Answered step by step

Verified Expert Solution

Question

1 Approved Answer

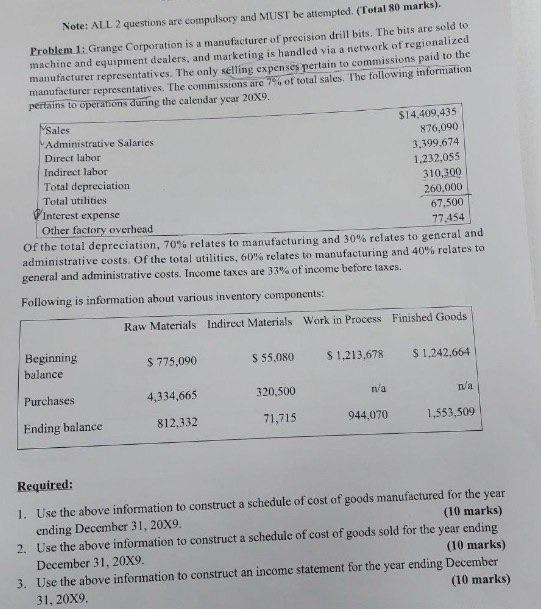

Note: ALL 2 questions are compulsory and MUST be attempted. (Total 80 marks). Problem 1: Grange Corporation is a manufacturer of precision drill bits.

Note: ALL 2 questions are compulsory and MUST be attempted. (Total 80 marks). Problem 1: Grange Corporation is a manufacturer of precision drill bits. The bits are sold to machine and equipment dealers, and marketing is handled via a network of regionalized manufacturer representatives. The only selling expenses pertain to commissions paid to the manufacturer representatives. The commissions are 7% of total sales. The following information pertains to operations during the calendar year 20X9. Sales Administrative Salaries Direct labor Indirect labor Total depreciation Total utilities Interest expense Other factory overhead $14,409,435 876,090 3,399.674 1,232,055 310,300 260,000 67.500 77,454 Of the total depreciation, 70% relates to manufacturing and 30% relates to general and administrative costs. Of the total utilities, 60% relates to manufacturing and 40% relates to general and administrative costs. Income taxes are 33% of income before taxes. Following is information about various inventory components: Raw Materials Indirect Materials Work in Process Finished Goods Beginning balance $775,090 $ 55.080 $ 1,213,678 $ 1,242,664 Purchases 4,334,665 320,500 n/a n/a Ending balance 812.332 71,715 944,070 1,553,509 Required: 1. Use the above information to construct a schedule of cost of goods manufactured for the year (10 marks) ending December 31, 20X9. 2. Use the above information to construct a schedule of cost of goods sold for the year ending December 31, 20X9. (10 marks) 3. Use the above information to construct an income statement for the year ending December (10 marks) 31, 20X9.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started