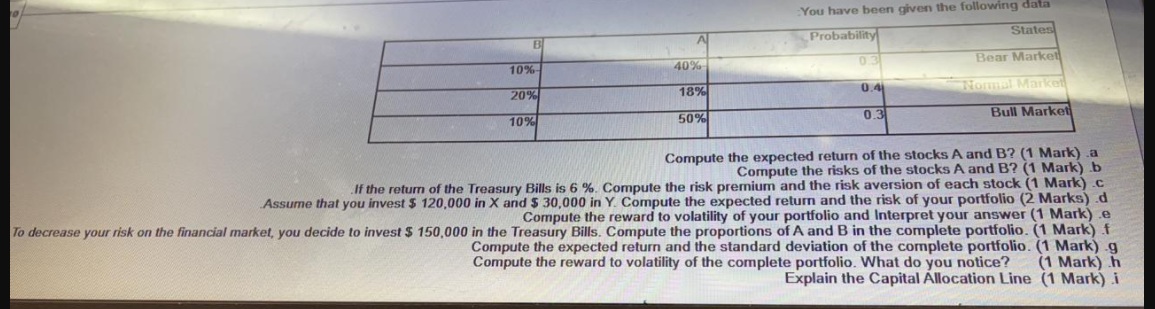

Question: You have been given the following data States B Probability 03 Bear Market 10% 40% 0.41 TO Marken 20% 18% Bull Market 0.3 10% 50%

You have been given the following data States B Probability 03 Bear Market 10% 40% 0.41 TO Marken 20% 18% Bull Market 0.3 10% 50% Compute the expected return of the stocks A and B? (1 Mark) .a Compute the risks of the stocks A and B? (1 Mark) .b .If the return of the Treasury Bills is 6 %. Compute the risk premium and the risk aversion of each stock (1 Mark).c Assume that you invest $ 120,000 in X and $ 30,000 in Y. Compute the expected return and the risk of your portfolio (2 Marks) .d To decrease your risk on the financial market, you decide to invest $ 150,000 in the Treasury Bills. Compute the proportions of A and B in the complete portfolio. (1 Mark) f Compute the reward to volatility of your portfolio and Interpret your answer (1 Mark) Compute the expected return and the standard deviation of the complete portfolio. (1 Mark) g Compute the reward to volatility of the complete portfolio. What do you notice? (1 Mark). Explain the Capital Allocation Line (1 Mark) i You have been given the following data States B Probability 03 Bear Market 10% 40% 0.41 TO Marken 20% 18% Bull Market 0.3 10% 50% Compute the expected return of the stocks A and B? (1 Mark) .a Compute the risks of the stocks A and B? (1 Mark) .b .If the return of the Treasury Bills is 6 %. Compute the risk premium and the risk aversion of each stock (1 Mark).c Assume that you invest $ 120,000 in X and $ 30,000 in Y. Compute the expected return and the risk of your portfolio (2 Marks) .d To decrease your risk on the financial market, you decide to invest $ 150,000 in the Treasury Bills. Compute the proportions of A and B in the complete portfolio. (1 Mark) f Compute the reward to volatility of your portfolio and Interpret your answer (1 Mark) Compute the expected return and the standard deviation of the complete portfolio. (1 Mark) g Compute the reward to volatility of the complete portfolio. What do you notice? (1 Mark). Explain the Capital Allocation Line (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts