Question: 1. A firm can choose between two projects, Project A and B. The payoffs to each project depend on whether the world turns out

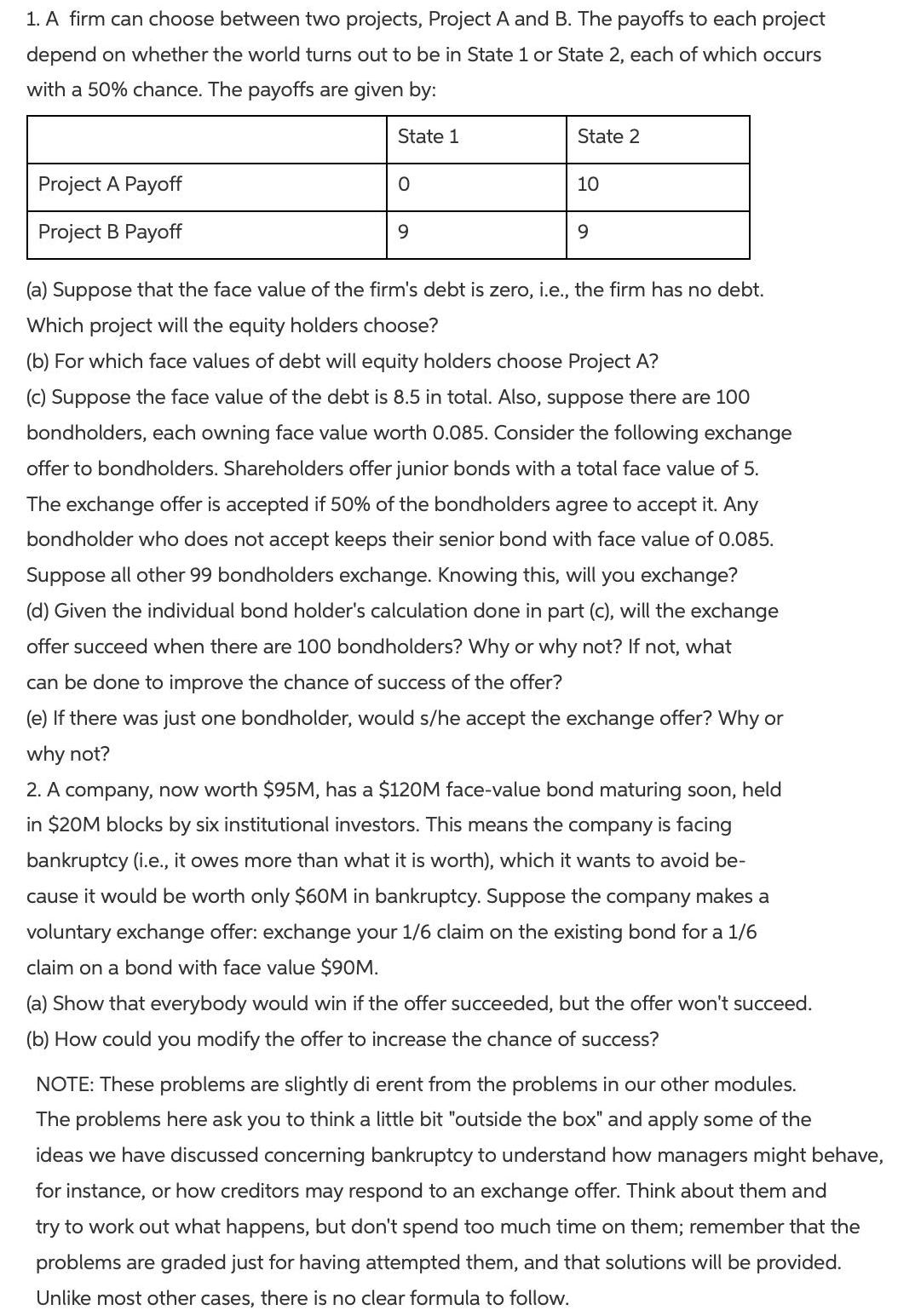

1. A firm can choose between two projects, Project A and B. The payoffs to each project depend on whether the world turns out to be in State 1 or State 2, each of which occurs with a 50% chance. The payoffs are given by: State 1 Project A Payoff Project B Payoff 0 9 State 2 10 9 (a) Suppose that the face value of the firm's debt is zero, i.e., the firm has no debt. Which project will the equity holders choose? (b) For which face values of debt will equity holders choose Project A? (c) Suppose the face value of the debt is 8.5 in total. Also, suppose there are 100 bondholders, each owning face value worth 0.085. Consider the following exchange offer to bondholders. Shareholders offer junior bonds with a total face value of 5. The exchange offer is accepted if 50% of the bondholders agree to accept it. Any bondholder who does not accept keeps their senior bond with face value of 0.085. Suppose all other 99 bondholders exchange. Knowing this, will you exchange? (d) Given the individual bond holder's calculation done in part (c), will the exchange offer succeed when there are 100 bondholders? Why or why not? If not, what can be done to improve the chance of success of the offer? (e) If there was just one bondholder, would s/he accept the exchange offer? Why or why not? 2. A company, now worth $95M, has a $120M face-value bond maturing soon, held in $20M blocks by six institutional investors. This means the company is facing bankruptcy (i.e., it owes more than what it is worth), which it wants to avoid be- cause it would be worth only $60M in bankruptcy. Suppose the company makes a voluntary exchange offer: exchange your 1/6 claim on the existing bond for a 1/6 claim on a bond with face value $90M. (a) Show that everybody would win if the offer succeeded, but the offer won't succeed. (b) How could you modify the offer to increase the chance of success? NOTE: These problems are slightly di erent from the problems in our other modules. The problems here ask you to think a little bit "outside the box" and apply some of the ideas we have discussed concerning bankruptcy to understand how managers might behave, for instance, or how creditors may respond to an exchange offer. Think about them and try to work out what happens, but don't spend too much time on them; remember that the problems are graded just for having attempted them, and that solutions will be provided. Unlike most other cases, there is no clear formula to follow.

Step by Step Solution

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts