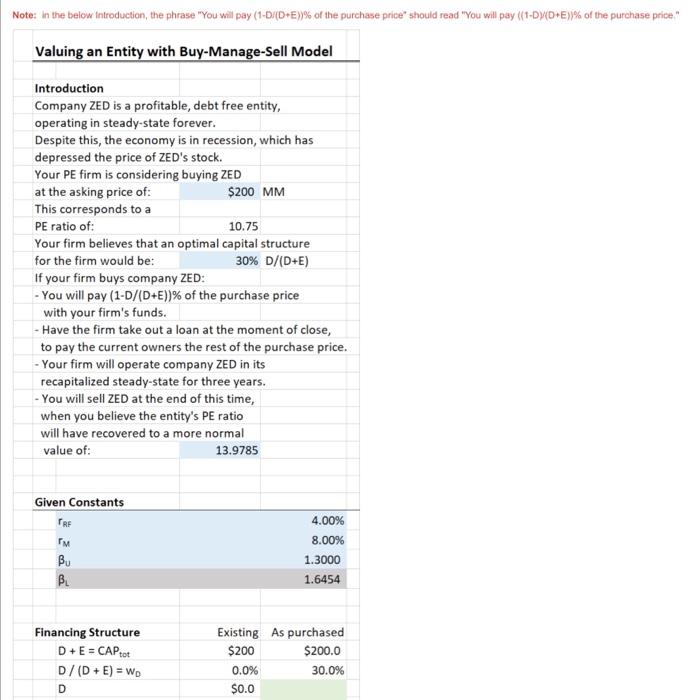

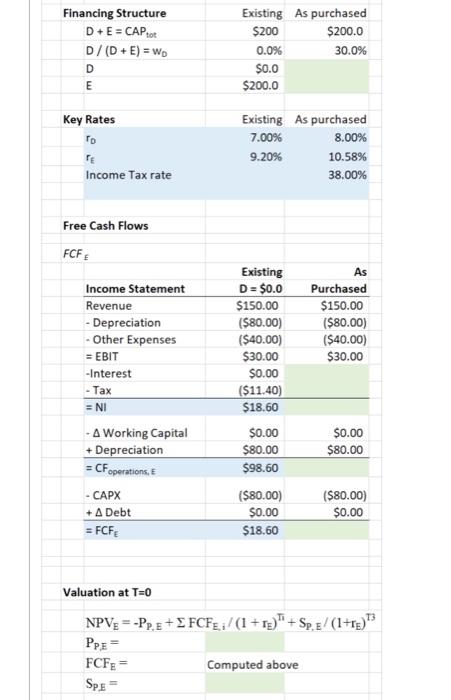

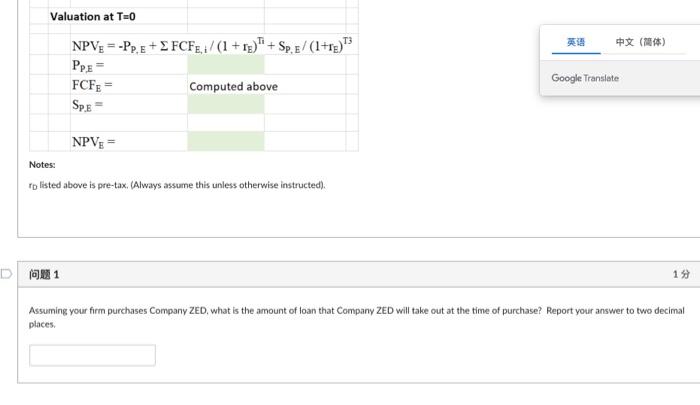

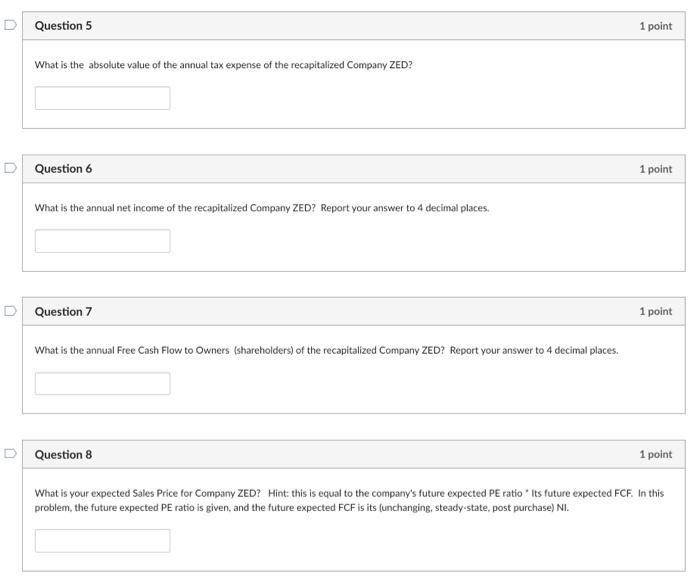

Note: In the below Introduction, the phrase "You will pay (1-D/{D+E9% of the purchase price should read "You will pay ((1-DWD+E9% of the purchase price." Valuing an Entity with Buy-Manage-Sell Model Introduction Company ZED is a profitable, debt free entity, operating in steady-state forever. Despite this, the economy is in recession, which has depressed the price of ZED's stock. Your PE firm is considering buying ZED at the asking price of: $200 MM This corresponds to a PE ratio of: 10.75 Your firm believes that an optimal capital structure for the firm would be: 30% D/(D+E) If your firm buys company ZED: - You will pay (1-D/(D+E))% of the purchase price with your firm's funds. - Have the firm take out a loan at the moment of close, to pay the current owners the rest of the purchase price. - Your firm will operate company ZED in its recapitalized steady-state for three years. - You will sell ZED at the end of this time, when you believe the entity's PE ratio will have recovered to a more normal value of: 13.9785 Given Constants RE 4.00% 8.00% 1.3000 1.6454 Bu BL Financing Structure D+E = CAP D/D+E) = WD $200 Existing As purchased $200.0 0.0% 30.0% $0.0 D Financing Structure D+E = CAPO D/(D+E) = WD D E Existing As purchased $200 $200.0 0.0% 30.0% $0.0 $200.0 Key Rates Existing As purchased 7.00% 8.00% 9.20% 10.58% 38.00% FE Income Tax rate Free Cash Flows FCF Income Statement Revenue - Depreciation - Other Expenses = EBIT -Interest As Purchased $150.00 ($80.00) ($40.00) $30.00 Existing D = $0.0 $150.00 ($80.00) ($40.00) $30.00 $0.00 ($11.40) $18.60 $0.00 $80.00 $98.60 -Tax $0.00 $80.00 = NI - A Working Capital + Depreciation = CF operations. E CAPX + A Debt = FCF ($80.00) $0.00 $18.60 ($80.00) $0.00 Valuation at T=0 NPV= = -Pp, E+FCFE/ (1 +TE)"+Sp.E/ (1+r)" Pp. FCFE Computed above SPE () Valuation at T=0 NPV = -Pp.E+FCFg.:/ (1 + rg)" + Sp.8/(1+r)" Pps- FCFE- Computed above Sp. Google Translate NPVE Notes: To listed above is pre-tax. Always assume this unless otherwise instructed). D 1981 197 Assuming your firm purchases Company ZED, what is the amount of loan that company ZED will take out at the time of purchase? Report your answer to two decimal places D Question 5 1 point What is the absolute value of the annual tax expense of the recapitalized Company ZED? D Question 6 1 point What is the annual net income of the recapitalized Company ZED? Report your answer to 4 decimal places. D Question 7 1 point What is the annual Free Cash Flow to Owners (shareholders) of the recapitalized Company ZED? Report your answer to 4 decimal places. D Question 8 1 point What is your expected Sales Price for Company ZED? Hint: this is equal to the company's future expected PE ratio " Its future expected FCF. In this problem, the future expected PE ratio is given, and the future expected FCF is its (unchanging, steady-state, post purchase) NI. Note: In the below Introduction, the phrase "You will pay (1-D/{D+E9% of the purchase price should read "You will pay ((1-DWD+E9% of the purchase price." Valuing an Entity with Buy-Manage-Sell Model Introduction Company ZED is a profitable, debt free entity, operating in steady-state forever. Despite this, the economy is in recession, which has depressed the price of ZED's stock. Your PE firm is considering buying ZED at the asking price of: $200 MM This corresponds to a PE ratio of: 10.75 Your firm believes that an optimal capital structure for the firm would be: 30% D/(D+E) If your firm buys company ZED: - You will pay (1-D/(D+E))% of the purchase price with your firm's funds. - Have the firm take out a loan at the moment of close, to pay the current owners the rest of the purchase price. - Your firm will operate company ZED in its recapitalized steady-state for three years. - You will sell ZED at the end of this time, when you believe the entity's PE ratio will have recovered to a more normal value of: 13.9785 Given Constants RE 4.00% 8.00% 1.3000 1.6454 Bu BL Financing Structure D+E = CAP D/D+E) = WD $200 Existing As purchased $200.0 0.0% 30.0% $0.0 D Financing Structure D+E = CAPO D/(D+E) = WD D E Existing As purchased $200 $200.0 0.0% 30.0% $0.0 $200.0 Key Rates Existing As purchased 7.00% 8.00% 9.20% 10.58% 38.00% FE Income Tax rate Free Cash Flows FCF Income Statement Revenue - Depreciation - Other Expenses = EBIT -Interest As Purchased $150.00 ($80.00) ($40.00) $30.00 Existing D = $0.0 $150.00 ($80.00) ($40.00) $30.00 $0.00 ($11.40) $18.60 $0.00 $80.00 $98.60 -Tax $0.00 $80.00 = NI - A Working Capital + Depreciation = CF operations. E CAPX + A Debt = FCF ($80.00) $0.00 $18.60 ($80.00) $0.00 Valuation at T=0 NPV= = -Pp, E+FCFE/ (1 +TE)"+Sp.E/ (1+r)" Pp. FCFE Computed above SPE () Valuation at T=0 NPV = -Pp.E+FCFg.:/ (1 + rg)" + Sp.8/(1+r)" Pps- FCFE- Computed above Sp. Google Translate NPVE Notes: To listed above is pre-tax. Always assume this unless otherwise instructed). D 1981 197 Assuming your firm purchases Company ZED, what is the amount of loan that company ZED will take out at the time of purchase? Report your answer to two decimal places D Question 5 1 point What is the absolute value of the annual tax expense of the recapitalized Company ZED? D Question 6 1 point What is the annual net income of the recapitalized Company ZED? Report your answer to 4 decimal places. D Question 7 1 point What is the annual Free Cash Flow to Owners (shareholders) of the recapitalized Company ZED? Report your answer to 4 decimal places. D Question 8 1 point What is your expected Sales Price for Company ZED? Hint: this is equal to the company's future expected PE ratio " Its future expected FCF. In this problem, the future expected PE ratio is given, and the future expected FCF is its (unchanging, steady-state, post purchase) NI