Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: please answer Question 2 only because you have answered question one I first posted as according to Chegg rules you said SUBJECT:INVESTMENT APPRAISAL Question

Note: please answer Question 2 only because you have answered question one I first posted as according to Chegg rules you said

SUBJECT:INVESTMENT APPRAISAL

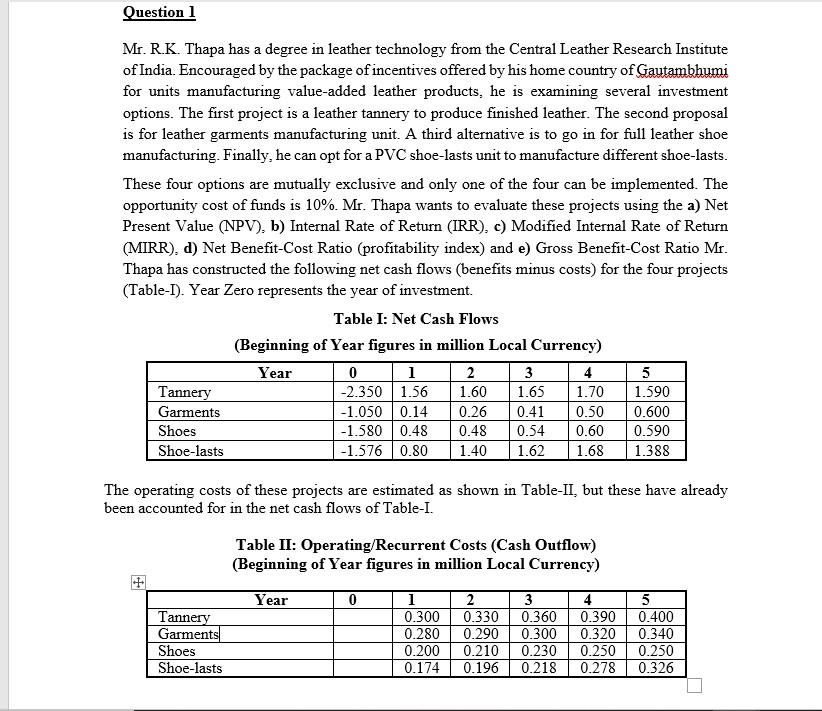

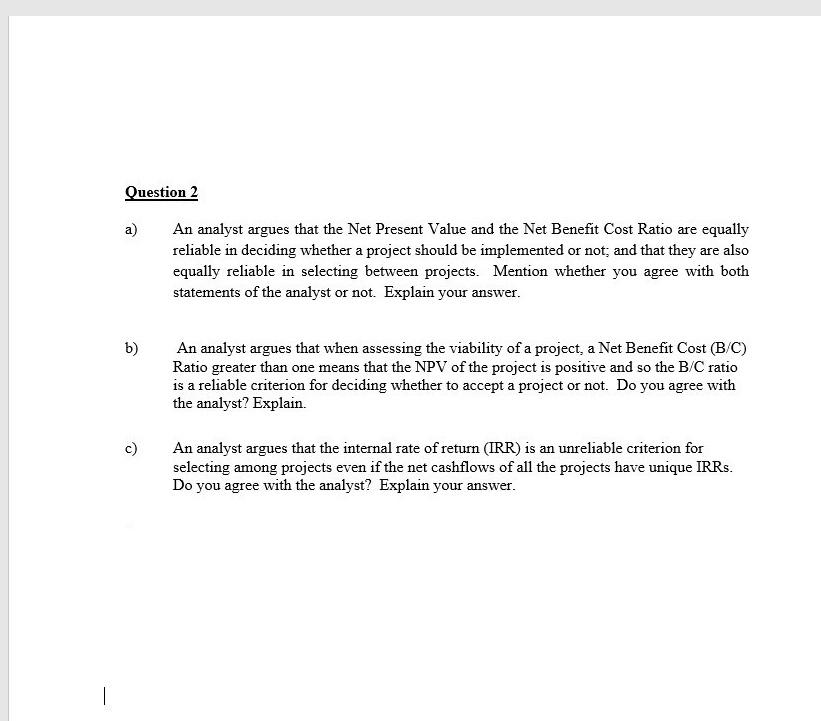

Question 1 Mr. R.K. Thapa has a degree in leather technology from the Central Leather Research Institute of India. Encouraged by the package of incentives offered by his home country of Gautambhumi for units manufacturing value-added leather products, he is examining several investment options. The first project is a leather tannery to produce finished leather. The second proposal is for leather garments manufacturing unit. A third alternative is to go in for full leather shoe manufacturing. Finally, he can opt for a PVC shoe-lasts unit to manufacture different shoe-lasts. These four options are mutually exclusive and only one of the four can be implemented. The opportunity cost of funds is 10%. Mr. Thapa wants to evaluate these projects using the a) Net Present Value (NPV), b) Internal Rate of Return (IRR), c) Modified Internal Rate of Return (MIRR). d) Net Benefit-Cost Ratio (profitability index) and e) Gross Benefit-Cost Ratio Mr. Thapa has constructed the following net cash flows (benefits minus costs) for the four projects (Table-1). Year Zero represents the year of investment. Table I: Net Cash Flows (Beginning of Year figures in million Local Currency) Year 0 1 2 3 4 5 Tannery -2.350 1.56 1.60 1.65 1.70 1.590 Garments -1.050 0.14 0.26 0.41 0.50 0.600 Shoes -1.580 0.48 0.48 0.54 0.60 0.590 Shoe-lasts -1.576 0.80 1.40 1.62 1.68 1.388 The operating costs of these projects are estimated as shown in Table-II, but these have already been accounted for in the net cash flows of Table-I. Table II: Operating/Recurrent Costs (Cash Outflow) (Beginning of Year figures in million Local Currency) + Year 0 Tannery Garments Shoes Shoe-lasts 1 0.300 0.280 0.200 0.174 2 0.330 0.290 0.210 0.196 3 0.360 0.300 0.230 0.218 4 0.390 0.320 0.250 0.278 5 0.400 0.340 0.250 0.326 Question 2 a) An analyst argues that the Net Present Value and the Net Benefit Cost Ratio are equally reliable in deciding whether a project should be implemented or not, and that they are also equally reliable in selecting between projects. Mention whether you agree with both statements of the analyst or not. Explain your answer. b) An analyst argues that when assessing the viability of a project, a Net Benefit Cost (B/C) Ratio greater than one means that the NPV of the project is positive and so the B/C ratio is a reliable criterion for deciding whether to accept a project or not. Do you agree with the analyst? Explain. c) An analyst argues that the internal