answer of Question 3, show the impact of $25 million dollars deposit outflow on the NewBank's balance sheet. (ii) What is the shortfall in reserves? Show your calculation. (iii) Show all the adjustments in its balance sheet that the NewBank can do to meet its reserve Answer Method 1: \begin{tabular}{lll} \hline Assets & Liabilities & (HK$ million) \\ \hline Reserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & Liabilities & Checkable Deposits \\ Method 2: & & Bank Capital \\ \hline Assets & & \end{tabular} Method 3: \begin{tabular}{lll} \hline & Liabilities & (HK\$ million) \\ \hline Rsseserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & \end{tabular} Method 4: \begin{tabular}{lll} \hline & & (HK \$ million) \\ \hline Assets & Liabilities \\ \hline Reserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & \end{tabular} Note: 1. Write down your answers of Question 3 and 4 in this worksheet. 2. Answer the questions of "Participation Task 9 (PT9)" (5 MC Questions)" in the Moodle. Question 3 NewBank started its first day of operations with $6 million in capital. A total of $100 million in checkable deposits is received. The bank makes a $50 million commercial loan and holds $30 million of securities. If required reserves are 8%, what does the bank balance sheet look like? Answer Question 4 If there is a deposit outflow of $25 million, show all the adjustments that the bank has to make in its balance sheet in order to meet its reserve requirement. (i) Based on the answer of Question 3, show the impact of $25 million dollars deposit outflow on the NewBank's balance sheet. (ii) What is the shortfall in reserves? Show your calculation. (iii) Show all the adjustments in its balance sheet that the NewBank can do to meet its reserve Answer Method 1: \begin{tabular}{lll} \hline Assets & Liabilities & (HK$ million) \\ \hline Reserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & Liabilities & Checkable Deposits \\ Method 2: & & Bank Capital \\ \hline Assets & & \end{tabular} Method 3: \begin{tabular}{lll} \hline & Liabilities & (HK\$ million) \\ \hline Rsseserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & \end{tabular} Method 4: \begin{tabular}{lll} \hline & & (HK \$ million) \\ \hline Assets & Liabilities \\ \hline Reserves & Checkable Deposits \\ Loans & Bank Capital \\ Securities & \end{tabular}