Answered step by step

Verified Expert Solution

Question

1 Approved Answer

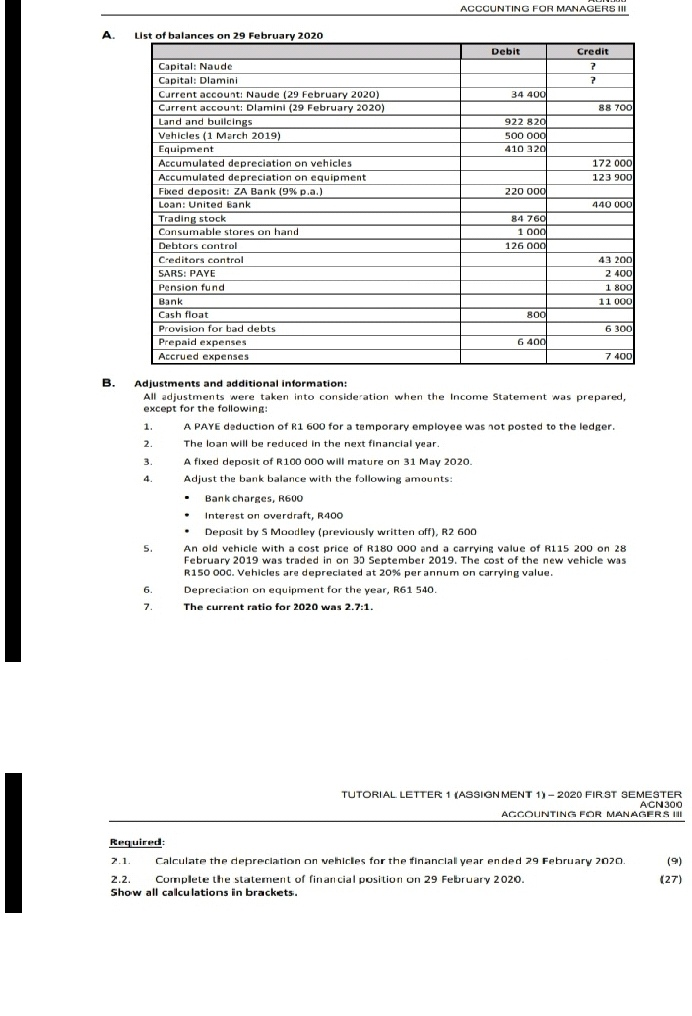

Note: there is no information missing ACCOUNTING FOR MANAGERS III List of balances on 29 February 2020 Debit Credit 34 400 88 700 922 820

Note: there is no information missing

ACCOUNTING FOR MANAGERS III List of balances on 29 February 2020 Debit Credit 34 400 88 700 922 820 500 000 410 320 172 0001 123 900 220 000 440 000 Capital: Naude Capital: Dlamini Current account: Naude (29 February 2020) Current account: Dlamini (29 February 2020) Land and builcings Vehicles (1 March 2019) Equipment Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit: ZA Bank (9% p.a.) Loan: United Bank Trading stock Consumable stores on hand Debtors control Creditors control SARS: PAYE Pension fund Bank Cash float Provision for bad debts Prepaid expenses Accrued expenses 84 7601 1 000 126 000 43 200 2 4001 1 800 800 6300 6400 7400 Adjustments and additional information: All adjustments were taken into consideration when the Income Statement was prepared, except for the following: A PAYE deduction of R1 600 for a temporary employee was not posted to the ledger. The loan will be reduced in the next financial year. A fixed deposit of R100 000 will mature on 31 May 2020. Adjust the bank balance with the following amounts: Bank charges, R600 Interest on overdraft, R400 Deposit by S Moodley (previously written off), R2 600 An old vehicle with a cost price of R180 000 and a carrying value of R115 200 on 28 February 2019 was traded in on 30 September 2019. The cost of the new vehicle was R150 oog. Vehicles are depreciated at 20% per annum on carrying value. Depreciation on equipment for the year, R61 540. The current ratio for 2020 was 2.7:1. TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMESTER ACN 300 ACCOUNTING FOR MANAGERS IN Required: 2.1. Calculate the depreciation on vehicles for the financiall year ended 29 February 2020 2.2. Complete the statement of financial position on 29 February 2020. Show all callculations in brackets. (9) (27) ACCOUNTING FOR MANAGERS III List of balances on 29 February 2020 Debit Credit 34 400 88 700 922 820 500 000 410 320 172 0001 123 900 220 000 440 000 Capital: Naude Capital: Dlamini Current account: Naude (29 February 2020) Current account: Dlamini (29 February 2020) Land and builcings Vehicles (1 March 2019) Equipment Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit: ZA Bank (9% p.a.) Loan: United Bank Trading stock Consumable stores on hand Debtors control Creditors control SARS: PAYE Pension fund Bank Cash float Provision for bad debts Prepaid expenses Accrued expenses 84 7601 1 000 126 000 43 200 2 4001 1 800 800 6300 6400 7400 Adjustments and additional information: All adjustments were taken into consideration when the Income Statement was prepared, except for the following: A PAYE deduction of R1 600 for a temporary employee was not posted to the ledger. The loan will be reduced in the next financial year. A fixed deposit of R100 000 will mature on 31 May 2020. Adjust the bank balance with the following amounts: Bank charges, R600 Interest on overdraft, R400 Deposit by S Moodley (previously written off), R2 600 An old vehicle with a cost price of R180 000 and a carrying value of R115 200 on 28 February 2019 was traded in on 30 September 2019. The cost of the new vehicle was R150 oog. Vehicles are depreciated at 20% per annum on carrying value. Depreciation on equipment for the year, R61 540. The current ratio for 2020 was 2.7:1. TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMESTER ACN 300 ACCOUNTING FOR MANAGERS IN Required: 2.1. Calculate the depreciation on vehicles for the financiall year ended 29 February 2020 2.2. Complete the statement of financial position on 29 February 2020. Show all callculations in brackets. (9) (27)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started