Question

Note: 35% of Manufacturing Overhead is variable, and 90% of S&A costs are fixed, while the rest of S&A are commissions. Given the data above

Note: 35% of Manufacturing Overhead is variable, and 90% of S&A costs are fixed, while the rest of S&A are commissions.

Given the data above answer questions 1-7

1. What is the contribution Margin for the new line of sweet potato chips?

2. What is the breakeven amount for the sweet potato chips in dollars and units?

3. What is the margin of safety for the sweet potato chips in both dollars and units?

4. What is the degree of operating leverage for the sweet potato chips?

5. How much would operating income increase if sales increased by 20%?

If the sales commissions increased on chips by 25%, they expect to increase sales by 8%. Alternatively, they could spend an additional $150,000 in fixed advertising, which would raise our sales by about 7%. Would either of those increases in cost be worthwhile? Which would be better?

6. What would be the effect on the sweet potato line’s net income if the company increased sales commissions as in Scott’s first alternative?

7. What would be the effect on the sweet potato line’s net income if the company increased advertising expense as in Scott’s second alternative?

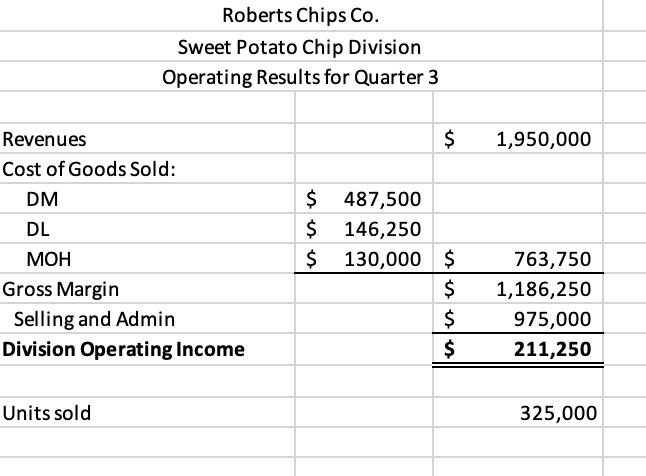

Revenues Cost of Goods Sold: DM DL MOH Roberts Chips Co. Sweet Potato Chip Division Operating Results for Quarter 3 Gross Margin Selling and Admin Division Operating Income Units sold $ $ 487,500 $ 146,250 $ 130,000 $ esse $ $ $ 1,950,000 763,750 1,186,250 975,000 211,250 325,000

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions we first need to identify and calculate various financial aspects from the data provided Lets start with the first question 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started