rate of return (IRR) is an unreliable criterion for selecting among projects even if the net cashflows of all the projects have unique IRRs. Do you agree with the analyst? Explain your answer. | Question 1 Mr. R.K. Thapa has a degree in leather technology from the Central Leather Research Institute of India. Encouraged by the package of incentives offered by his home country of Gautambhumi for units manufacturing value-added leather products, he is examining several investment options. The first project is a leather tannery to produce finished leather. The second proposal is for leather garments manufacturing unit. A third alternative is to go in for full leather shoe manufacturing. Finally, he can opt for a PVC shoe-lasts unit to manufacture different shoe-lasts. These four options are mutually exclusive and only one of the four can be implemented. The opportunity cost of funds is 10%. Mr. Thapa wants to evaluate these projects using the a) Net Present Value (NPV), b) Internal Rate of Return (IRR), c) Modified Internal Rate of Return (MIRR). d) Net Benefit-Cost Ratio (profitability index) and e) Gross Benefit-Cost Ratio Mr. Thapa has constructed the following net cash flows (benefits minus costs) for the four projects (Table-1). Year Zero represents the year of investment. Table I: Net Cash Flows (Beginning of Year figures in million Local Currency) Year 0 1 2 3 4 5 Tannery -2.350 1.56 1.60 1.65 1.70 1.590 Garments -1.050 0.14 0.26 0.41 0.50 0.600 Shoes -1.580 0.48 0.48 0.54 0.60 0.590 Shoe-lasts -1.576 0.80 1.40 1.62 1.68 1.388 The operating costs of these projects are estimated as shown in Table-II, but these have already been accounted for in the net cash flows of Table-I. Table II: Operating/Recurrent Costs (Cash Outflow) (Beginning of Year figures in million Local Currency) + Year 0 Tannery Garments Shoes Shoe-lasts 1 0.300 0.280 0.200 0.174 2 0.330 0.290 0.210 0.196 3 0.360 0.300 0.230 0.218 4 0.390 0.320 0.250 0.278 5 0.400 0.340 0.250 0.326 Question 2 a) An analyst argues that the Net Present Value and the Net Benefit Cost Ratio are equally reliable in deciding whether a project should be implemented or not, and that they are also equally reliable in selecting between projects. Mention whether you agree with both statements of the analyst or not. Explain your answer. b) An analyst argues that when assessing the viability of a project, a Net Benefit Cost (B/C) Ratio greater than one means that the NPV of the project is positive and so the B/C ratio is a reliable criterion for deciding whether to accept a project or not. Do you agree with the analyst? Explain. c) An analyst argues that the internal rate of return (IRR) is an unreliable criterion for selecting among projects even if the net cashflows of all the projects have unique IRRs. Do you agree with the analyst? Explain your answer. |Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started